What drives consumers to add personal care products to their Amazon carts? Here are four unique ways to motivate consumers to shop this burgeoning category on Amazon.

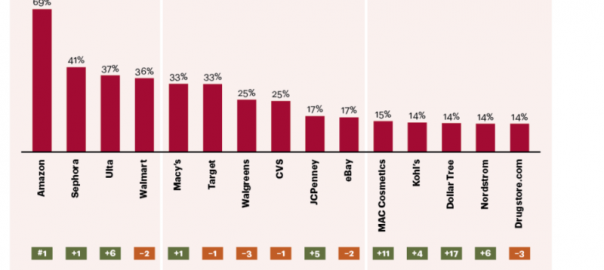

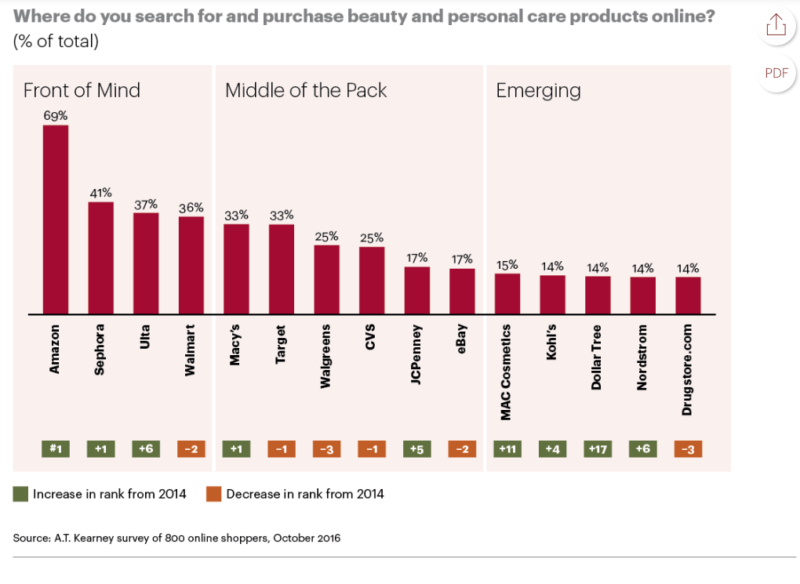

Nearly 70 percent of consumers say they search for and purchase beauty and personal products on Amazon.

This will come as no surprise to anyone watching or involved in the space. Increasingly, consumers have been opting for digital convenience from the beauty and personal products category. As new models disrupt the space, from subscribe and save options, digital-native vertical brands, and Amazon’s private label Basic Care products, it seems established brands have been hit the hardest when it comes to losing market share.

Given the importance of your digital shelf performance, and the rapid pace of Amazon’s dominance of the consumables market overall, I took a close look at what was winning on the website as part of my work at my company Salsify. As in many markets, the tactics to successfully sell beauty and personal care on Amazon differ slightly depending on the price point.

But after analyzing more than 200,000 product pages on Amazon, I noted four overarching lessons. Many product pages fail to provide ample content for shoppers, giving beauty and personal care brands a significant opportunity to win in the category. Let’s look at those four lessons.

Lesson 1: Image is everything

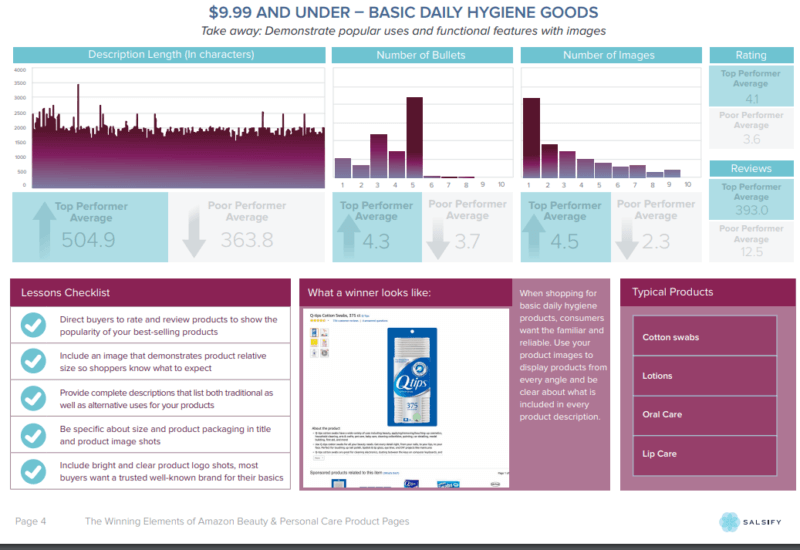

Consumers expect more images, even for low-priced products. Be sure to provide several high-quality images of the product that demonstrate what the packaging looks like, lists any key ingredient information or dosing information, shows the product in use, and provides shoppers a sense of the size or options that your product may come in.

