JD Rockefeller grew up poor. His father, an unreliable con-man that sold snake oil to unsuspecting consumers. Although absent for most of JD’s life, he instilled in Rockefeller an entrepreneurial spirit and mindset. Rather than do chores like other kids his age, the young Rockefeller would buy a block of candy and cut it into small chunks to sell it to the neighborhood kids for a profit.

Being the eldest boy with an absentee father, he was forced to quit school to support the family. In addition to his candy enterprise, he also raised turkeys and sold potatoes. At one point, his own father cheated young Rockefeller. His father justified his actions by saying that he wanted to make JD sharp and teach him to always get the better part of a deal.

After his family moved from New York to Ohio, JD Rockefeller studied bookkeeping since he had an aptitude for numbers. At age 16, he got his first job as a bookkeeper and learned the inner workings of the business. One day on his way home, he saw a wildcatter strike oil in Ohio and realized that oil would change the world.

Rockefeller could see that drilling for oil was very risky and not a very efficient way to make a living. After contemplating how to minimize his risks and capitalize on what he knew would be an up-and-coming oil boom, Rockefeller concluded that refining oil was safer and more profitable than drilling for it in the long run. Having no background in oil, he found scientists to figure out how to refine oil into its usable components.

In those early days, the principal product produced from crude oil was Kerosine, the oil used in lamps. Unfortunately not much was known about the refining process at that time and the products produced were inconsistent, resulting in some volatile varieties of Kerosine. In fact, Kerosine developed a negative reputation since some blends were highly combustible and could start fires.

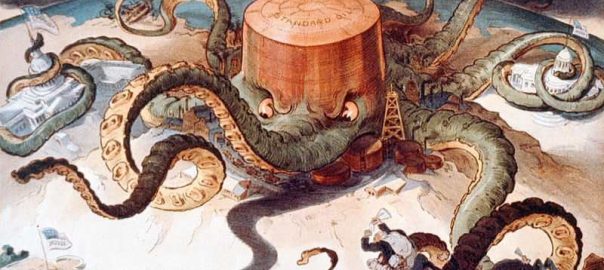

By following the advice of his scientists, Rockefeller made a more consistent and less volatile product. Moreover, JD Rockefeller named his company “Standard Oil” because he knew that the name would show people that all Kerosine products with his brand name were uniform.

When the Civil War ended and the Great Westward Expansion began, a new oil-fueled economy was ushered in. By employing expert scientists, borrowing heavily, reinvesting his profits, and using his financial acumen to manage his costs, Rockefeller was able to be more efficient than his competitors. He leveraged his position in the quickly expanding industry and soon Standard Oil was the most profitable refiner in Ohio. The railroads were fighting among themselves to control his freight traffic.

Rockefeller was contacted by Cornelius Vanderbilt. Vanderbilt offered Standard Oil steep discounts over standard shipping costs provided that Standard Oil could ship 60 train loads of Kerosine per day. JD Rockefeller agreed to the deal even though his production volume at the time was less than half the contracted amount. However, he knew that a deal with Vanderbilt would increase his profit margins and thereby grab the attention of investors. He was right. Investors came on board to meet and exceed Vanderbilt’s demand.

With Standard Oil stock on the rise, JD Rockefeller started to buy out his competitors. In a 4 month span, Standard Oil absorbed 22 of Cleveland’s 26 refineries and Rockefeller was swimming in the product. A rival railroad to Vanderbilt’s was the Pennsylvania Railroad. Thomas Scott, vice president and financier of the Pennsylvania Railroad, took notice of Standard Oil’s rapid expansion. Scott had an idea to create a cartel between the railroad and oil to control prices.

The Pennsylvania Railroad offered Standard Oil a better deal than Vanderbilt to be part of their cartel by transporting his Kerosine on their rail lines. Rather than break the deal with Vanderbilt, Rockefeller played the railroads against each other to attempt to get an even better deal. However, this move backfired as Scott and Vanderbilt felt Rockefeller was angling for too much control and they colluded to marginalize Rockefeller.

Using a tactic Vanderbilt used to build his empire, Scott and Vanderbilt agreed that neither company would offer Rockefeller a discounted rate and charged him triple what he was previously paying in the hopes of bankrupting Standard Oil. Rockefeller saw this action for what it was: an act of war.

Appearing to be at the mercy of Vanderbilt and Scott, Rockefeller looked for a way to strengthen his position. A solution to JD Rockefeller’s dilemma came from an unlikely place. To transport oil from its source at the well to either a railroad terminal or local refinery, teamsters charged exorbitant rates since the oil producer’s options were limited. In fact, the transportation cost charged by the Teamsters to transfer a barrel of crude oil by horse only a few miles to a railroad station or nearby refinery exceeded the cost of shipping a similar barrel of Kerosine by rail from Cleveland all the way to the East Coast.

