There’s a low-key reset transpiring across multiple enterprise stacks. Here’s how martech leaders can respond.

I recently taught some martech workshops (in person!) and received numerous fascinating questions from stack leaders. Clearly, 2023 represents another year of great change as omnichannel aspirations take on higher priority and leaders continue to revisit their platform choices amid growing hype around artificial intelligence and machine learning.

Here’s my take on three clusters of questions and topics that arose:

- CDP programs as stalking horses for customer data modernization.

- Rethinking your engagement tier.

- Adtech-martech integration.

Each topic has its own value and some cases, urgency. But together, the answers reflect a broader reset occurring across enterprise martech stacks.

1. CDP as stalking horse

Over the past year, we’ve advised several large enterprises in CDP technology selections. We saw great diversity in enterprise needs and maturity (and fortunately, a wide range of vendor offerings to meet those), plus some common questions which I’ve also fielded at recent conferences and webinars.

- How can we tell if we’re ready for this?

- What do we need operationally to succeed?

- What’s the likely timeframe for financial payback?

And so on…

I’ve come to conclude that CDP technology initiatives frequently become “stalking horses” for the broader need for customer data ecosystem modernization and should therefore be treated as such. Of course, this feels backward. Shouldn’t we get our enterprise act together before we select any new technology? That’s a rational take.

Yet, we also see the utility in running parallel tracks over the 12 to 16 months it takes to select and burn in a CDP, whereby one workgroup works on the technology and the other workgroup labors to get data sources, quality, pipes and governance overhauled.

Historically, we’ve seen this phenomenon before where an organization leveraged a platform implementation to drive key business change. Consider:

- Early web content management system implementations forcing a consolidation of digital strategies.

- Digital asset management platforms compelling major enterprise asset clean-ups.

- Ecommerce platform pilots driving key standardizations around digital commercial ops and customer-focused UX design.

Nevertheless, any enterprise looking at CDPs or recently licensing such a platform will need to spend even more resources getting their broader customer data toolset to cohere into a rational ecosystem. This work gets measured in years. It also means paying close attention to architectural fit amid a CDP marketplace with an unusually wide set of potential capabilities. Indeed, typically one-third of CDP selection projects we see at RSG are replacement efforts, where the enterprise rushed into a poor-fitting choice the first time.

Ultimately, my advice boils down to not having a “CDP project” at all — rather a customer data modernization (or “transformation” if you must) program that happens to include a CDP initiative.

