— July 18, 2018

The freedom and flexibility of freelance work is becoming increasingly popular among the American workforce, especially with Millennials. The number of freelancers has tripled since 2014 and nearly half of recent college graduates are pursuing this non-traditional career path.

While the ability to work from home, a coffee shop or even a beach on a tropical island sounds like a dream come true, the freelancer life isn’t always as glamorous as it seems. There are no guarantees that you will always have work to do, which means no steady stream of income.

But what does a freelancer do during the ‘in-between gigs’ time periods that can stretch on for weeks – or even months – when business is slow?

Making smart financial decisions is important for every business and individual, but it is especially important for workers in the gig economy who have no steady paycheck to fall back on. This is why freelancers must make plans and take action before and during these in-between times to make sure that finances don’t fall to pieces until the next paying project comes along.

Let’s discuss the four smartest steps any freelancer can take to avoid financial disaster as they search for the next gig.

1. Make Saving Automatic

Everyone knows that sending part of each paycheck to your savings account is smart. But that doesn’t necessarily mean that everyone does it. Sadly, 57% of Americans have less than $ 1,000 in savings, a frightening statistic for freelancers who may not be able to pay rent or buy groceries if a long period of time passes between jobs.

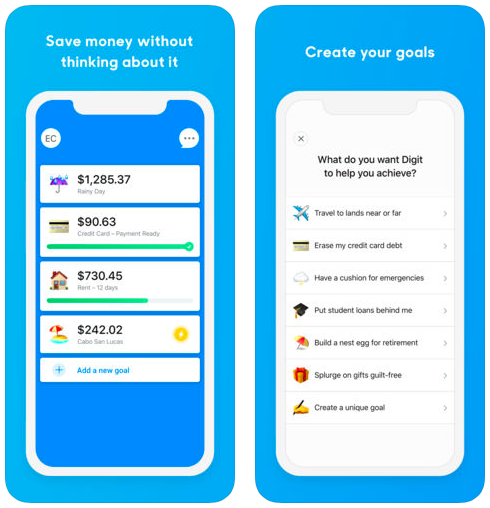

There are several great apps out there that will automatically transfer the exact amount from your paychecks to cover various payments, whether they be essential, such as credit card payments and rent. Or, you can set up “fun savings” for travel or anything leisure related.

For example, Digit analyzes your spending habits to determine the safe amount of money to save per day for all of your financial needs, including that rainy day. This service is excellent for freelancers who have any amount of debt, as Digit Pay will automate payments to help you stay on track to paying it off. Mint is another financial planning app (that is backed by Intuit) to help you create a personalized budget for savings and spending. It will remind you when bills are due, show you your credit score, all while helping you find a savings account service with maximum APY returns to get the most out of your savings.

It is so important that freelancers know how much to put away from each paycheck so that their expenses and any unexpected charges can be covered. By making this savings strategy automatic, you can rest assured that you will have the funds to fall back on should you need them in the future.

2. Use Credit Cards Wisely

Credit cards are a dangerous, but absolutely necessary tool for freelancers, especially during times of financial instability. However, it can be way too easy to charge everything and put off payments for another day. This kind of mentality is exactly why the average American has nearly $ 6,000 in credit card debt alone.

Of course, it’s tempting to charge everything to your credit card when you don’t have cash flowing in, but this can lead to huge amounts of debt. To make matters worse, many cards up their interest rates astronomically after the first year of use, which means that you spend more in the long run.

Be sure that you do your research when opening up new lines of credit and be aware of interest rate changes as time goes on. If you are carrying a balance when the interest rate goes up substantially, do yourself a favor and read a guide to balance transfer credit cards so you don’t end up losing huge amounts of money in interest. This is the trap credit card companies want you to fall into.

3. Invest in Yourself

While money may be tight, investing in your own skills and education is the smartest move you can make. Expanding your areas of expertise can open the doors for more opportunities and higher pay. According to Payoneer’s report, the average hourly rate for freelancers sits at around $ 19. However, experts in various industries can earn far more than this. Legal skills pay the most, averaging $ 28 per hour, while IT, programming, and engineering knowledge can earn you closer to $ 21.

