Adobe expects an 8.4% increase over last year’s online spending, nearly twice the increase seen last year.

U.S. online holiday shoppers are expected to spend $ 240.8 billion in November and December this year, according to a forecast by Adobe. This represents a 8.4% increase over last year’s holiday season, significantly higher than last year’s 4.9% year-over-year growth.

Why we care. This is good news for retailers with a solid digital marketing strategy. In recent years, holiday spending has shifted to early sales events like October’s Amazon Prime Big Deal Days — this year, running October 8 and 9. Also, a segment of consumers spread their gift-buying throughout the entire year. Understanding where their customers fit in these trends will help a business make the most out of the holiday push.

Mobile shopping. The anticipated record-breaking spending will also lift mobile shopping into uncharted territory. Mobile purchases are expected to reach $ 128.1 billion this year, up 12.8% YoY. This means mobile will have a 53.2% share of online shopping versus desktops and laptops.

Cyber Week. Cyber Week, the five days from Thanksgiving to Cyber Monday, is set to drive $ 40.6 billion in U.S. sales, according to Adobe. This is a 7% increase over 2023.

“The holiday shopping season has been reshaped in recent years, where consumers are making purchases earlier, driven by a stream of discounts that has allowed shoppers to manage their budgets in different ways,” said Vivek Pandya, lead analyst, Adobe Digital Insights, in a release.

Expensive goods. In analyzing consumer patterns over the last five years, Adobe found sales of the cheapest goods increased 46%, while sales of the most expensive goods declined 47%. (Adobe divided goods into four price tiers.)

This year, Adobe expects the trend to reverse. Sales of the most expensive goods are expected to increase by 19% this holiday season, compared to pre-holiday sales. This is because of price discounts, not because shoppers are feeling wealthier.

“These discounting patterns are driving material changes in shopping behavior, with certain consumers now trading up to goods that were previously higher-priced and propelling growth for U.S. retailers,” said Pandya.

Last-minute vs. planning ahead for holidays. Higher-income customers are most likely to spend for holidays in the two months preceding a holiday, according to Klaviyo’s survey of over 8,000 consumers globally. Consumers with incomes under $ 100,000 are more likely than other brackets to shop for holidays last minute, but are also more likely to do holiday shopping throughout the year.

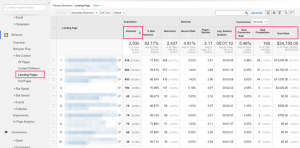

Here’s the full breakdown of when consumers spend by income level:

Plans to spend more. Eight in 10 consumers said they planned to spend as much or more than last year. Nineteen percent of consumers said they’d spend more, and 61% said they’d spend the same. Only 20% said they’d spend less.

Less than half (48%) of consumers said inflation affects their current spending decisions.

Top factors. Pricing was the top factor in holiday spending. Here is how other considerations ranked in the Klaviyo survey.

Shopping by generation. The same percentage (34%) of Gen Z and Baby Boomer shoppers plan to shop online and in-store. The differences between generations lie in the disparities among the other two-thirds.

Over half (53%) of Gen Z will do most or all of their shopping online, while only 25% of Boomers will. Here’s how shopping behaviors break down by generations:

Klaviyo’s 2024 Consumer Spending Report can be downloaded here (registration required).

The post 2024 online holiday spending set for record year with $ 240 billion in sales appeared first on MarTech.

(10)