Advertisers Increase Google Ads Spending By 15% In Q3 2022: Tinuiti

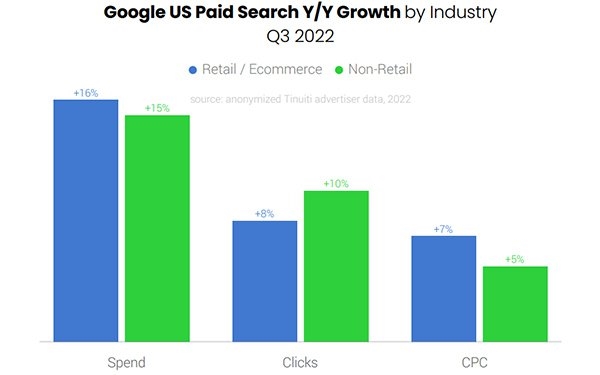

Spending on Google search ads overall grew 15% year-over-year (YoY) in Q3 2022, slowing from 18% growth in the prior quarter for advertisers working with Tinuiti, a full-service agency.

Although Google faces a slowdown due to the uncertain macroeconomic environment, growth stabilized during the third quarter to near pre-pandemic levels.

“Google is settling back into a spend growth rate more in line with what we are seeing in late 2019, prior to the pandemic,” said Mark Ballard, associate director of research at Tinuiti. “The rate of growth in Q3 2022 is right where it was in 2019. It’s much more positive than what we see for Meta, which is negative growth. Search is in a good place. Meta faces some headwinds in things like privacy measures, more competition from companies like TikTok, whereas Google with search is able to deliver strong results.”

The Tinuiti Google Ads Benchmark Report is based on anonymized performance data from Google programs under Tinuiti management, with annual digital ad spend under management totaling more than $3 billion. The data does not represent the official performance of Google advertising.

Retail and ecommerce spend on Google search ads rose 16% YoY in Q3, outpacing other industries by a mere point. A quarter earlier, other industries lagged retailers in Google spend growth by five points. Retailers saw click growth decelerate modestly in Q3, other advertisers saw a recovery in volume growth.

Retail and non-retail advertisers saw weaker Google cost-per-click (CPC) growth compared with Q2. The average order value (AOV) produced by Google search ads was up 4% YoY in Q3 2022, but AOV growth has trended lower since a peak in May 2021.

Ballard said the group is looking closely at how the current economic situation will influence things, meaning whether consumers will get turns off from buying in Q4 2022. The size of orders is taking a bit of a hit.

While average order value (AOV) growth rose in 2021 compared with relatively weak results from the early days of the COVID-19 pandemic, in more recent months, inflationary pressure has helped keep AOVs growing.

If inflationary forces weaken, AOV growth is likely to continue to slow.

Across seven major product categories, apparel brands saw some of the weakest Google AOV growth rates in Q3 2022.

Some retailers — particularly in apparel — now face a glut of inventory following the supply-chain problems of late 2020 and 2021. Larger discounts have become a common means to clear inventory ahead of the holidays.

One major source of uncertainty and concern in Q3 was the shift from Google Smart Shopping Campaigns to Performance Max Campaigns. If the move went poorly, it would have negatively affected spending growth trends. Growth in Shopping spending is running a little behind the pre-pandemic level of late 2019, which averaged 24% growth.

Spending on Google Shopping rose 19% YoY in Q3 2022, compared with 26% growth a quarter earlier.

Tinuiti also recently published a holiday shopping survey where consumers shared what they thought about the holidays. Most are concerned about inflation, but they plan to shop earlier. Consumers may substitute less expensive brands for the more expensive ones.

“In terms of traffic to and from Google search ads, we don’t see a dramatic shift,” he said. “It will be tricky to navigate the fourth quarter as we anticipate earlier demand. Consumers are expecting a good price.”

Clicks from Google Maps to advertiser brick-and-mortar store location details rose 39% compared with 2019 in Q3 2022. These Get Location Details clicks have generally trended counter to major surges in COVID cases, falling 95% YoY in April 2020 before recovering during the rest of that year. They also seemed relatively weak during the initial Omicron spike in late 2021 and early 2022, falling by as much as 11% compared to 2019.

Spending growth for Google text advertisements slowed slightly to 13% YoY as click growth improved and cost per click (CPC) growth cooled. Google’s text ads have experienced their own transition in recent months, with advertisers losing the ability to create or edit Expanded Text Ads at the end of June 2022 in favor of the Responsive Search Ad format, the report notes.

Responsive Search Ads accounted for 83% of Google text ad clicks in September.

Privacy measures lessoned the role of Google’s website visitor targeting method, with advertisers turning to In-market and Affinity segments instead. In-market and Affinity audiences each produced 17% of Google text ad clicks in Q3 2022, the largest shares across Google’s audience targeting segments.

The report supports a lot of interesting trend data. For Tinuiti clients, YouTube spend grew 19% in Q3 2022 — up from 14% growth in Q2. connected TV (CTV) was a bright spot for YouTube with spend more than doubling compared to Q3 2021.

Across the Google Display Network (GDN) and DV360 platforms, advertisers saw weaker CPM growth than a quarter earlier. GDN CPMs were up 8% YoY in Q3, down from 15% growth in Q2, while DV360 CPMs fell 6% in Q3, compared to running flat in Q2.

(7)

Report Post