— July 8, 2019

Technology has fundamentally changed the way banks work and, perhaps more importantly, how customers interact with them. While branches still exist, few of us venture into them unless we absolutely have to.

And why would we, when we can do almost everything we need to on our computers and, more latterly, our smartphones?

While the period of technological change that got us to this point saw massive disruption, the banks that put customer experience (CX) at the centre of their transformation efforts have thrived.

“Financial institutions that lead in customer experience (CX) have a higher recommendation rate, a higher share of deposits, and a greater likelihood that customers will increase their portfolio of new products and services from their bank. While financial institutions that let their customer experience decline, risk losing up to 12.5% of their share of deposits.” – Study by Kantar

In particular, they put a lot of work into their digital communication efforts. And, as banking braces for the next technological wave, digital communication will become even more critical.

CX and Digital Communication

As things stand, digital communication is already critical for banking.

Banks cater to customers of different ages, who come from a wide spectrum of backgrounds. Many of those banks will embrace new ways of communicating with their customers, while others would much rather things didn’t change. But, not adapting to meet the expectations of today’s ever demanding consumers, could be detrimental for business…

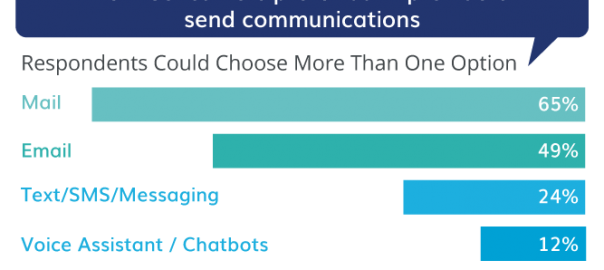

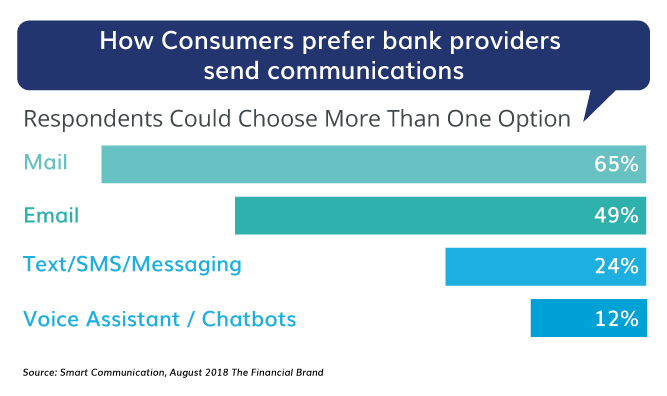

A survey by Smart Communications finds that almost two-thirds (63%) of consumers say they would consider switching banking providers if communications don’t meet their expectations.

Good CX means allowing customers to communicate using the channel of their choice. Importantly, however, it also means being consistent and accessible across all communication channels.

So, the bank’s website and app should have the same tone and feel as the communications it sends out via email, text, and instant messaging.

This level of consistency is especially important when it comes to introducing and helping customers get to grips with any new technologies available to them. Customers are much more likely to accept and embrace a new piece of technology if the communication around it looks and feels familiar.

And, using digital communication, banks can build lasting relationships with virtually their entire customer base, creating regular engagement and trust – which are vital to good CX.

Safety matters

The need for trust becomes more important when you factor in how vital security is to CX in the banking space.

Cyber crime, in its various forms, costs banks and its customers billions of dollars every year. And while a lot of progress has been made when it comes to fighting off cyber-attacks, the truth is they’re engaged in a digital arms race with cyber criminals. And technology can only go so far when it comes to protecting customers.

As such, the banks’ most valuable tool when it comes to keeping customers safe is education, which is best achieved through digital communication. Informing customers about the latest forms of cybercrime, and how they can protect themselves, means they’re much less likely to become victims.

This kind of communication also makes customers feel more secure. It allows the bank to demonstrate that it understands cybercrime and is willing to empower its customers in avoiding it. A great way to build trust, as it helps people feel that their money is being properly safeguarded.

In the banking space, where safety and trustworthiness are the default expectations, creating this sense of confidence is especially important.

The banks that foster this sense of trust end up with more loyal customers who, in turn, are more willing to adopt any new products offered to them.

Playing the long game

It’s absolutely vital that banks build this sense of trust into their long-term CX plans, especially as banking moves further and further into the digital realm.

Creating this sense of trust means building relationships and this requires regular and consistent communication.

Business & Finance Articles on Business 2 Community

(56)