Columnist Steve Tutelman examines retailers’ Google Shopping performance from Thanksgiving to Cyber Monday, revealing how consumers are changing their approach to the holiday shopping season.

Thanksgiving, Black Friday and Cyber Monday are evolving concepts for shoppers and retailers alike. Catching Thanksgiving and Black Friday deals doesn’t require rushing to the stores, or even to the nearest computer. Cyber Monday isn’t just a day. It’s a whole week or more.

Just how much the holiday kickoff has changed is evidenced by retailers’ Google Shopping performance during the bonanza of Thanksgiving to Cyber Monday.

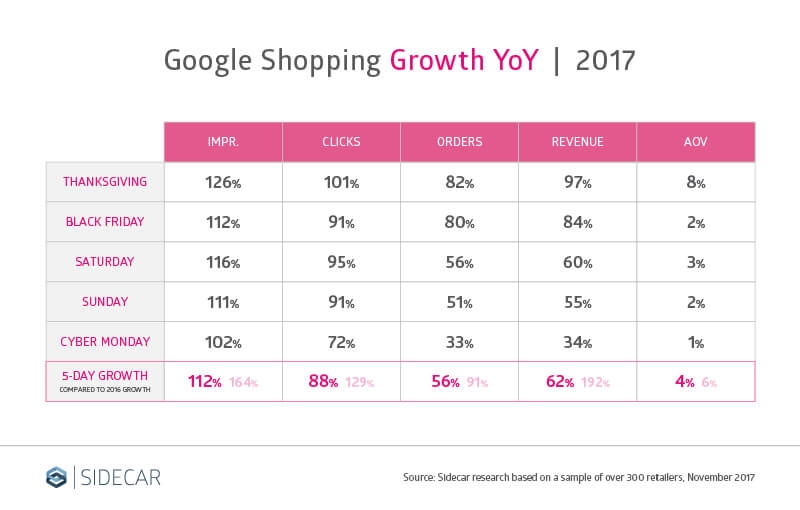

Traffic from the channel jumped 88 percent over the same five-day period last year, according to our research into a sample of over 300 retailers ranging in size and vertical. Revenue was up 62 percent, and retailers nearly doubled their investment in Google Shopping over the same period last year — likely due to a combination of surging traffic and an increased number of retailers competing in the channel.

Many retailers throw out the rule book during the biggest shopping days of the year. They often prioritize revenue, customer growth and clearing out inventory over traditional direct response ROI tactics like driving return on ad spend (ROAS).

But the holiday kickoff is also a time to expose new consumers to your brand, reactivate dormant shoppers and acquire a larger share of wallet among existing customers.

This year’s developments in Google Shopping speak to the growing evolution of an opportunity in the channel. Perhaps more important, the results also show how consumers are approaching the holiday season differently and what marketers are doing to adjust.

1. Turkey with a side of mobile shopping

Thanksgiving has become a shopping day in its own right. Retailers started reshaping consumers’ perception of the day in 2012 when many businesses began opening their doors on Thanksgiving for the first time. More recently, we’ve seen a swing in the opposite direction, with retailers like REI closing not only on Thanksgiving, but on Black Friday as well.

Where have these shifting activities left consumers on Thanksgiving? On their phones, where they can take advantage of deals whether retailers have opened their stores yet or not.

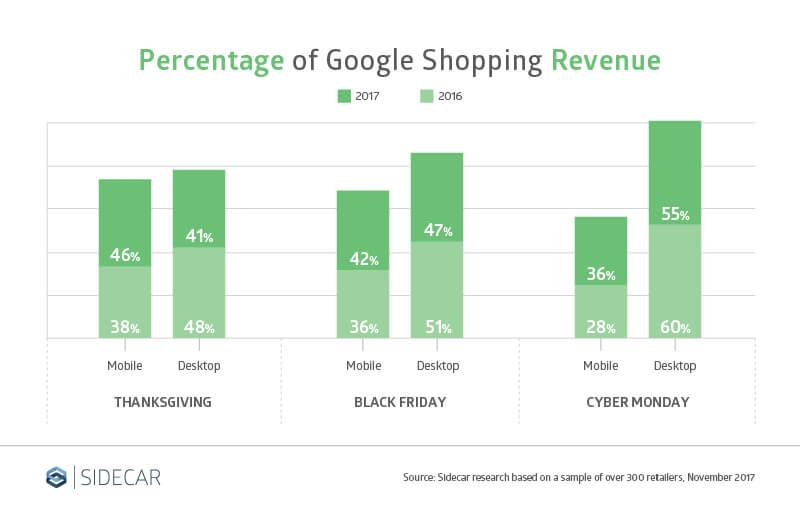

In our analysis of Google Shopping data, mobile’s importance stood out the most on Thanksgiving. Mobile (which comprises smartphones for all our findings here) represented 46 percent of Google Shopping revenue on Thanksgiving.

