At the end of 2013, I wrote an article entitled, “Video Is the Future of Social” for AllThingsD. In it, I predicted the important role that video would play in the social Web, and why. Two years later, as digital video has grown exponentially, thanks to platforms like YouTube, Facebook, Instagram and Snapchat, it feels more and more like we are at the precipice of yet another tipping point for content and content distribution.

So for 2016, I’m making five new predictions on the future of streaming video, and the platforms and industries at the center of this disruptive market.

1) Free ad-supported video viewing (AVOD) will continue its meteoric growth, but consumers will retaliate against poor advertising experiences.

The industry is already starting to pay the price for egregious ad loads and disruptive, irrelevant ad experiences. This trend will continue to amplify in 2016. A 2015 report by PageFair and Adobe says that 16 percent of the U.S. online population blocks ads, an increase of 48 percent from the previous year.

But this type of ad blocking is just the tip of the iceberg, and the advertising industry needs to wake up and heed the warning signs. For advertisers, this is a call to action to create more compelling and relevant content that is tailor-made for each digital platform. For publishers and platforms, it is a call to action to further innovate and create experiences that align with consumer expectation, mindset and intent.

2) YouTube and Facebook will continue to square off, and it will probably result in a split decision.

In the video arena, each of these platforms offers tremendous audience scale and distinct advertising solutions: YouTube has Google Preferred and TrueView, and Facebook has people-based marketing. As brand marketers shift their broadcast budgets to these open platforms, they will demand certain assurances with regard to brand and content alignment, especially given the variety of uploaded content. Meanwhile, audiences will be equally demanding with their content and viewing experiences.

Two different constituents with a strong set of expectations will most likely result in a split decision. This is to say, one of the platforms might win with the audience, and the other platform might win with the advertisers. YouTube’s new ad-free subscription service, YouTube Red, is a strong step to diversify revenue and dependency on advertisers. Now the challenge is to prove they can convert a percentage of those billion-plus free viewers into paying customers.

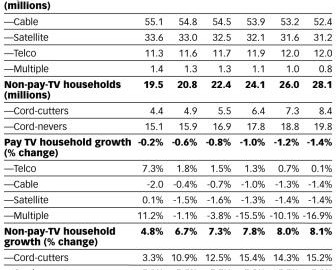

3) Cord-cutting and cable unbundling will increase, making the “skinny bundle” an increasingly attractive option.

The latest forecasts demonstrate that a growing percentage of Americans are “cutting the cord” (4.9 million households in 2015) — and those in the business of television are rushing to keep up. At last year’s CES, Dish premiered its Web-based Sling TV service, which is designed to appeal to a younger generation of “cord-cutters” and “cord-nevers.”

The latest forecasts demonstrate that a growing percentage of Americans are “cutting the cord” (4.9 million households in 2015) — and those in the business of television are rushing to keep up. At last year’s CES, Dish premiered its Web-based Sling TV service, which is designed to appeal to a younger generation of “cord-cutters” and “cord-nevers.”

In 2015, HBO, Showtime and CBS all debuted standalone streaming services. These new Web-based TV services — coupled with popular offerings like Netflix, Amazon and Hulu — have opened consumers’ eyes to the reality of the “skinny bundle.” As consumers adjust to the appeal of making a la carte programming choices, the industry will head directly into my next prediction…

4) The subscription video on demand (SVOD) wars are just beginning, ushering in a new disruptive, hypercompetitive era.

Last August, Disney CEO Bob Iger alluded to the fact that disruption was occurring in the multichannel television universe (cable), and that it wouldn’t be inconceivable to go direct to consumers with Disney’s flagship brand, ESPN. That in turn sparked a massive investor sell-off of TV-related stocks. That market shock might go down in history as the sounding bell for what will certainly become known as The Era of SVOD. Netflix, Amazon, Hulu, HBO, YouTube Red (as well as more niche SVOD players like Crunchyroll, DramaFever and NBC/Uni’s new Seeso, to name a few) are all vying for consumer attention and the accompanying subscriber revenue.

James Murdoch spoke plainly at the Goldman Sachs Conference last September about the power of OTT (“over-the-top” content, delivered digitally) and how it directly relates to increased control in a disruptive market. The major issues facing those competing in the SVOD arena not only includes subscriber acquisition, but also retention, given that consumers can unsubscribe with a simple click. In the race to attract paid subscribers, platforms that have large audiences viewing free content can be powerful conversion funnels. This bodes well for YouTube Red. In 2016, the other SVOD players will need to leverage the scale of free viewing platforms to drive subscriber growth or quickly become irrelevant in the war for consumer attention.

5) Media companies will become data and tech companies in order to survive and thrive.

This last prediction is actually a warning. I’m a fan of creative IP and the machine that has honed that process of leveraging that IP to drive large media companies. But the biggest mistake anyone can make in this world of nonlinear streaming distribution with diverse global audiences is to think that a media company of tomorrow only needs to focus on (January 19, 2016)’s playbook.

The greatest coup Netflix pulled off in its early days was to downplay with the media companies (from which it was licensing content) the importance of its data and the substantive role that data could play in building enterprise value. Today, we know that Netflix data (which isn’t shared externally) drives its development, production and distribution strategies and decisions. Its data is driving its growth, and growth is everything — especially when everything is up for grabs.

I believe 2016 will be another interesting chapter in the disruptive market of streaming video. The platforms, industries and brands that are at the center of this disruption will continue to innovate or pay the price. The stakes are too high to not heed the warning signs.

Digital & Social Articles on Business 2 Community(38)

Report Post