Setting your pricing structure and agreeing on fees with clients is one thing.

But it doesn’t do you a lick of good if that money doesn’t make it’s way speedily and safely from their account to yours.

Turns out, not all late payments are caused by malice. Or laziness. Usually, there’s confusion – on method, on timing – that’s getting in the way and keeping you anxious about whether or not you’ll have funds on hand to cover your expenses and investments.

Nothing beats doing work that you love and having clients who are raving fans…except actually getting paid for it.

Let’s shine a light on how to make sure that money gets into your hands as smoothly as possible.

TIMING

Define exactly when the client is required to make their payment.

Up front: 100% of the payment is required before a client has a session with you or you ship their product

Instalments: Client pays a deposit up front, and then another payment when the project is finished. You could even have a midpoint instalment to reflect the project hitting an important milestone.

Example:

A web designer can charge 50% as a deposit, and 50% upon the go-live of the new site.

Example:

A video editor can charge 50% as a deposit, 25% when the rough-cut is delivered, and 25% before the final video is sent.

Royalties: Client pays you based on the number of finished goods sold. Consignment sales are similar, with you only receiving payment once the product has been sold to end consumers.

Example:

An author receives a % of each copy of their book sold.

Example:

A jewellery maker receiving payment from a boutique after their necklaces are sold.

Payment After Invoicing: Client pays you a certain number of days after an invoice is sent. 15days, 30days, 60days, etc. For a small business, longer payment terms can mean cash flow struggles, so if you’re asked for 30day+ terms be sure to trade it for something else you value!

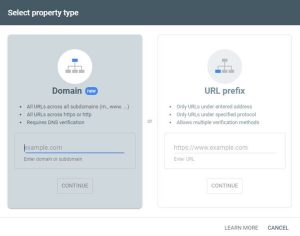

METHOD

Make sure you outline how the client should send money your way. There’s nothing worse than receiving a cheque that you can’t cash because it’s in a foreign currency. Or have a wire transfer come through that dings you with massive bank fees.

Cash: If you work with client in person, accepting cash may be the easiest option

PayPal/Electronic Payment Platforms: Clients can send payment either on their own, in response to an invoice you create in the system, or with PayPal hooked up to your scheduling system or e-commerce platform.

Cheque: It may seem like an old fashioned option, but if you’re working with a larger company, higher amounts (where the PayPal fees would add up fast!) or clientele that’s a bit more old-fashioned, accepting cheques can work a charm.

Wire/Bank Transfers: If you’re working internationally, with larger project fees then a wire transfer may be the way to go. There’s a trust factor here, since you’ll be sharing bank account details.

WHAT IF…

“Client shall pay via PayPal to ambitious.entrepreneur@makemoney.com upon receipt of invoice.”

Great. But what if that doesn’t happen?

Include some language in your payment terms that will outline what happens if payment is late. You may want to include:

Late Fees: A percentage of dollar value charged to the client as an administrative fee if payment is not received on time. This should be big enough that it drives the right behaviour, but not so big that it’s punitive. Be careful not to call it a ‘penalty’ though! That may not be enforceable in some States/Countries.

Work Stoppage: If the client hasn’t paid…you stop working. If you provide ongoing services (blog writing, VA support) this is an especially effective way of ensuring payments arrive on time.

Retention of Work Product: No payment of the final invoice? Then no finished designs/files/documents are provided to the client. You hang on to them as a bit of an insurance policy.

Here are some templates to get you started:

Instalments

“Client will pay {Your Name Here} 50% of the agreed fee upon signature of this contract, and the final 50% before delivery of the final design files. Payment will be made via PayPal. {Your Name Here} will send an invoice to Client for each instalment. Work on the Project will not begin until the initial 50% payment is received, and final design files will remain property of {Your Name Here} until the final payment is received in full.”

30 Day Payment

“Client will pay {Your Name Here} within 30 days of the receipt of invoice, by cheque made payable to {Your Name Here}. In the event payment is not received by the 30th day, an administrative fee of 10% of the invoice value will be applied for each delay of 7 calendar days.”

Consignment

“Client will pay {Your Name Here} for Product sold in each 30 day period. On the 1st Monday of each month a statement of sales and payment via PayPal will be due to {Your Name Here}. In the event that a sales statement and/or the required payment is not received on the 1st Monday of the month, {Your Name Here} reserves the right to stop shipment of additional Product to Client, and invoice an administrative fee of $ 50 for each delay of 5 business days.”

Business & Finance Articles on Business 2 Community(85)

Report Post