By contrast, Cyber Monday remains a day of shopping primarily on desktop — although mobile is eroding desktop’s dominance. Desktop drove 55 percent of Google Shopping revenue on Cyber Monday in 2017, down from 60 percent last year.

It appears that a perfect storm is brewing. Consider this combination: The pendulum is shifting back to consumers staying home on Thanksgiving. Mobile experiences continue to improve. Consumers have increased trust in mobile shopping. Google is evolving its Shopping channel to cater to the mobile format, with rollouts such as the mobile-centric Showcase Shopping Ads.

Thanksgiving is becoming a day of mobile shopping — and it appears that’s why it experienced the most growth of the five-day period overall.

2. Thanksgiving comes into its own

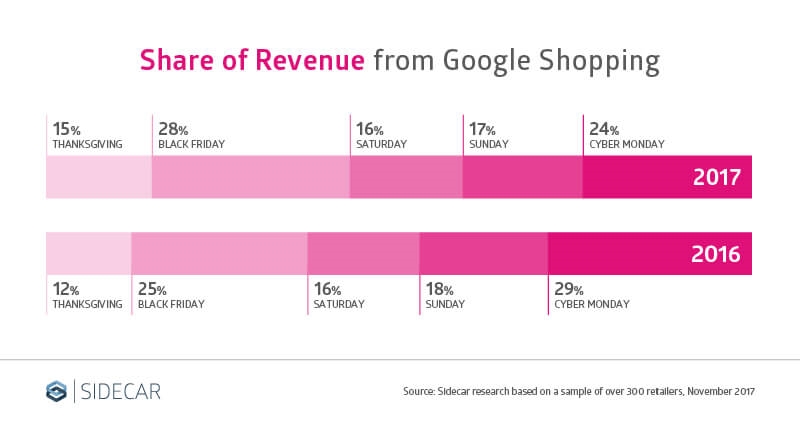

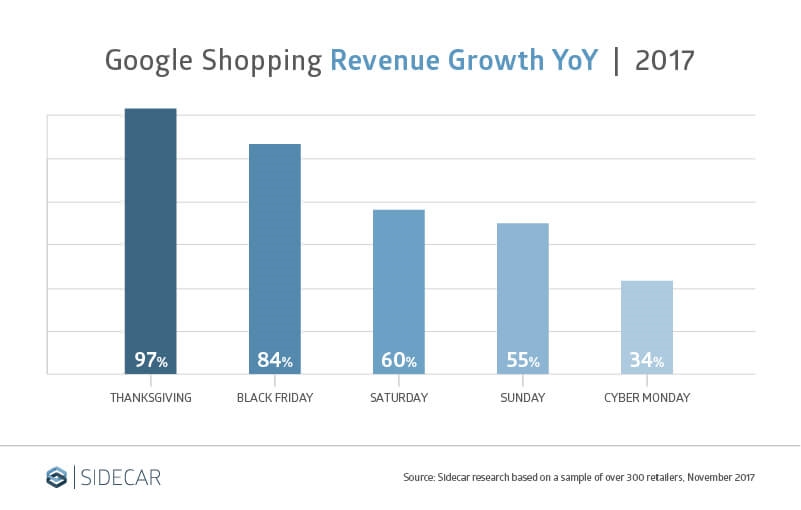

Google Shopping traffic doubled year over year on Thanksgiving, and nearly every other topline metric followed suit — including revenue.

The holiday previously trailed the growth of the other four days by significant margins. The starkest contrast last year was Black Friday, which nearly tripled in revenue year over year, while Thanksgiving revenue grew by just 26 percent.

