The first thing you have to ask yourself while starting a new business is what separates you from your competitors. If you can figure out what sets you apart from other providers in the market, then the next step is highlighting your differences to get the best prospects in the market. An online business loan can get you ahead by enabling your small business to quickly and efficiently accomplish all the things you need to do.

But the problem is that most small business owners find it hard to showcase their competitive edge in the market because they lack money.

Did you know that 29% of business failures are due to insufficient capital?

Rather than a traditional loan the best thing business owners can do who are facing such problems is take online business loans.

Do you want to know how an online business loan can help you excel in your business and keep you from going under?

Keep reading this article as share with you the five outstanding benefits of online business loans.

-

Improve your customer support

One of the easiest ways to ensure that you find more customers and generate revenue is by improving your customer support. The more you focus on improving the experience of your customers, the easier it will be for you to build your brand in the market.

But how can you go on to achieve perfection in your customer support if you don’t have money, to begin with?

Getting an online business loan is the best way you can support the expenses of improving your customer support.

An online business loan will allow you to employ the latest solutions and technologies like chatbots, so your customers will see you as having the most up to date equipment.

Buy new equipment

A small business can fail to achieve the heights it deserves if it doesn’t use the right equipment.

Gone are the days when all the products available in the market used to be the same. If your competitors are using better equipment and software than you, then their products will reach the audience you are trying to get.

Online business loans can help you buy state of the art devices and equipment if you don’t have money to do so.

Using the amount you get through the loans, you will make better buying decisions to help excel your business.

Pay your regular expenses

No person can run a business without spending money regularly to support its operations. If you fail to meet the daily expenses of your business, then how do you plan on taking your business to the next level?

The only way you can ensure the existence of your business through paying the regular expenses is by getting an online business loan.

A proper loan plan will enable you to support your business, and you will be spared from the awful task of asking for money from your friends and family.

Hire the best people

Hiring the most talented people can take your business to the next level.

If you are the only person running the small business and have no one by your side to handle the business operations, how can you ensure the future growth of your business?

Getting new people on board who are passionate about what they do and want to contribute to the growth of your business can help you take your business to the next level and be competitive online.

Market your products and services

No matter how great your products and services are, if you fail to take them in front of your target audience, you will never be able to meet your business goals.

It’s important to ensure that you follow proper marketing plans to fuel the growth of your business.

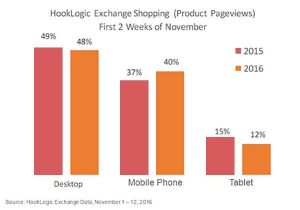

This includes social media marketing, SEO, email marketing campaigns, networking, search engine marketing, brand imaging and more.

A small business loan will help you finance your marketing campaigns without paying extraordinary interest rates.

The interest rate you end up getting will depend on a number of factors, such as your credit score or the nature of your business.

But keep in mind that one of the primary benefits of taking out a small business loan is that the bank does not dictate how you can use the loan once in your hands.

This allows much flexibility and ability to respond to various market conditions without having to consult with anyone.

Another great advantage is that the profits you generate by the loan are all yours! All you are required to do is pay down the loan and its interest in a given time period.

Conclusion

Business loans are able to turn profits for many businesses, with studies showing that a single loan caused 61% of businesses to turn profitable.

Getting an online business loan can give you the capital gains you need to enable you to run proper marketing campaigns on both traditional and online channels to help grow your business in no time.

Business & Finance Articles on Business 2 Community

(38)