Across price points on Amazon, I saw that ‘Top Performer’ pages (those within the top 10 percent of sales rank) had a minimum of double the image count of ‘Poor Performer’ pages (bottom 10 percent of sales rank).

Even basic hygiene goods categories with products like cotton swabs or toothpaste priced under $10 had an average of 4.5 images for top performers.

Use the brand products you have today to help your shoppers see exactly what they are buying and lend more credibility to the page. In addition, I saw many brands reflecting the answers to commonly asked questions or spotlighting key features of the product in an image to catch shoppers attention to primary reasons to buy.

Lesson 2: Wisdom is a crowd

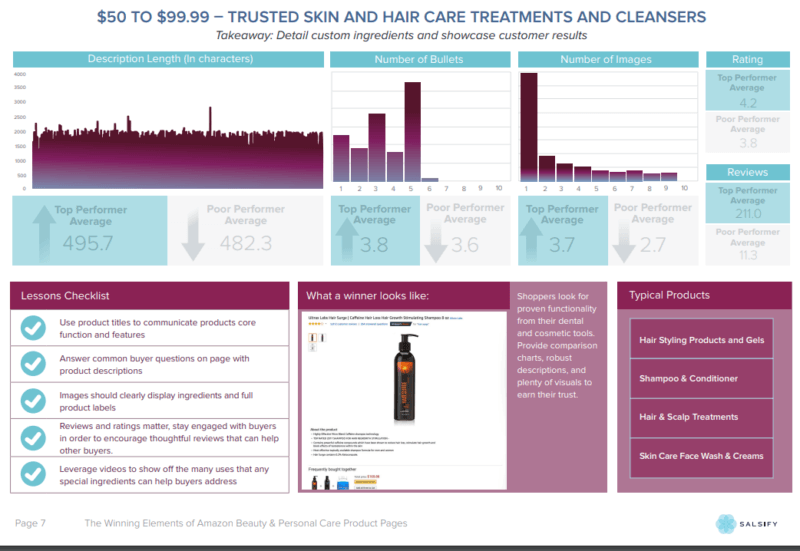

To beat your competitors, get your review count into the triple digits. An overwhelming trend across top-performers is the number of reviews their products receive. This clearly plays an enormous role in winning buyer trust and answering feature and benefit questions for buyers.

Our analysis showed that rather than upping bullet count, having hundreds of reviews on a product page was an enormous factor in winning sales.

For example, in trusted skin, hair care treatments and cleansers priced $50 – $99.99, Top Performers had an average of 211 product reviews. The low performers in this category had an average of 11.3 product reviews.

While Amazon has clear policies against incentivizing or paying for product reviews, many brands are able to improve their counts with basic post-purchase follow-up. Include a request for reviews in packaging and any post-purchase emails.

Lesson 3: It doesn’t take a five-star rating

Following on the previous lesson, while review count matters, star ratings are not as critical. So don’t sweat the star ratings. If your product averages four stars on Amazon, you are in good company in the beauty and personal care category.

Across every price point, there was a mere 0.5 difference in average ratings from top performers to low performers. In fact, regardless of whether shoppers were spending $10 or $99.99 for a product, the average star rating for top performers was 4.2. Products under $10 or over $100 had an average star rating of 4.1.

The data in this part of the analysis can be used to highlight the importance of collecting buyer feedback and responding to it more than getting high marks across the board.

Lesson 4: Bare minimum page is the baseline

Most brands are doing the bare minimum when it comes to product content. There is an enormous opportunity for you to dominate the market. When I looked across the data, product pages in the beauty and personal care category had one image and five bullet points in the product description. Based on my experience and our company research, this is categorically the wrong approach. Top performers across every price point are using images and outstanding content to tell the full brand story rather than relying on bullets, titles or description length.

By investing in product content beyond the minimum required by Amazon, brands have the opportunity to increase Sales Rank and market share on the website at a critical moment of its continued growth.

Top-performing products generally have product pages that quickly give consumers a robust view of what they might buy — particularly through imagery and reviews.

Opinions expressed in this article are those of the guest author and not necessarily Marketing Land. Staff authors are listed here.

Marketing Land – Internet Marketing News, Strategies & Tips

(74)