2. Rethinking your engagement tier

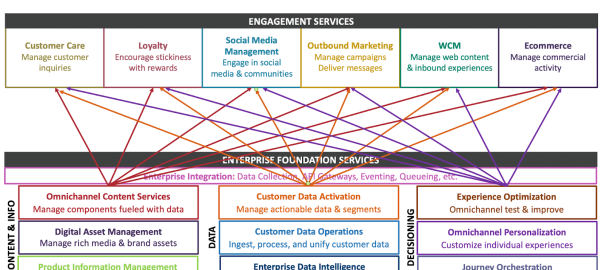

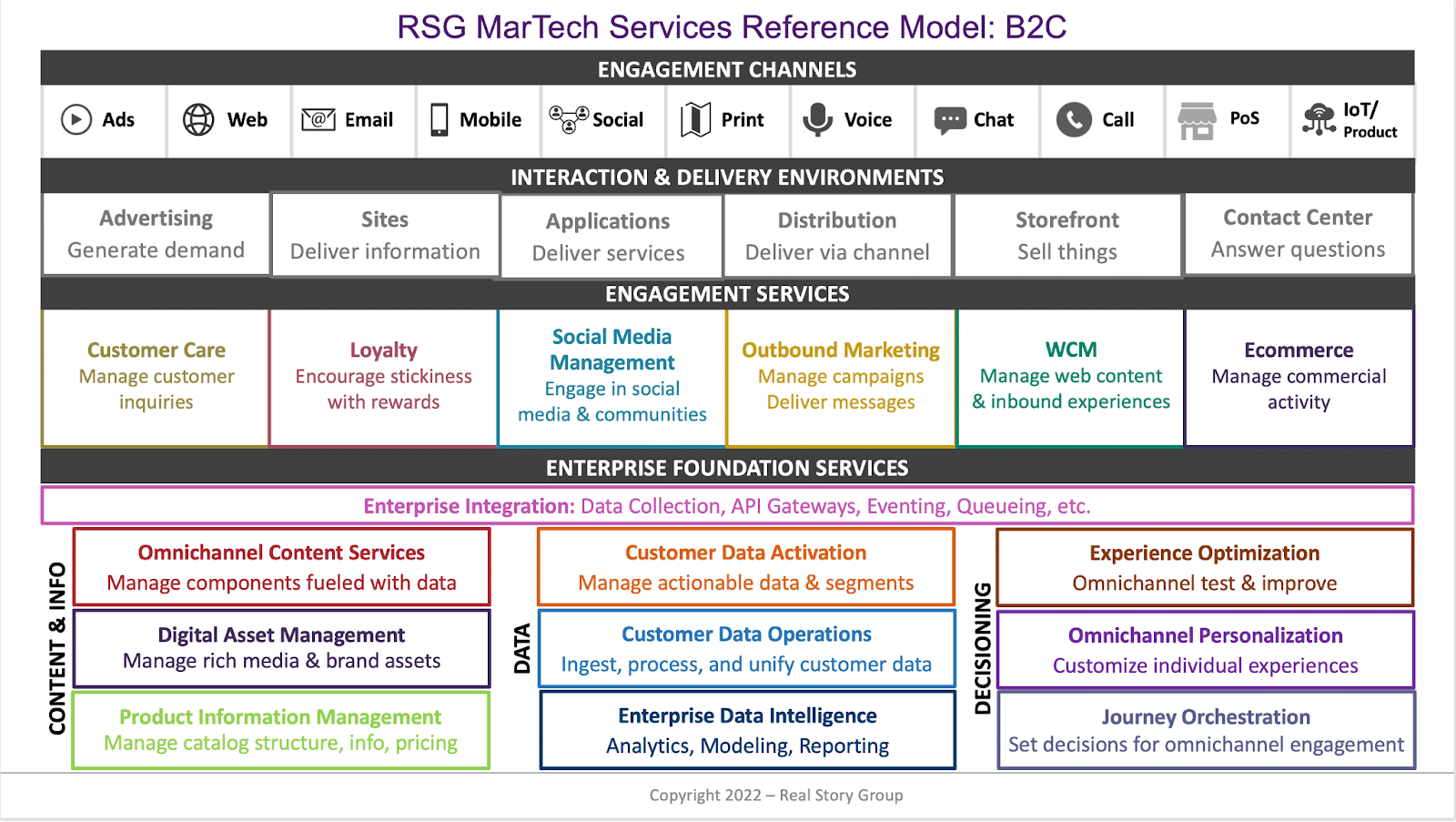

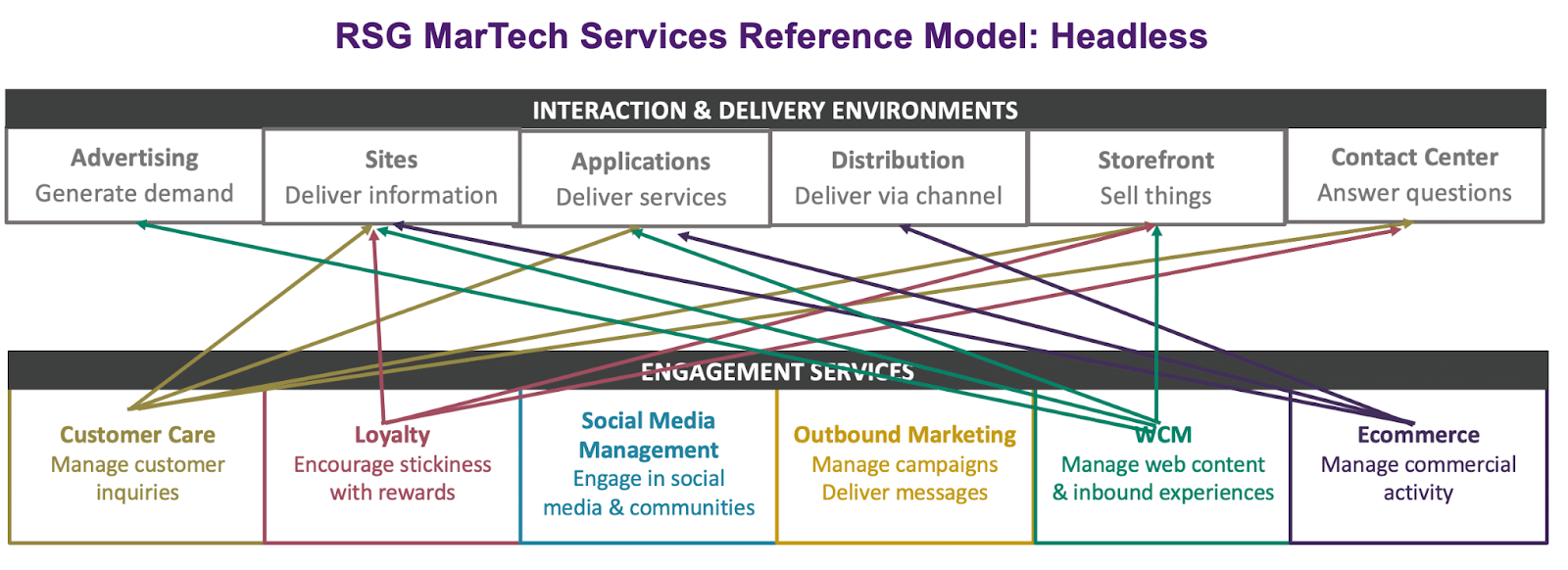

The other questions I tend to receive revolve around long-standing investments that martech leaders have made at the engagement services tier. See the multi-colored single middle band in the chart below.

In most cases, the enterprise had been working with those platforms for a long time— had beefed up the teams managing them and invested in complicated modifications. And yet… questions arise.

Our WCM/CRM/social/ecommerce/etc. platform is getting long in the tooth and it takes more time to do simple things; is that normal?

Why is it so hard to integrate with all the other platforms at the same tier? E.g., email touchpoints with website personalization and commerce recommendations?

Why can’t the platform simply inherit content, data and commands from enterprise-wide platforms, rather than doing everything itself? I’m copying a bunch of data and files around; again, is this normal?

I won’t call this wave of concern a tsunami yet. But I sense growing disaffection at this tier. Architecturally, many enterprises have put energy into making engagement platforms “headless.” That’s a useful way to decouple key services from actual delivery environments.

This trend already challenges martech leaders because most engagement platforms were never designed to run headlessly, leading to crude workarounds or replacement plans.

