I bet you haven’t thought of business plan #1

You might believe that you only need ONE plan to grow your business.

Today, I will share the must-have business plans to achieve business mastery.

You might think a business plan just fills the need of the board, partners, investors, or the bank.

In reality, a business plan is much more, although it is vital to helping you get the finance you need to make your business flourish it’s a tool that can help you;

- Prioritise

- Gain control

- Communicate business direction

- Monitor progress

There are crucial business plans that you must have; they are Technology, Marketing, Finance, Operational and Strategy. They are the pillars on which your business is built and are integral to its survival and growth.

Technology Plan

I will start with a business plan you probably haven’t thought about – but an important pillar for success.

Your technology plan refers to the level of congruence between the technology and its use within your business to achieve the business’ goals. It should cover;

- Team capability and productivity

- Internal Processes

- IT Management responsibility

- Innovation

- IT Strategy alignment with business goals

Measure your team’s skills and how they interact with your current system to give you the insight to identify opportunities to keep staff happy, learning and productive.

Gather information about your business’ internal processes to understand of everything in your business from inventory and sales right through to customer satisfaction. An effective audit and detailed documentation of internal process may highlight current or potential bottlenecks in your business.

Define who will manage your IT, if in-house detail the various responsibilities of the management team. If your business doesn’t have the internal capability outsource to an IT management consultancy, who can look after all your IT requirements such as helping you create an IT strategy plan, innovation, and ongoing maintenance.

Due to the sheer number of variables that come with technology use within a business, there is no solve-all answer, but technology plan will highlight how to get more value from IT investments which are increasingly important in the digital business environment.

Set a benchmark and set SMART goals — goals that are specific, measurable, attainable, relevant, and timely. When senior team members have a clear vision of the overall strategy, IT projects, expenditure and priorities can be aligned with business goals.

Marketing Plan

Want more leads & sales? I’m guessing you do, so you’ll need a marketing plan.

Running a business involves gathering leads and closing sales, despite this many business owners fail to dedicate the time to defining their marketing strategy.

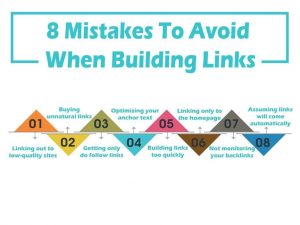

A marketing plan should include;

- Current Position Analysis

- Target Customer Definition (Persona)

- Unique Selling Point

- Competitor Analysis

- Setting SMART Goals

- Budget

- Action Plan

It’s important to get as much information as possible about economic, industry, customer, and competitor trends to help you understand your marketplace. Understanding how your business is perceived in the market will define what actions will be effective & profitable.

Once you have identified your market, go further and create a profile for each of your target personas. The persona is a semi-fictional representation of your ideal customer based on your research used to direct your marketing efforts.

The next step of your marketing plan should be to define your Unique Selling Proposition; essentially what differentiates you from the rest of your competitors. By determining your competitive advantage, you can position yourself well against competitors and in your target’s minds.

Complete a competitor analysis to understand how they meet customer’s needs which can provide great insight as well as tactics that can be applied when marketing to your clients.

Goals are an essential part of a good marketing plan. Set SMART goals which are customised for your organisation and should be tracked throughout their progressions. The goals you have set for your team will dictate what strategies will be best for you.

Once you’ve set your marketing goals, you then must allocate a budget that is tailored to your goals & strategies. Consider if you have internal resources and capabilities to execute your plans as some activities may need to be outsourced to a specialist who has the time, skills and experience.

Financial Plan

Financial data plays a significant role in backing up your goals and ability to deliver; astute investors will look closer at your financial plan as much as any other.

Your financial plan should be developed with a professional accountant or financial advisor after setting the goals for your business. It should cover;

- Projections

- Improving Cashflow

- Budgeting

- Sales potential

Projections will allow you to build from your sales forecast and complete three critical statements; cash flow, income, and a balance sheet. These are also called Pro-forma statements and are essential for every standard business plan.

Projected cash flow is one of the most critical information tools for your business shows a schedule of the money coming into the business and expenses that need to be paid. The result is the profit or loss at the end of the month or year.

Budgeting is a collect-all term that concerns the calculation of the expenses associated with the running of the everyday and future operations of the business. This data can be collected into two tables called an expense table and capital requirements table.

An expense table is focused on fixed, variable and semi-variable costs of the business. The capital requirements table clearly states in detail the money needed to start the business and grow, outlining how the capital will be used, the source of collateral and the depreciation your assets incur year on year.

Your sales potential is based on not only an analysis of the market conditions but also concerning the inherent potential of the business. The sales potential charts the possibilities for the product, as well as the business, over a set period of three to five years.

Operational Plan

The operations plan is designed to outline how the business functions and addresses the logistics of the organisation including;

- Used suppliers and vendors

- Responsibilities of the management team

- Tasks assigned to each division

- Further breakdown of capital and expense requirements

- Specifics about maintaining the property

- The operations’ cycle

- Sources of labour and number of employees

- Data on operating hours and facilities

To execute your strategies, it’s critical to assign responsibilities to actively move you which is essentially the function of an operational business plan. This is connected to the staffing section which identifies, explains the roles and defines the cost of each team member.

It should also outline specific project deadlines, and internal objectives used to stay on track to meet your goals as a business. As a larger part of the operational plan is internal, it will be more concise that a fully detailed financial or marketing plan.

When you have set your goals in place, create and formalise procedural tasks and assignments for different departments. This will outline where resources are allocated and how various parts of the business will interact.

Strategic Plan

A strategic business plan paints a larger picture, describing how employees and departments will work together at a high-level to create a successful culmination to the company’s goals. A strategic plan covers high-level views of;

- Feasibility

- Growth

- Business Goals

As you build the strategy for your business, examine your strengths and weaknesses as a business and consequentially decide how to implement it.

Some use the phrase feasibility to refer to a start up. It also relates to the steps taken to validate a technology, product, or market as a target and whether it requires additional strategy and financial projections.

Addressing the feasibility of your business plans is an import for senior management and business owners to address at in the planning stages and throughout the implementation of any plans as it will highlight the value-creating activities which can be repeated.

All business want to grow, highlighting opportunities to do so and how to act upon them deservedly requires a sizeable chunk of your attention.

First, analyse your business and compare it against industry benchmarks while looking to Improve your internal processes. It’s important to start by asking whether you can grow within your workplace and then scouting external opportunities for business growth.

Growth requiring outside investment would necessitate developing and inspecting a cash flow statement which should be included in your strategic plan so you can understand what your needs are now and will be in the future.

Conclusion

By laying out these 5 plans you should understand how your business is put together, which areas of your business you should prioritise, your action plan and have the ability to measure your success.

Business & Finance Articles on Business 2 Community(60)

Report Post