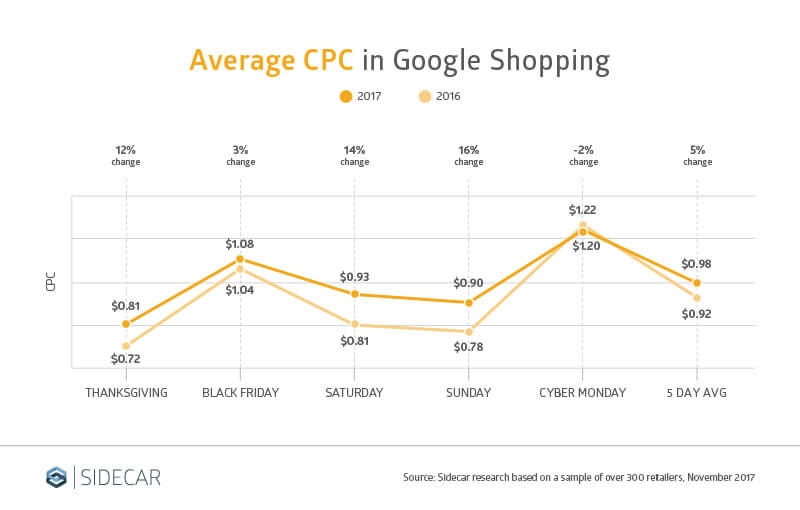

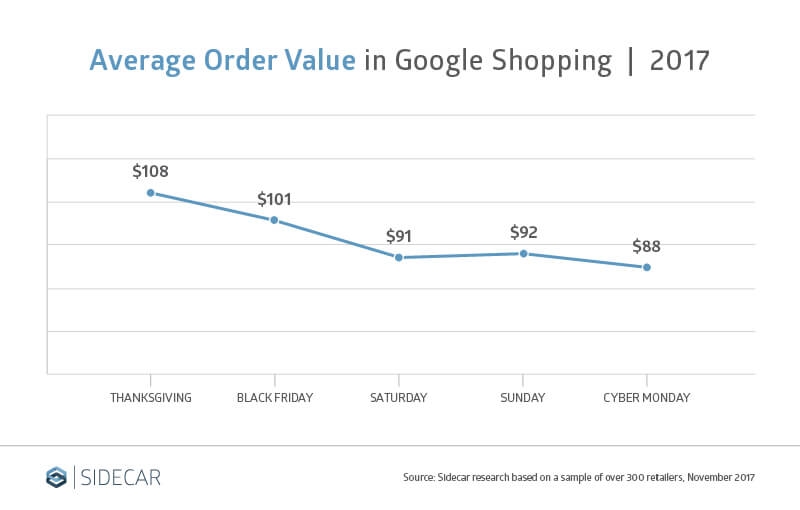

In 2017, retailers who bet heavily on Thanksgiving reaped rewards. Thanksgiving had the lowest average CPC (Cost Per Click) and the highest AOV (Average Order Value) of the five-day period.

AOVs overall ticked up slightly from the same period last year (averaging 4 percent higher for the five-day period than in 2016), pointing to the strong economic fundamentals we’ve seen in the US this year.

3. Black Friday rebrands as a mobile shopping day

The past couple of years have seen online sales grow on Black Friday. This year was no different. Consumers spent a record $5.03 billion online on Black Friday this year, an increase of 16.9 percent over last year, according to Adobe Analytics.

Following suit, within Google Shopping, Black Friday saw an 84 percent growth in revenue and accounted for the highest share of revenue (28 percent) from the channel over the five-day period. Black Friday also drove the highest share of clicks (24 percent) and orders (26 percent) for the period.

But take another look at mobile’s impact on Black Friday. Mobile drove 42 percent of Google Shopping revenue that day, up from 36 percent last year. By contrast, desktop is starting to fall out of favor on Black Friday, driving 8 percent less revenue year over year.

At the same time, foot traffic was relatively flat on Black Friday, according to ShopperTrak data. Consumers are still hitting the stores — but data shows they’re increasingly buying on their phones.

Deloitte estimated in a 2016 report that $0.56 of every dollar spent in a brick-and-mortar store is influenced by digital. Channels like Google Shopping and local inventory ads (LIAs) appear to be making digital investment a more important driver of store traffic and overall sales than ever before.

4. Google Shopping = mobile

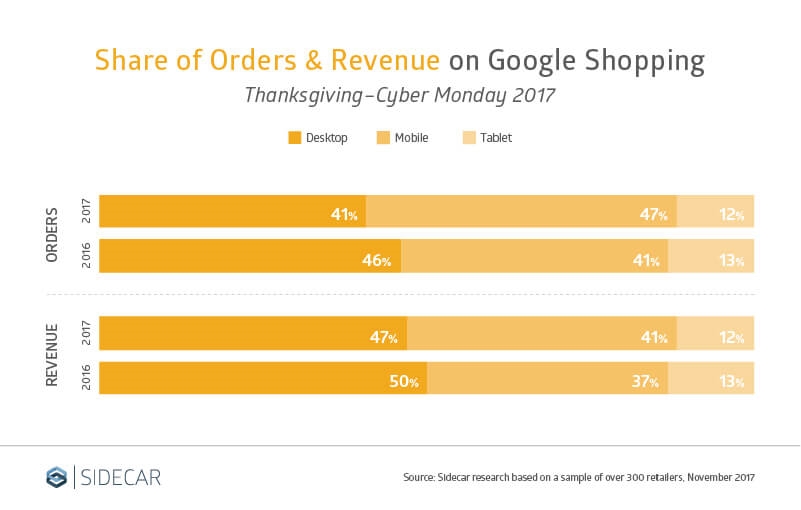

Ultimately, you can’t talk about Google Shopping without talking about mobile. Among all devices, mobile drove the most impressions (58 percent) and clicks (63 percent) for the five-day holiday kickoff this year. Our 2016 data similarly showed mobile drove the highest percentage of impressions and clicks.

