Those new to the finance world and looking into retirement may be overwhelmed with all the new terms and information out there. In this article, we give you a Fixed Annuity 101 Guide to help you understand everything you need to know about them.

What is a Fixed Annuity?

A fixed annuity is essentially an insurance contract that promises pay to the buyer. They guarantee a specific interest rate contingent upon the contributions from the buyer to the account. Simply put, the buyer gives a lump sum or makes a series of payments over time to an insurance company. In return, the buyer gets fixed income throughout retirement.

Fixed annuities are often used in retirement planning, although slightly different from a 401k or a Roth IRA. 401ks offer no upfront tax break, although it rewards investors with tax-free withdrawals in retirement. That means you never pay taxes on the money you make from these accounts, but you can’t touch the account until you reach a certain age. Annuities, on the other hand, are tax-deferred.

Thus, you only pay taxes when you receive payments from the annuity. However, annuities do offer guaranteed income during retirement, while a 401k is just a lump sum.

How does a Fixed Annuity work?

Most people buying annuities will purchase it through a large payment, but others will purchase it through payments over time. Once the annuity is purchased, the insurance company guarantees that the account will earn a certain amount of interest. After the purchase and the interest starts compounding, the buyer, or annuitant, enters the accumulation phase.

The insurance company will calculate those payments based on the amount in the account itself, the owner’s age, and a handful of other factors. During this phase, the account will grow tax-deferred. The taxes on the contract will be based on an exclusion ratio.

An exclusion ratio is simply the ratio of the account holder’s payments to the amount accumulated in the account. This is then based on gains from the interest earned during the accumulation phase. Overall gains will be taxed eventually, but only when the annuitant receives the payment.

After that, the insurance company will use the money from the annuitant and invest it in various places.

After the money has accumulated, the payout phase begins. The payout phase will continue for a specified number of years, or for the rest of the annuitant’s life. This is typically agreed upon before purchasing the annuity.

What are the Different Types of Annuities?

There are two main types of fixed annuities, being life annuities and term certain annuities. A life annuity is an insurance product with fixed payments at intervals. You’ll set when these payments happen. The central aspect of life annuities is that they go until the person’s death that takes out the annuity. A life annuity will pay you guaranteed income, not indexed by inflation. Also, when a life annuity is enacted, it’s not revocable.

A term certain annuity is essentially the same thing, but there’s a set end date to the contract. Term certain annuities will typically offer larger payouts than a life annuity. Since it pays out over a specific time period rather than until the annuitant’s death, the insurer is at less risk. If the annuitant dies before the period ends, the beneficiary will receive the payments.

Benefits

There are a handful of ways annuitants can benefit from these contracts.

Predictable investment returns

Fixed immediate annuities are generally very safe and secure. Your money isn’t really being moved around between different functions within the market. Fixed annuity rates are typically derived from the yield the insurance company generates. Insurance companies will typically invest in high-quality corporate and government bonds. These are relatively safe for the company, and they are then responsible for paying the annuitant back at the rate from the annuity contract.

To calculate the return on a fixed immediate annuity, there’s a simple equation. You take the total amount you put into the annuity and divide it by the number of months left. This would be the end date on the contract, or your calculated life expectancy. The number you get will be your monthly income amount. If that’s confusing, here’s an example

If you are a 65-year-old man with around $ 100,000 to invest, you’ll receive a base of $ 259.20 per month. You would start getting these payments the month after the annuity starts, usually for the rest of your life. We obtain this number by multiplying the 21 or so years left for the expected life of a 65-year-old man by 12. 12 represents the number of payments per year you would receive monthly.

Variable immediate annuities are a little different than fixed. Since the money you put in goes into different parts of the market, inflation will be a factor. However, it shouldn’t go down further than the base amount, such as $ 259.20 in the previous example.

