The five-day stretch from Thanksgiving to Cyber Monday was record-breaking for e-commerce but brands still have more time for profitable sales on Amazon.

On Cyber Monday alone, consumers spent $9.4B via online channels – that’s up $1.5B from just last year, according to Adobe, and another record-breaking figure in terms of e-commerce sales. For marketers, the entire five-day stretch known as Cyber 5, but dubbed “Turkey 5” by Amazon, was likely a banner sales weekend, but looking at year-over-year Amazon data, what’s clear is that your holiday fortunes are not made or broken on that period alone.

As part of the research my company conducted, it is clear that on a conversion rate and cost-per-conversion basis, some of the best sales days on Amazon come after Cyber Monday. To maximize your total sales, and potentially capture market share from competitors, your advertising budgets and strategy on the site needs to align with this reality.

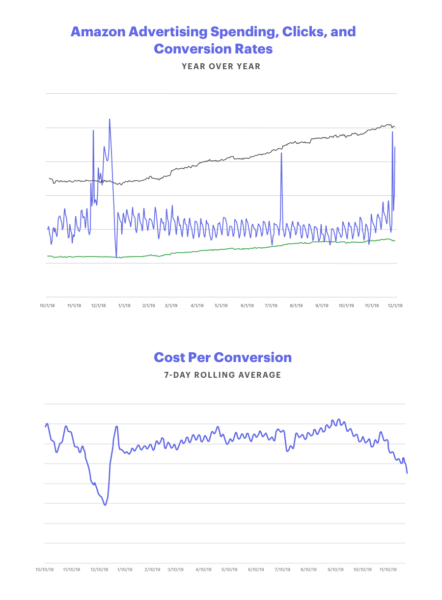

As seen in the below graphs, which are drawn across a same-set of more than 700 Amazon sellers, ad conversion rates continue to rise from Cyber Monday all the way through the Dec. 22 shipping cutoff. Yet, the average cost-per-conversion declines over the same period.

This is likely due to two contributing factors.

Perhaps most impactfully, many brands budget to spend aggressively during that five-day period and, due to the extremely high volume of consumers on the site, blow through a fixed budget for the season. While those holiday period campaigns may have driven high sales volumes at profitable costs, those same brands now don’t have the ability to stay aggressive over the intervening days, substantially tapering down spend and bids through the remainder of the year and missing out on these additional profitable sales.

Secondly, when consumers are shopping on Amazon a matter of weeks or days before Christmas, they are less inclined to do a great deal of research when buying their gifts. Time is of the essence, and the data bears out that users are more likely to click and convert on a sponsored product ad during this period.

In 2019, that latter point may be even more important, as the time between Cyber Monday and Christmas nearly a full week shorter, lending itself to more “last minute” holiday gift buying.

The bottom line is that on Amazon, it’s imperative that you consider uncapping budgets around holiday periods and other high-traffic events on Amazon in particular, provided you have the ability to set and adjust bids to align with the value of a given sale after discounts, fees, etc.

This is driven home by the overarching trend over the five-day period itself. Even in the face of a large number of sellers aggressively advertising during this time, the massive amount of consumers coming to Amazon and subsequently clicking on ads outpaced that rate. Across gift-giving categories and more than 219,000 products, Amazon ad spend was up significantly, but CPCs either remained flat, declined, or rose at a level far below the corresponding spend increase – compared to the prior four-week average.

In a sense, it was easy for a brand to spend substantially more on Amazon advertising over “Turkey 5” – we saw a 92% increase from pre-holiday levels on average – but they were likely driving sales at a more profitable rate from that ad spend. With conversion rates remaining high following Cyber Monday, that efficiency is likely to increase, albeit with less traffic overall.

Maximizing the holiday home stretch and beyond

With some time still remaining until the Dec. 22 shipping cutoff, there are some tactical levers brands can pull to capture more of those profitable sales. We talked about the value in uncapping budgets through Dec. 22, but that needs to be paired with bids that are set in line with any promotional or non-promotional pricing which may be in place for a given product.

By consistently bidding to value on an individual product level, brands can bring in more profitable sales on Amazon during these high traffic periods. Additionally, this is a good practice year-round, as it minimizes the risk of wasting ad spend while allowing for scale when a bump in user purchase activity warrants additional investment.

Opinions expressed in this article are those of the guest author and not necessarily Marketing Land. Staff authors are listed here.

Marketing Land – Internet Marketing News, Strategies & Tips

(19)

Report Post