In response, some oil producers began to invest in pipelines to transfer their crude oil to a refinery, proving that oil could be transported by pipeline to bypass the Teamsters. Rockefeller figured that if a pipeline could transfer oil from the oil well to a refinery, a huge network of pipelines could link wells to refineries, cutting out both the Teamsters and the railroads altogether from the lucrative oil shipping business. Although building a pipeline of this scale was a massive investment and came with significant risks, Rockefeller was driven to win in his feud with the railroads at all costs.

When the pipeline was complete, it was 4,000 miles in length and connected wells in Ohio, Pennsylvania, and West Virginia to his refineries in Cleveland. The pipeline was a huge blow to many area railroads since 40% of the cargo shipped by the railroads was from Standard Oil. JD Rockefeller’s pipeline exposed the fact that the railroad industry was overbuilt and relied too heavily on a single customer, Standard Oil. Many small railroad companies went bankrupt and stock prices fell, busting the railroad bubble. One-third of railroads went bankrupt in the resulting 1873 crash.

As Vanderbilt had done before, Rockefeller saw this as an opportunity to build his own distribution system. Standard Oil agreed to sign contracts with strategic railroads that were failing to keep them afloat. However, in gratitude for his business, the railroad would have to agree to “drawbacks,” which were essentially rebates offered to Standard Oil for shipments made by his competitors. All he needed to do was show them their books, so they knew what they were up against, and make them a decent offer. If the railroad declined, Rockefeller would run them into bankruptcy and buy up their business at a fire sale when the bottom fell out of their stock. He would then use the newly acquired railroad to expand his own distribution system.

The Pennsylvania Railroad operated by Scott was outside JD Rockefeller’s pipeline control so Standard Oil was still forced to use their railroad to ship this product to market. Since two-thirds of the Pennsylvania Railroad’s oil freight was from Standard Oil, they knew it was only a matter of time before Rockefeller would be gunning for them too. Scott’s plan was to diversify so he built his own pipelines and decided to get into the lucrative oil business himself. When Rockefeller became aware of Scott’s plan, he offered Scott an ultimatum – Quit the oil business or Standard Oil would pull all of its shipments from the Pennsylvania Railroad. Scott knew that his Pennsylvania Railroad was the only railroad between Pennsylvania and New York, a route Standard Oil needed to get Kerosine from its refinery in Pittsburgh to customers in New York. Just as when he partnered with Vanderbilt, Scott felt that he had leverage over Rockefeller and said “no deal.” Based on Scott’s reply, Rockefeller pulled his shipments from the Pennsylvania Railroad and shut down his Pittsburgh refinery as threatened.

While this move hurt Standard Oil, JD Rockefeller knew it would hurt Scott’s Pennsylvania Railroad far more. In fact, Scott was forced to lay off half of his workers. In response to the massive layoff, workers at the Pennsylvania Railroad rioted and burnt down 39 buildings, and destroyed 1200 train cars. By the end of the day, the Pennsylvania Railroad was in ruins.

With the advent of electricity, Rockefeller saw that the demand for Kerosine would soon wain as the principal source of light in people’s homes. Like any good entrepreneur, he looked for a solution to this problem. Originally, gasoline was the fuel component that was factored out of crude oil to make them a more stable Kerosine product. Gasoline was considered a waste byproduct that was disposed of. Convinced that there must be a use for the highly flammable gasoline, he hired a team of scientists to see if there was a practical use for it.

The developers of the internal combustion engine were looking for fuel and Rockefeller had the answer in gasoline. Rockefeller began to buy internal combustion engines and use the gasoline byproduct of his refinery to power the refinery’s own machines. The timing was perfect as engineers were incorporating the internal combustion engines into carriages. Thus the automobile industry was born, fueling the next wave of growth for Standard Oil and making JD Rockefeller the world’s first billionaire.

Business Lessons from JD Rockefeller

Below are 13 business lessons that small business owners can take away from JR Rockefeller’s success as a businessman.

- JD Rockefeller created a near-monopoly with Standard Oil, controlling 90% of the US oil supply by the time Rockefeller was just 33 years old.

- He owed much of his success to a focused education in finance and knew how to keep his costs down.

- He knew the value of community and surrounded himself with competent experts.

- Rockefeller used leverage in the form of debt and equity investments to make the most of situations.

- Rockefeller knew enough to change course when the market was against him.

- He knew that wherever there is uncertainty, there is also an opportunity.

- He treated the business like a game, a game to win.

- He always looked for leapfrog technology and was never complacent.

- He found solutions to problems by looking to other industries.

- He always looked for the checkmate move.

- He also remained semi-paranoid about what his competitors were doing.

- Rockefeller knew that you make money by buying when the market and competition are down.

- Finally, the greed of the Teamsters and the railroad caused their customers to find workarounds and cut them out of the business altogether.

What lessons from the history of JD Rockefeller and Standard Oil can you apply to your business?

Business & Finance Articles on Business 2 Community

(42)

Report Post