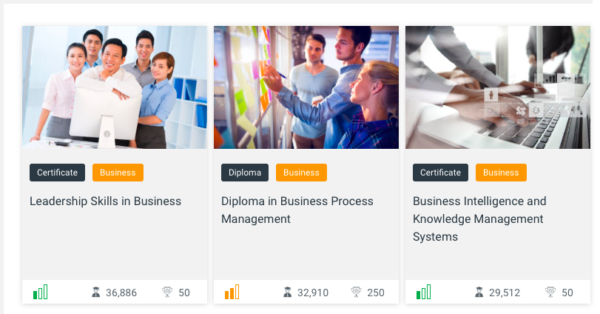

You don’t necessarily have to go back to school to gain the skills and certifications needed to expand your skillsets. It can be as easy and cheap as enrolling in online courses from sites like Coursera, which connect you to online college courses around the country that allow you to earn credits or certificates that can help you land a higher paying gig next time. Some sites, like Alison, even offer free online business-focused classes that provide a diploma or certificate upon completion.

As a freelancer, your resume and set of skills are your best asset. By using the time between jobs to learn new skills or refresh your memory on topics that you typically come across in the industry, you can become a more valuable freelancer, which leads to higher paychecks.

4. Check Out Safe Investment Opportunities

According to a financial investment report conducted by Morgan Stanley, interest in sustainable and responsible investing increased by 33%, with 28% of Millennials agreeing that it was a wise financial decision to make. Obviously, this shows that most people know that investing wisely is important for accruing wealth and making your money work for you. But when funds are tight (like when a freelancer is between gigs), investing seems like an impossibility.

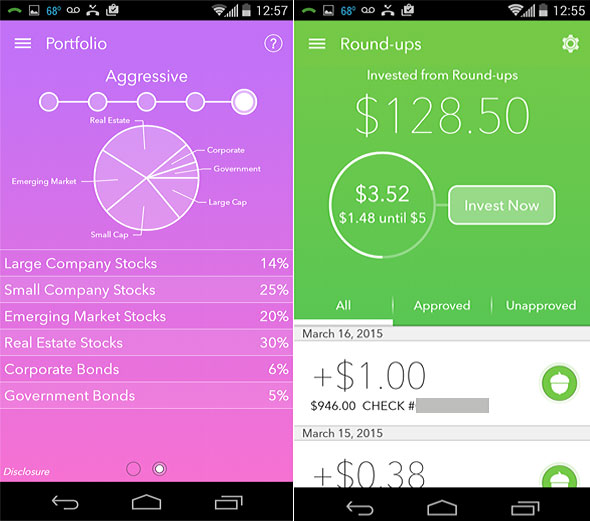

The great news about smart investments is that every little bit counts. As a freelancer in-between gigs, chances are that you don’t have large liquid assets, but you probably have a few extra dollars here and there. Apps like Acorns make investing automatic by rounding up all of your credit and debit card charges to the next dollar amount and investing the loose change as micro-investments that can earn you a sizable return over time.

This is why making safe, high-yielding investments is the best strategy for freelancers to accrue wealth when they have money coming in and when they don’t. Even a high-interest savings account can be an investment that offers steady returns year after year. Other options like savings bonds or peer-to-peer lending can be available when you have larger amounts of cash to invest.

Conclusion

While you certainly shouldn’t plan for failure, it is important to be prepared for periods of time when you may be out of work as a freelancer. The good news is that making smart financial moves doesn’t have to be complicated or even super restrictive on your budget. By using automated tools for payments and savings, you don’t even need to think about it or be afraid that you’ll miss anything. Don’t be afraid of credit cards, but do make wise choices with spending and debt allocation. And finally, make wise investments, including ones with yourself and your skills for better opportunities in the future.

Business & Finance Articles on Business 2 Community

(39)

Report Post