Business acquisition can serve as an instant boost to market share and, if the company to be merged is the right one in the right financial position, may lead to a future on assured footing within the industry. However acquisitions can be inherently risky and just as they may lead to literal overnight success so too can they lead to financial instability if due diligence has been poorly paid. So with this in mind here we take a look at the ways in which you can ensure due diligence is given the time that it deserves.

- Appreciate that no two due diligence tasks are ever the same

No two mergers are ever the same and due diligence extends far beyond merely applying to business acquisitions. Most specifically the following situations each make for drastically differing examples where due diligence is required, and these serve to highlight just how different a due diligence project may be.

No two mergers are ever the same and due diligence extends far beyond merely applying to business acquisitions. Most specifically the following situations each make for drastically differing examples where due diligence is required, and these serve to highlight just how different a due diligence project may be.

- Product acquisitions

- Distributor deals

- Breaking into a new market

- Merging or acquiring another business

- Starting a new product line

- Licensing a technology

- Focus upon making a business decision, rather than merely crunching data

Data undoubtedly drives decisions, however when undertaking due diligence it can be fairly easy to begin to focus solely upon the data, rather than extracting and analysing the data in meaningful ways that can lead to solid business logic. So always keep the purpose of your due diligence in mind, keeping data analysis relatively simple with around four main questions to be posed that provide a definitive answer as to whether you should merge, acquire or undertake whatever task you may be weighing up.

- Ensure that any uncertainty is explored

Due diligence is, in the most basic terms, about weighing up risk. However one of the very first questions you’ll likely ponder is just how far you have to research in order to satisfy all of your questions.

In short the answer to this very much lies within the uncertainty that you face, and the time spent upon each due diligence task may vary significantly depending upon how complex a topic you may be tackling. Above all you should focus on minimising the uncertainty of the business decision. Here are some tips to reduce risk and uncertainty for businesses.

- Rule out a ‘No’ before testing out a ‘Yes’

Before you plunge head first into a months’ long due diligence project it’s prudent to rule out an easy ‘No’ first. So tackle those key questions and topics that would lead to an outright rejection, and once these are satisfied you can move ahead with the more time consuming tasks that may lead to a ‘Yes’ decision.

- Choose a team of specialists who really know what they’re doing

Due diligence takes specialist knowledge and, depending upon the exact business decision that you’re facing, may demand the skills of the following roles: accountant, HR expert, marketing specialist, tax experts and product developers. Tax evasion for example can be an issue not always uncovered and something that’s a very topical area for discussion currently. In fact, it is estimated that between $ 21 trillion and $ 32 trillion in untaxed wealth is deposited in off shore jurisdictions.

- Use experts. But use them wisely.

Utilizing an outside series of experts is costly, however in some instances it is more than justified. That said it can be all too easy to commission numerous experts across a wide range of differing topics, which may serve to add more unnecessary complexity to your decision.

- Get past the figures

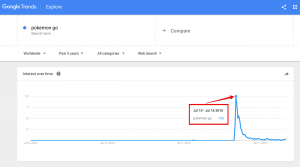

Cold hard cash is important, and solid figures are vital in making a wise, informed business decision: ROI, market performance, product reach, licensing fees, profit margins, added costs and turnover are all leading factors in business logic. However these are far from the be all and end all when paying due diligence and looking beyond this is essential in gaining a complete picture of business health. So tackle topics such as trends, market drivers, predict potential and risks across all business departments and consider these qualitative factors in your decision.

- Consider industry customer adoption levels of new ideas, services or products

If you’re specifically tackling due diligence in relation to a new product or market, or your business deal includes a line of potential new products, you must consider the rate of customer adoption. It is pretty standard, regardless of the industry, for the adoption of new products to take years and placing weight upon such potential must be considered as a long term risk, as well as unassured revenue and profits. There are some great tips on how to launch new products or ideas.

- Weigh up customer reaction

The customer is always right, and this may never be truer than when merging or acquiring another business. Will there be a proposed boycott? Such as was seen with the Kraft/Cadbury hostile takeover? Or could share prices treble, just as was enacted by the Nokia/Microsoft merger (at least initially, that is… the less said about the share price of Microsoft today, the better). Of course even negative customer reactions may be addressed in many instance, however stringent planning for immediate customer placation may be required, and the company who gets this wrong may risk an unmanageable wrath of a shrinking customer base.

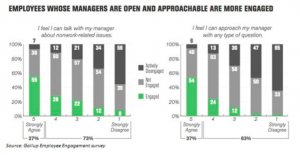

- Keep everyone happy: from potential employees right through to your managing Director counterpart

One drastically overlooked consideration when considering a merger or acquisition is the people involved within the process; we’re talking managing directors, decision makers and the skills and attitudes that such people may possess. All too often perfectly viable mergers have fallen to the irretrievable wayside simply because of the a disagreement or breakdown in communication between the invested parties, so always bear in mind that such deals are about far more than wise business decisions made at the right price. Good communication is pivotal for successful mergers. What’s more you may even require the skills of previously in-house staff and management post deal (particularly where product lines may be new to your company or where significant technology is involved).

These 10 tips should help you when performing due diligence and ensure that things go as smoothly and with as little issue as possible.

If you have any tips leave them in the comments below.

(255)

Report Post