Privacy Update: ATT IDFA Opt-In Rate At 25% Overall, But Varies By Vertical

It’s been a year since Apple’s industry-shaking rollout, as part of the iOS 14.5 launch, of the App Tracking Transparency (ATT) framework requiring user consent to share the Identifier for Advertisers (IDFA).

The move sent mobile and other marketers scurrying to find new approaches to privacy, targeted advertising and user acquisition — including adoption of a mix of ATT opted-in, device-level data, and aggregated SKAdNetwork data, notes Adjust, the mobile marketing analytics platform.

But getting the opt-in remains a crucial strategic starting point for mobile campaigns.

So where do opt-in rates really stand?

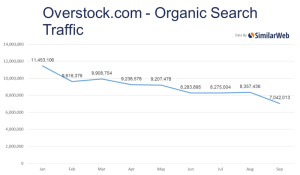

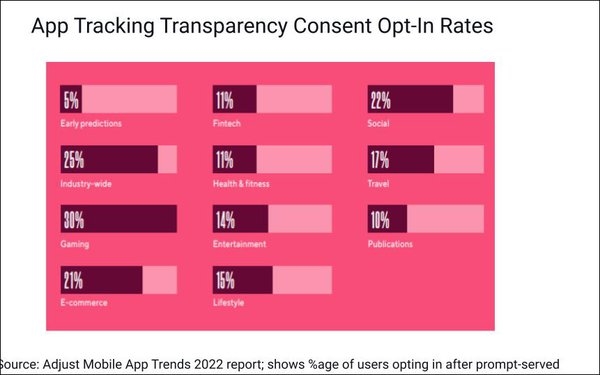

While early predictions hypothesized industrywide opt-in rates as low as 5%, recent Adjust data, offered in its new Mobile App Trends 2022 report, presents a less dire scenario.

Industrywide, opt-in rates are actually at about 25% — up from 16% in May 2021, according to the report, based on full-year 2021 data from thousands of apps worldwide tracked by Adjust.

For gaming, the opt-in rate is up to 30%.

The report also notes that data from AppLovin-owned studios shows multiple popular games yielding opt-in rates as high as 75%.

Consent rates do vary widely by vertical (infographic above).

Still, Adjust predicts “a continued upward trend as more users understand the value of opting in and receiving personalized advertisements — something the gaming industry has been most successful in presenting until now.”

Effective marketing depends on knowing who you’re marketing to. In the digital world that’s becoming harder than ever as third-party cookies are phased out. Speaking at The MarTech Conference, Integrated AdTech CEO Ken Zachmann walked listeners through the challenges and opportunities of identity resolution in this new environment.

“Cookies have been what we’ve really focused on to do everything that we do as marketers,” Zachmann said. “This big change that’s happening, and not to be dramatic, but we’re calling it the cookie apocalypse.”

Here’s some cookie apocalypse numbers: Chrome accounts for more than 50% of all browser usage. So, when third-party cookies are gobbled off Google’s browser, that’s a loss of 50+% of that information. That’s on top of the 30+% lost when Safari and Firefox killed cookies. You can understand the eschatological reference.

Life after cookies

There are still many ways to gather information, of course. However, they all come with their own identity resolution drawbacks.

- Personally Identifiable Information data providers (PII): These are companies like LiveRamp or Acxiom or Experian Marketing Services who take PII information – first name, last name, email – and build profiles of individuals and households. “The challenges that they’re going to face when they build out these identities is scale,” said Zachmann. “As increased iOS limitations come on, as increased consent management from different states are released, they’re going to have to really work very diligently to make sure that they’re maintaining proper consent to manage these different PII standpoints.” There are also issues about interoperability, he added. These providers like to keep their data to themselves and have companies use their stacks for activation and measurement.

- Probabilistic data providers: They make probable assumptions about what a group of intenders or users or consumers are going to be doing. They use a subset of seed data, one-to-one level data about someone. That could be an email from a place they’ve registered, then the provider will add data from other places where that email address has been used, like e-commerce, news, etc. This lets them build a pretty good demographic picture of this person, without knowing who they are. From there the provider will use this small seed set of data and blow it out using look-alike modeling or analytics. “It can be very effective as far as getting more scale,” said Zachmann, “but the accuracy gets decreased and oftentimes we’re paying for users who may or may not be interested in the offer we have on the table.”

- Authenticated hashed email (HEM) data providers: They take regular email addresses and encoding them using a cryptographic hashing function. This creates an obfuscated string of characters, or hash, to represent the email. This creates an identifier that doesn’t share restricted information and can then be used as a single unified identity used for tracking across channels and devices. relate to either household propensities, intent, behaviors, contextual reading behaviors. “The problem with these hashed emails is that they only have about a 20% to 40% reach,” said Zachmann. “Because they’re hashed and because hashed email really can’t be either denominized or shared … you kind of have to stay in their world or in their sandbox.”

- Data Management Platform (DMP) data providers: These are companies like Oracle or Lotame and others that build backbones of data. They use their own first- and second-party data and assign a proprietary ID to them. “Tricky part about DMP’s is that while they have large scale they don’t often have the ability to have their ID interoperable between other platforms,” said Zachmann. “Like moving the ID to say the trade desk where you want to activate your ads or moving it to a measurement partner that you already use. Oftentimes those ID’s right now don’t talk together and it’s really difficult to do addressability and measurement when the DMP’s ID is more insulated.”

- App data providers: They collect information about where and when their app users engage in content and make purchases. And they’re able to stitch that data to a household IP, which gives them yet more data. They are in the midst of their own “APPocalypse.” Apple now requires them to get users’ consent for collecting data. Although Google is dragging its feet on the issue, they are moving in that direction and already require apps to disclose what is being collected and why. “I think right now the opt in rates across the US is only about 24% of iOS users who are opting in to be targeted on their device,” said Zachmann.

- CTV: A lot of the people who cut the cord with cable TV are using connected TV devices like Roku and Fire TV Stick. Those devices have IDs and the companies combine that with your IP address and first party data to create the information they sell. “They have a known measurement stack and are becoming a bigger part of the pie,” said Zachmann. They can be part of marketers’ data mix, but not all of it, he added.

There may be a solution

The best currently available solution is also one of the hottest new buzzwords: Clean rooms.

These use privacy-enhancing technology which lets data owners (including brands and publishers) share customer first-party data in a privacy-compliant way. This makes it possible for first-party data for the same person, from different sources, to be combined even while they remain anonymous.

“They’re really … shaking up the identity landscape because they’re providing this system where you can go in, put in your data [and] they’re going to take care of it for me,” said Zachmann. “They’re going to cleanse it, make sure all the opt outs are removed, make sure everything is done, and all the consent management profiles are maintained.” They’re a good way to deal with both interoperability and privacy issues, he added.

The post A guide to the strange new world of identity resolution appeared first on MarTech.

(50)

Report Post