We rely on data and statistics from various surveys, vendors and publications to form opinions and develop insights into our lives and our business. When you want to build your own survey, what essentials do you need to gather specific data, analyze and produce unique research? It’s hard work. A lot of hard work, but worth the effort if you can do it.

Three years ago, we at ANNUITAS wanted to understand the challenges enterprise B2B marketers in demand generation roles were facing. We scoured the web to find data, reports and relevant information on this unique group of marketers, however, we found most data skewed towards mid-size organizations or small business. That wasn’t going to work for us. So, we decided to build our own study and then share the data with the B2B market to help us all become better marketers.

For those of you thinking about developing your own research, you should go for it as it provides great insight into your target audience. It’s an invaluable experience, providing a unique opportunity to engage with your peer community and to establish credibility.

Here are 5 areas to focus on when developing a survey:

Define key objectives:

It sound like a no-brainer, but understanding what you want to achieve by creating a survey is an essential first step. Be honest. If you just want something for click-bait, fair enough, but know that this is NOT best-practice. Clearly define and map your objectives for the research to ensure you are asking the right questions to accomplish your objectives.

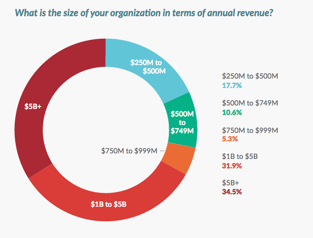

In the ANNUITAS study, we wanted to hear directly from B2B enterprise marketers working in demand generation in organizations with annual revenues of 250 million dollars or more. We didn’t want to learn about those in smaller organizations, we were interested in the complexities that come with large, global, multi-product organizations with complex sales and marketing organizational structures.

Identify your audience:

Know who you want to hear from and accept nothing less. The more specific the audience, the more challenging it may be to get responses, but the better your data will to meet your objectives. Most survey platforms enable selection of key criteria to segment survey respondents making obtaining the most relevant respondents possible.

Anticipate challenges:

When conducting a survey from unknown participants with specific criteria, expect things to take longer than expected. Plan for this, especially if you are doing this for the first time. Define your cadence for communication through a variety of channels depending on what preferences your audience has and adjust based on the volume of responses needed.

Always aim for more responses than you need for a valid study and set a limit for the minimum of responses to keep focused.

Be objective with the data:

Let your data do the talking. After obtaining responses and compiling your data, keep your opinions to yourself and rely on what the data presents to build your insights. Developing insights is not easy, however. According to a recent Harvard Business Review, gathering metrics is easy, but building insights is the hard part, as they are rare.

It’s important to remember you may not get all the information you need to build insights with the first round of data collection as some data may be best suited for discovering broader trends rather than developing specific insights.

Share:

Have a solid, documented plan to share the data and any related insights developed from your survey and data collection. Slice and dice the data to highlight different aspects of your study and distribute the data through a variety of channels and mediums. Make it easy for others to use your data too. In this sharing economy, make sure you provide the results in a variety of formats to best enable sharing across multiple platforms or even other languages.

We develop two versions of our study (full version with analysis and a condensed version), a webinar, an infographic later in the year, post the slides from the webinar up on SlideShare and will use the data for various content pieces throughout 2017. Use the data anywhere and everywhere it makes sense.

Before you develop your survey, take some time to read this article from SurveyGizmo. It shares some helpful tips based on their extensive experiences in the field and might save you from making a few mistakes along the way.

Business & Finance Articles on Business 2 Community(50)

Report Post