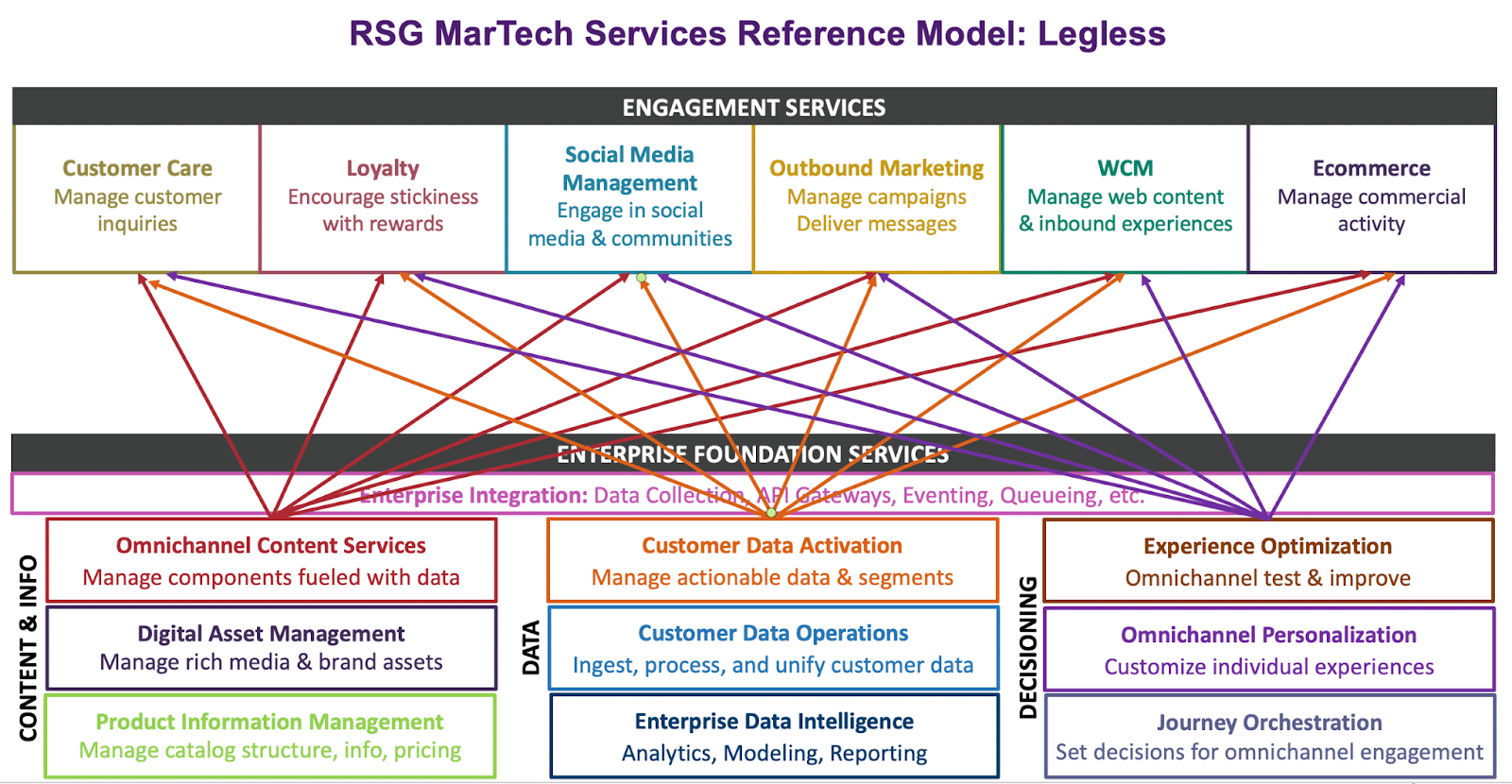

Yet, the coming omnichannel decade will drive an even more significant architectural innovation: legless.

Legless moves key content, data and decisioning services lower in your stack, explicitly enabling them to be shared across channels, enabling omnichannel deployment while reducing integration complexity along the way.

For sure, most enterprises haven’t arrived here yet, but many are moving in this direction. And once again, it’s creating stress among more traditional engagement platform vendors, whose systems are used to serving as heavyweight environments as opposed to more agile, lighter, pass-through spaces. That disgruntlement among martech leaders I mentioned earlier will lead to even more replacements over the next few years at the engagement tier.

In the meantime, where to seat AI / ML? Vendors within every block in these diagrams will boast about their new capabilities in this area, and many hallway conversations — full of excitement and trepidation alike — revolve around where and how to use those capabilities. For a long time, AI and ML comprised a feature. But as use cases and possibilities have grown substantially in recent quarters, you’ll want to start thinking about them as a layer in your stack.

In other words, that aging WCM platform isn’t going to become any sprier via the vendor injecting some random learning algorithm into it. Same for ecommerce, social and everything else. Enterprises that care about transparency and accountability will want to develop their own decoupled AI/ML capabilities at the foundation layer and extend them across the stack.

3. Finding real value in adtech-martech integration

The other hot topic among martech leaders bending my ear has been adtech–martech stack integration. On the surface, both stacks tend to resemble each other in terms of assembling content and using data to send it off to a particular interaction environment, typically according to some specific logic.

Yet, adtech and martech stacks have tended to evolve independently, with enterprises often licensing separate tools that do very similar things. But with the rise of foundation services (like CDPs) and the challenges of data deprecation martech and adtech leaders are taking a fresh look at closer integration to answer some key questions like:

- Shouldn’t our analytics and attribution models cover the full spectrum of a customer journey via both paid and owned+operated channels?

- How can we better leverage first-party data to improve our return on ad spend?

- How do we navigate the shoals of context- and channel-based consent?

- How can we automate the integration of paid media and owned-channel touchpoints in always-on campaigns?

Forward-thinking leaders are asking even more questions, so there’s no lack of use cases here. I sense particular enthusiasm around strategies that would create more efficient spend in all channels, particularly paid media.

This is partly a technical challenge, but for most enterprises we work with, it’s even more of a governance and organizational issue to work out. For some of you, that’s good news! You may not always be able to change your technology base, but hopefully, you can transform how your enterprise teams work together.

Final thoughts

If you, too, find yourself asking questions similar to those posed above, know that you’re not alone. There’s a low-key reset transpiring across multiple enterprise stacks. My advice is to create an intentional strategy around it and not recoil from making tough decisions about legacy platforms, including those from “name” vendors.

The post 3 prevailing themes pointing to a martech reset appeared first on MarTech.

(11)

Report Post