But 2017 was a turning point when it came to another KPI: orders. Last year, desktop drove the most orders across the five days. This year, mobile represented 47 percent of orders, outpacing desktop’s contribution of 41 percent.

Several factors are likely at play in driving this shift. First and foremost: 2017 was a big year for improving the mobile shopping experience. Retailers uncovered friction, hastened load times, added mobile payment options and updated clunky click paths.

Related to this improvement, comfort levels around mobile shopping appear to be growing. Google Shopping is a reflection of a retail market that seeks to cater to the digital, and especially smartphone, generation.

5. Building markets for deal hunters

It appears the growing hype on Black Friday could have led to diminished urgency to shop on Cyber Monday. Year-over-year revenue growth for Cyber Monday — 34 percent — was a laggard compared with the rest of the five-day period. It was the only day to not top 50 percent revenue growth.

While part of this may be that Cyber Monday is reaching its ceiling, it also appears that year-round bargain buying could be diminishing shopper activity. Nearly two-thirds of consumers said they shop for holiday gifts throughout the year with the rise of constant discounts like deal websites and Amazon Prime Day, according to Accenture’s latest Annual Holiday Shopping Survey.

Additionally, it appears retailers are doing a better job incentivizing impulse purchases, which, in turn, also reduces the rigidity of shopping on particular days of the year. Shoppers see less need to buy on Cyber Monday when they have many other days of deals and discounts from which to choose.

6. Competition can’t be underestimated

While Google Shopping continues to experience significant growth, there are some key indicators in performance-oriented metrics that show the channel may be approaching a saturation point.

Historically strong consumer performance and retailers’ investments in the channel have caused CPCs to rise in Google Shopping. Retailers doubled their spend in the channel for the five-day period, while increasing their ad depth and widening the breadth of areas in which they focused their spends.

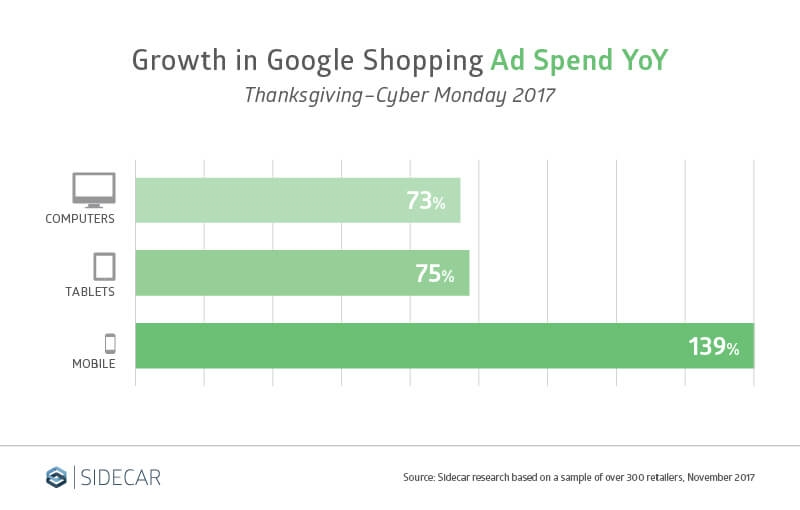

Retailers also are continuing to invest heavily in mobile. For the five-day period, ad spend was up 139 percent year over year on mobile, while retailers increased their investment in desktop by 73 percent.

That change in investment was so big that retailers spent more on mobile Google Shopping ads every day other than Cyber Monday. In 2016, by contrast, mobile was the leading investment only once: Thanksgiving.

Growth is not a given by just providing Google with a well-optimized product feed and developing a logical campaign structure. Basic optimization tactics are table stakes.

Retailers need a dedicated and sophisticated strategy to succeed in Google Shopping — one that evolves with developments in the channel and retail as a whole. With findings like the ones we’re seeing from this year’s holiday kickoff, there’s certainly an opportunity to capitalize on Google Shopping’s growth with the right approach.

Opinions expressed in this article are those of the guest author and not necessarily Marketing Land. Staff authors are listed here.

Marketing Land – Internet Marketing News, Strategies & Tips

(61)

Report Post