Using an electronic trading platform allows you to monitor and purchase a variety of financial products by connecting you with financial professionals. These platforms mobilize the trading process and open up opportunities for you to access diverse markets that offer unique trading prospects. When looking for a platform, assess it carefully for features that support the continued growth of your portfolio.

Necessary Funds and Fees

While some electronic trading programs are easy to use, others require you to pay commission fees to the brokers handling the deals. It’s also important to find out how much money you need to establish an account and whether or not a certain balance has to be maintained in order to avoid fees. Do the math to figure out how much of your money will go toward paying to trade and how much you actually get to keep. If the impact on potential profits is too large, you might want to consider a different platform.

Ease of Use

You have a choice of either software-based or web-based trading platforms to access the market. Software is installed on your computer or device of choice. You can engage in web-based trading on any computer with an Internet connection. Look for a user interface with a streamlined layout and intuitive controls. Other options, including automatic trading and integration with third-party software, enhance the trading experience.

Comprehensive Data

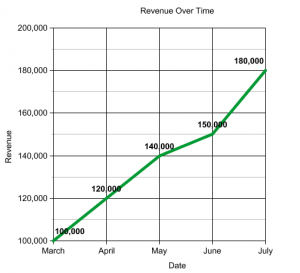

To make the best selections when trading online, you need a platform that provides stock charts updated in real time. Historical data should also be available so that you can compare current trends with past performance. It’s easier to make smart trading decisions when you can closely monitor the ups and downs of the market. Look for a platform with a range of offerings that gives you the option of diversifying to enjoy the biggest possible dividends.

Optimal Performance

Slow speeds and platform downtime lead to lost trading opportunities. Remember that you’re competing with many other traders for a finite number of chances to make big profits. The more trading time a platform can ensure, the more time you’ll have to monitor, track and participate in the trades that matter to you. If a platform can’t guarantee that kind of access, you’re not likely to get the returns you desire.

Reliable Security

Since trading online means dealing with real money and extremely sensitive personal information, security is of the utmost importance. The platform you use should have a firewall set up for both the server and the application. Redundant data stored on synced servers protects against the loss of information that could potentially put a dent in profits.

The right trading platform allows you to diversify your portfolio and maximize revenue no matter where you are. Many programs offer a demo or trial version that you can use to determine whether your chosen platform is the right fit. Take advantage of this to test the features and ensure that it gives you everything you need to have a profitable trading experience.

Business & Finance Articles on Business 2 Community(102)

Report Post