Agencies Seen As Lucrative M&A Targets

Mergers and acquisitions (M&As) of digital agencies has been one of the biggest interests across the business model of FE International, a M&A advisory firm specializing in the tech industry.

Unlike many businesses in the digital media sector, agencies are the least affected by fluctuations in rankings by Google, artificial intelligence (AI) and other externalities, according to the report.

“Good agencies are primarily reputation driven – clients are attracted by referrals in the long-term and these businesses are less likely to be hurt by outside factors particularly if they have recurring contracts with clients,” the report states.

The data shows a 59% increase in the number of buyers telling FE International they are interested in agency businesses today, compared with what they said in 2020. It suggests that this year will be an ideal time to build and consider selling a service-based business.

FE International released a report this week highlighting data-driven trends, challenges and opportunities that shaped the digital media industry in the first half of 2023.

The 1H 2023 State of Digital Media Report analyzes a range of topics, including content-consumption patterns, emerging technologies, advertising trends, monetization strategies and much more.

And while it is supported by extensive research and expert insights, one of the most insightful sections in the report focuses on agencies.

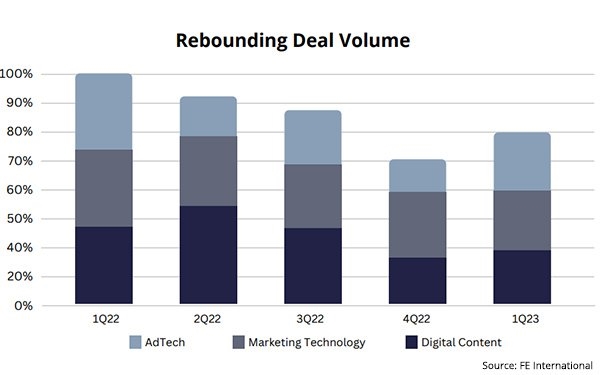

The digital media M&A market also has begun to rebound, but there are challenges ahead.

The online advertising market has seen advertising rates steadily decline since the start of 2022, as a focus on growth has shifted toward broad-based cost-cutting and increased focus on profitability.

Uncertainty about the impact of AI has prompted many digital-media companies to reassess their business models and investment strategies.

As consumer behavior continues to shift toward digital channels, businesses recognize the need to adapt and engage with their target audience virtually.

Through digital marketing, businesses can enhance brand awareness, drive customer acquisition, and ultimately achieve sustainable growth in today’s highly competitive market.

FE International has begun to see a rise in institutional investors enter the content sector, providing competition to strategics. These types of investors include mid-market private-equity funds backing operators, lower mid-market private equity funds, strategics and ultra-high net worth investors — typically deploying between $10 million and $25 million per acquisition.

These investors are data-driven and long-term in their analysis, so most business owners find success in exit planning through FE ahead of time — between three and 12 months in most cases.

Data indicates that companies that go through 6 to 12 months of exit planning sell at an average 14% higher multiple than those that do not.

The investment firm has seen inorganic growth through acquisitions since the beginning of 2022, with nearly 37% of its closed deals going to strategic and corporate acquirers.

The expectation is that the strong demand will continue through the remainder of 2023 and into 2024 as companies are becoming more aware that statistically they are most likely to continue growing if they make acquisitions consistently — not just as a one-off or ignoring it entirely.

In-house business development teams have also continued to look at smaller and smaller deals.

A decade ago, public companies would not buy $10 million market-cap companies, but it is now common.

(8)

Report Post