BlackRock Supports Investing In The Metaverse ‘Here And Now’

“The metaverse might sound futuristic, but the investment opportunities are here and now,” says BlackRock’s Reid Menge, adding that while volatility may continue in technology shares, the investment company is confident in the long-term value of the metaverse.

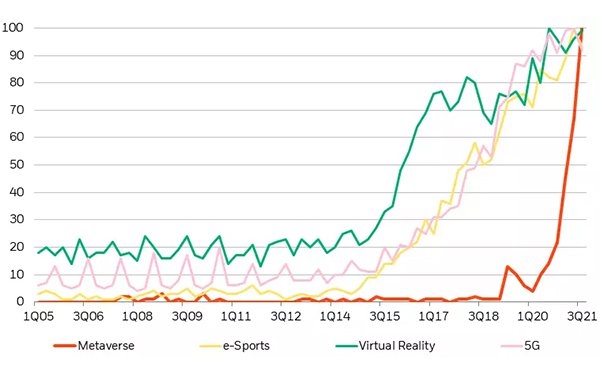

BlackRock’s belief in the metaverse as the next major investment opportunity is backed by society’s increasing interest, comparing the immersive virtual-world concept to that of the internet in the early 1990s, or the smartphone at the turn of the century.

“We expect it is going to be big, and very likely to change people’s daily lives,” Menge writes. “But we don’t yet know exactly how, or how big the shift will be.”

What BlackRock claims to know now is that the metaverse will change “work and play,” with virtual meetings, golf outings, and concert experiences all being revolutionized by metaverse technologies.

The company cites several factors that will lead to widespread metaverse success, including the ongoing development of next-generation hardware and increased computing power, the potential of cryptocurrencies, and the ways in which the COVID-19 pandemic has accelerated a shift to digital life, with people more used to working, shopping and socializing at home.

“We could see a breakthrough in AR glasses — a version light and smart enough to be worn every day — as soon as 2023,” Menge writes, calling this development a “game changer” for metaverse adoption.

These points are not surprising — many metaverse believers have cited similar ideas and predictions, including Matthew Ball, who provided a very detailed account in his book, The Metaverse: And How It Will Revolutionize Everything.

What matters most here revolves around the fact that one of the world’s preeminent asset management firms is publicly backing the metaverse, especially during a bear market, and has investment tips.

BlackRock has already launched a bitcoin private trust that advises how asset managers can give their institutional clients access to cryptocurrency markets via synthetic products. BlackRock owns the bitcoin, but the investment firm’s clients can purchase shares in the trust to gain exposure without having to own the digital asset themselves.

Overall, BlackRock says it sees the most immediate investment opportunity in companies that can supply big internet, software and smartphone companies with solutions — new-generation chips, batteries, and lenses needed to develop glasses and headsets.

Once the hardware comes to fruition — some time over the next decade — BlackRock is looking to services that will be accessed by new devices and metaverse-dependent software.

“We also like companies posed to play a key role in ‘building’ the metaverse, designing and creating virtual worlds,” the company says.

BlackRock admits that market volatility may continue to distract investors from long-term gains, but views tech “as the fabric upon which today’s economy is built,” and believes the digitalization of industries is a time consuming, yet necessary step toward a fully realized metaverse.

“The metaverse may not be mainstream until later this decade, but investment opportunities are available now.”

(9)