You do not get rich off your salary; you get rich off your investments. With my mindset some of the most important innovations coming from Silicon Valley revolve around financial technologies. Fintech has consistently been a lagging field as the financial markets tend to be conservative and focus more so on their bottom line than on introducing innovative solutions.

However, 2016 has been a tremendous year for Fintech with the widespread support of a number of disruptive companies, such as Robinhood, which allows free stock trading. This year is sure to continue this success and be the year that Fintech breaks out into the light.

1. High Yield Savings Accounts

Earlier in 2016, Goldman Sachs unveiled a savings account with no minimum that gives over a 1% interest rate. For anyone with a savings account, this is a huge increase from the near-zero or zero interest rate accounts most banks offer.

As Goldman Sachs is limited by cash reserves when it comes to their investments, due to regulations after the 2008 crash, they know if they can just get cash in their vaults they can make much more than the 1% by using their investment teams.

What this means is that not only should people drop all of their other banks and switch to Goldman Sachs, but also there is going to be a switch to create more innovative money management solutions on behalf of the banks in order to serve customers higher interest rate accounts.

Furthermore, this indicates a future in which not only will more banking be done online (as this Goldman account is entirely online), but also we will likely see a bigger transition of investment banks (such as Goldman, JPMorgan, Morgan Stanley, etc.) crossing the line into consumer banks (such as Wells Fargo, Bank of America, PNC, etc.) and vice versa.

2. Simplified Insurance

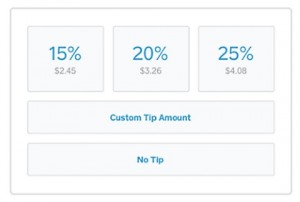

Does anyone really know what their insurance premiums go towards, what their rate changes will be each year, what is covered and what is not, or what types of insurance they need are? Insurance is one of the most complicated industries if for no other reason than the fact that it involves so many facets and moving parts.

Furthermore, companies tend to focus on specific types of plans and stratify coverage to give consumers more options. When consumers cannot understand what they are buying, they do not want options.

Just as Robinhood eliminated much of the red tape surrounding stocks, trading fees, and overall took a hardline to give consumers a perfect user experience, the insurance industry will need to see similar adoption. Already there are companies popping up offering simple and straightforward insurance coverage via apps.

Some solutions arising are pay-as-you-drive car insurance, easy-to-understand life insurance, and more. This is a big pain point for consumers and so will see huge adoption if someone can properly solve the problem.

3. Cryptocurrency

Bitcoin crossed the $ 900 mark this year, one of the biggest rallies of the digital currency since its spike and crash back in 2014. Additionally, Ether arose as a widely “mined” and traded crypto, proving that further currencies beyond just Bitcoin have viability to rise to similar prominence as Bitcoin.

According to Michael Gastauer, founder of WB21, venture capital funding has continued to pour into the industry and online wallets for the coins have grown consistently.

He explains while this industry still lacks any real value or substance behind the investment, it is beginning to reach a level of risk that is tolerable by a wider market and an increased dispersion of knowledge that makes it seem less sketchy.

As consumerization of cryptocurrencies continue to expand this had the potential to be a breakout industry where the concept of decentralized investments could have huge impacts on society in 2017.

4. New-Age Stock Trading

Robinhood is the golden standard of Fintech companies and while only a couple years old is already rapidly approaching a billion-dollar valuation and is continuing to improve their product offering.

The newest roll-out is a premium offering which offers margin trading, instant trading, after-hours trading, and more.

While it seems unlikely that anyone will be able to compete with Robinhood in their court, they are more than content to continually outperform themselves. This makes the entire industry of stock trading an interesting vertical to watch since it is almost guaranteed to keep getting disrupted as long as Robinhood is alive and kicking.

5. Shifts in Tax Policy

While this is not quite Fintech, tax policy will most definitely change in the coming years due to Republicans controlling Congress and President Trump campaigning on major promises to cut out loopholes in the tax code.

Some of these changes include eliminating the lack of capital gains taxes on realized gains of municipal bonds; meaning when you loan money to a city for public works, the interest on that loan is no longer tax-free.

Similar shake ups in bonds and various investment preferences will drastically alter the way in which private equity is invested and managed in America. Such changes will open and close opportunities for Fintech and need to be taken into account.

Business & Finance Articles on Business 2 Community(85)

Report Post