Tax-deferred growth

For all types of fixed annuities, the growth of the money invested is tax-deferred. The annuities themselves can be purchased with pretax income, or money that has already been taxed. The type of income, pre-tax or after-tax, will determine if it qualifies for tax-deferred status or not. Annuities that are purchased with money that has already been taxed are not eligible for tax-deferred status.

These are usually purchased at retirement or near the end of the working life of the annuitant. The great thing is that you’ll get tax-free growth on invested money. Also, the tax is deferred until the money is paid out.

Guaranteed income

The great thing about annuities is that you’ll have guaranteed income. Moreover, these regular and predictable payments occur regardless of market fluctuation.

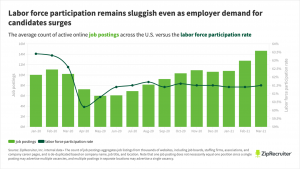

How are annuity rates set?

Insurance companies typically selling annuities will determine the growth rate. The annuity contract will contain those details. Rate setting will naturally vary from company to company. Generally speaking, the company will take a consumer’s premium and lump it with all of the other premiums received. Afterward, they’ll typically purchase some bonds that guarantee the return.

From this, they can offer a rate to the consumer or buy options for increased potential. Of course, different companies will play their cards differently, so you’ll see some things vary within each company.

Best rates today

Multi-year guaranteed annuities are a fixed annuity that guarantees a fixed interest rate. This rate is specified for a certain amount of time, usually three to 10 years. As of October 2021, the best Multi-year guaranteed annuity rates are 3.05 percent for ten years, and 2.95 percent for a seven-year or five-year period.

The best rate for a three-year period is 2.35 percent, while 2.15 percent is best for a two-year period. These rates change more often than you’d think, so be sure to stay up to date with the most recent information. At Due, you are guaranteed 3 percent and it doesn’t change.

Pricing levers

Various companies will use pricing levers as part of the crediting method. The first is the participation rate. The participation rate is a percentage, by which the insurer multiplies the change in an index during the contract term. This percentage helps them determine the amount of interest they will credit to an indexed annuity contract.

Next is the interest rate cap. Again, the annuity provider sets these, being the growth limit. Finally, the interest rate floor is the minimum interest rate that is credited to an annuity’s underlying investment portfolio.

Drawbacks

Sadly, when the annuitant dies, the beneficiary will owe sky-high taxes on the investment income. In addition, the beneficiaries won’t have tax-free status on any annuities they inherit. If you’re thinking about getting an annuity, consult with a specialist.

Guaranteed returns are a significant part of fixed annuities. However, they are usually very low. Sometimes you can produce higher returns by building a safe bond portfolio. Additionally, many insurance companies will use “teaser rates” in their contracts. This basically means that they’ll guarantee a certain return for a period of time. However, they will reduce this after a few years. This reduction will thereby reduce your returns.

Additionally, other fees like surrender charges, M&E charges, and commissions are present.

We couldn’t tell you about fixed annuities if we didn’t talk about the loss of flexibility. All annuities will have an accumulation period and a withdrawal period. You’ll have some flexibility when you are in the accumulation period. You can surrender the policy and withdraw the balance in case of an emergency, although some charges and penalties may be involved.

However, once you start the withdrawal period, you don’t get the same flexibility. You’ll get your payments, but you can’t get all your cash in an emergency. At this point, the insurance company owns your investment, and you own the income stream.

Fixed annuities are great, but they’re not perfect. So be aware of the downsides and play your cards accordingly.

How do I get a fixed annuity?

There are multiple places to buy a fixed annuity. Annuity providers include insurance companies, independent broker-dealers, mutual fund companies, and many more.

Here at Due.com, we can help you prepare for retirement and plan your annuities. We already have 12,000+ registered users, and have helped save more than $ 240 Million in retirement.

The average retirement income of our users is $ 2100 per month. So you control how much money you have when you retire, and we’ll help you every step of the way.

Business & Finance Articles on Business 2 Community

(42)

Report Post