Today’s business environment is heavily influenced by the “FUD factor,” or fear, uncertainty, and doubt. When FUD creeps in, the funding sneaks out and therefore restricts the ability for many businesses to access capital.

It’s times like this where the planning, discipline, and the fiscal responsibility of maintaining a healthy balance sheet will be most beneficial. Companies that have operated using sound accounting principles will likely be better suited to weather the economic recession or will even be in a place to capitalize on lower asset prices.

Business Expenses To Reconsider During Times of Crisis

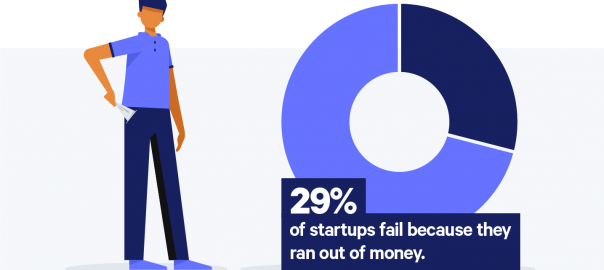

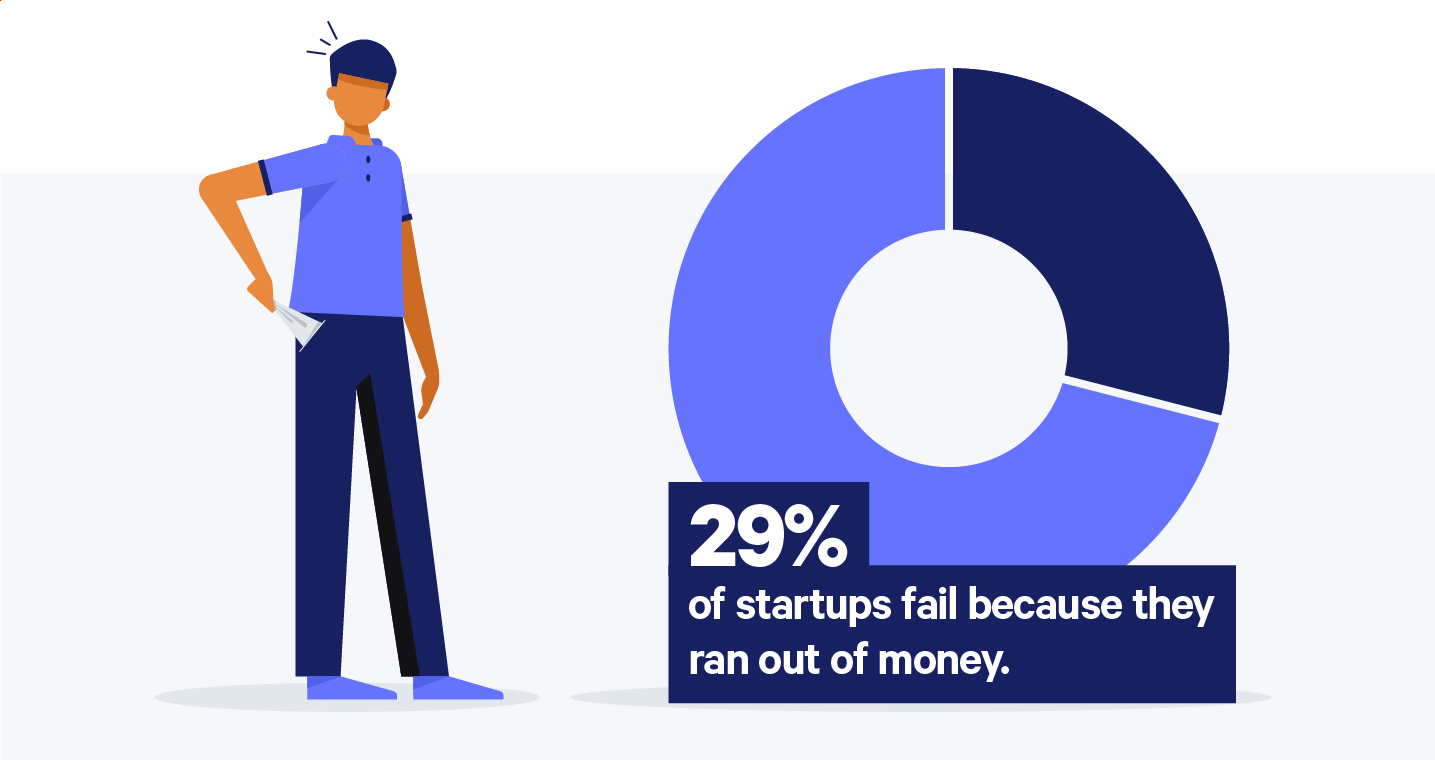

Companies like Costco and Walmart are doing quite well in spite of the economic turmoil, partially because they are seeing spikes in demand, but also because they’ve practice sound financial management. Having a solid grasp on cash flows and debt servicing is as important, if not more so, than having innovative new technologies to boast about. In fact, 29% of companies fail because they run out of money.

