When one looks at the business landscape today, one can quickly observe the rise of start-ups and ambitious small businesses looking to break into the big league. As with any company in its early growth stage, resources are typically limited and founders look to outsource several tasks. The popularity of virtual bookkeeping builds on this trend where business owners try to save their precious time and money, and focus on what they do best – running their business rather than crunching numbers.

Many small businesses are still warming up to the idea of virtual bookkeeping. While they may not bat an eyelid before outsourcing customer support or order fulfillment, some business owners are yet to get around the idea of hiring virtual bookkeeping services. Let’s look at 7 key reasons why virtual bookkeeping is here to stay and why should you actively consider them.

Specialized Services and Skill Set

A virtual bookkeeping service will typically provide you with a resource who knows your industry and the relevant accounting practices. In contrast to hiring a part-time resource locally who may not have relevant knowledge; a virtual bookkeeping executive would have the requisite experience to meet your needs. That apart, your virtual bookkeeper can call upon the considerable experience her team and managers possess, to deal with any tricky aspects. Most specialized accounting service providers have subject matter experts to support their resources and such assistance can at times prove invaluable.

Another interesting aspect of working with a virtual bookkeeping service is the availability of people with specialized skill sets. You get the chance to connect with a financial controller in case you need expert advice on your financials. Also if you need additional services, of and on, say job costing; your online bookkeeping service will most likely be able to help you on short notice.

Significant Cost Savings

As opposed to hiring a full-time bookkeeper in-house, opting for a virtual bookkeeping service offers significant cost savings. Besides the salary you are expected to pay to a full-time bookkeeper, you might also need to bear costs associated with insurance and payroll taxes. You may even need to provide suitable office space for the person to work effectively. In the case of a virtual bookkeeping service, you just pay a specific cost without any additional overheads. In many cases, such services are way cheaper than any full-time or even part-time resource you hire locally.

Save Time for Yourself

Engaging a virtual bookkeeping service is a sure shot way to save time and effort which you would otherwise expend on a full-time in-house employee. Virtual bookkeeping services derive a significant advantage from standardized processes and best practices they have developed over years. Your virtual bookkeeper will most likely work during your business hours and would have several communication channels with you. You can schedule interactions based on your availability and save time for more pressing business activities.

Safe and Reliable Service

Even today some business owners are a tad reluctant to share their financial data with third-party providers. However, such fears are quite misplaced as there are several reliable and trustworthy service providers offering virtual bookkeeping services. Add to that, when you work with a professional bookkeeping service, you benefit from the oversight of your financial data. Most reputed virtual bookkeeping firms work from secure office spaces and have monitoring software in place to track the activity of their resources. In fact, proper logs are maintained for compliance, and service level agreements are set to ensure deliverables. There are several top-end virtual bookkeeping providers offering a host of services at competitive prices.

Power of Technology

Virtual Bookkeeping services rely on technology to make their jobs easy. This essentially comes across as a boon for their clients. Assume you are on a business trip to a different city and suddenly wish to review accounts for a certain project. In the case of a full-time bookkeeper, you are most likely to call him and ask him to email the details. Seeking any clarifications would take further time.

In contrast, in a reputed virtual bookkeeping service, all your data would be available on the cloud which you can securely access through any device. You are also likely to get detailed explanations in case you seek them as there is always someone around to help you.

Many online service providers offer cutting-edge solutions to help several aspects of their client businesses. From expense tracking apps that seamlessly integrate into the accounting software to secure virtual file rooms which are encouraging businesses towards a completely digital environment for data storage.

Detailed Reporting

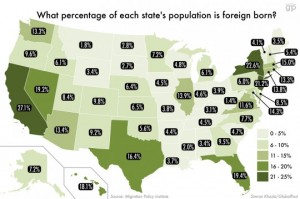

Most virtual bookkeeping services offer detailed reporting to their clients. Many of these reports are set to be delivered on an agreed schedule. You are also likely to receive timely alerts about any pending items that need to be addressed. Further, such firms also allow you to keep abreast of any changes in the regulatory and compliance environment. For businesses operating across different states, a bookkeeping service that keeps it abreast of the latest changes is always advantageous. Some service providers also offer clients options to receive alerts related to suspicious transactions, specific inconsistencies, etc.

Scalability

One of the biggest advantages of availing the services of a virtual bookkeeping service is scalability. An online bookkeeping service provider can quickly adjust to an increase in work volume, like increased transactions or complexity. In contrast, an in-house resource cannot work beyond certain human limitations, and hiring qualified resources in quick time is not easy. Moreover, if you do end up hiring more resources, and if the business ebbs after a period of time, you would be stuck with extra resources.

With a virtual bookkeeping service, you will have the option to engage on a pay-as-you-go model. When your business grows, you can immediately scale up without bearing overhead costs and spending precious time on hiring a new resource.

To conclude

In a fast-moving world with so many business models innovations and emerging tech, it’s clear that using outsourced services can adhere to one’s scalability greatly, and having your finances in place is mandatory.

Business & Finance Articles on Business 2 Community

(69)

Report Post