In this article, we provide a few expenses that you should reconsider—if not remove entirely—in the wake of the global pandemic and economic recession that follows.

Management Expenses to Justify

Today, collaboration, productivity, and business management software tools are improving the capabilities for millions of knowledge workers to work remotely. It’s also likely, innovations will emerge to help facilitate service-industry workers to perform their duties while giving customers safe social distance.

While it’s not likely the service industry will be able to work from home, the real estate footprints of many industries will likely diminish significantly.

Office Space

If your business has successfully worked through the mandated quarantine periods, you will have essentially participated in an involuntary experiment about whether or not your company can operate efficiently while working remotely.

Perhaps your team proceeded as close to business-as-usual as possible, maintaining high levels of productivity, and now questions whether working in an office is even necessary.

As offices re-open and your employees return to their normal commutes, one strategy to test is allowing a percentage of your workforce to remain remote, splitting the use of the office space and implementing desk sharing. If this works well, you will be able to downsize to a smaller, more affordable office space, while not losing the face-to-face interaction and collaboration within your business.

Expensive Tools

While some tools are simply unavoidable and will need to be accepted as the cost of doing business, the more expensive suites of tools will certainly need to be re-evaluated based on their cost-benefit analysis.

How much revenue generation and productivity savings does that expensive software as a service product actually benefit the business? How did the business perform these tasks before this software was used?

These questions must be deeply considered. If the SaaS product you are paying for has a large feature set that goes mostly unused, it’s possible you can renegotiate the terms of the pricing model to account for the partial usage of the tool. In times of crisis, companies understand the financial restrictions being placed on budgets, which is why many software companies have offered steep discounts in the wake of COVID-19’s disruption to the economy.

Marketing Expenses to Leverage

While leveraging debt can be a dangerous strategy during economic downturns, leveraging marketing strategies that work can be extremely beneficial.

Measure what Markets

In his bestselling book, Measure What Matters, legendary venture capitalist John Doerr discusses the importance of tracking the performance of the things that contribute to your mission and goals as a company.

In marketing and business generally, the term ROI, or return on investment, is thrown around in meetings and reports but rarely is it scrutinized in the way it deserves. In times of high scrutiny, like during economic recessions, the knee jerk reflex for many leaders is to simply cut the figurative budget tree down, instead of pruning back the branches.

Instead, we advocate for cooler heads to prevail, and to analyze the marketing channels and campaigns that are generating real returns on investment and double down on those. For example, if your social media marketing cannot measure a direct result in revenue, but your Google search ads or SEO strategy is responsible for driving significant traffic and revenue. It’s clear you should reduce, if not temporarily suspend your social media strategy, and double down on your search advertising and SEO efforts.

Reconsider What Matters

In times of reflection, we see what is truly essential to our business.

That expensive signage you had made for your offices, that branded swag for employees, and those embossed business cards for trade shows, all rendered unnecessary by the pandemic. Understand how discretionary expenses like this can be suspended indefinitely until the financial health of your business stabilizes.

It’s also important to reconsider your hiring and payroll. Can you utilize freelancers to avoid higher salaries and benefit programs dragging on your balance sheet? If you are a small business owner offering freelance services to larger enterprises, consider taking on the role of a micro-agency, sourcing other freelancers to contribute to your process and being diligent about time management. This will create a streamlined process that your clients will appreciate and reward with more business.

Continue Fiscal Responsibility Moving Forward

Let’s not think of them as budget cuts, but as balance sheet optimizations.

The businesses that have made strategic balance sheet optimizations and have not operated with unsustainable levels of debt, will come out of the market downturn in a better position than they went in.

Many business lessons will be learned the hard way during this period and will only serve to better the overall business environment in the future. Business owners and operators must learn the power of fiscal discipline and wield it responsibly in the future.

Some aspects of your business operations may change forever as a result of COVID-19, like the size of your office, the marketing strategies you leverage, and more, but one thing will remain virtually the same: fiscal responsibility. If you are struggling as a business to navigate the current economic environment, consider what expenses are driving your business forward and what expenses are holding your business back.

Business & Finance Articles on Business 2 Community

(74)

Report Post