A new type of financial services provider is emerging, and experts believe it has the power to transform global supply chains. Multinational giants such as Apple, Dell, Kellogg’s and Siemens have already engaged these financial technology companies – FinTech, for short — to help finance growth initiatives, penetrate untapped markets, innovate new products or services, and access capital previously unavailable in their supply chains. The fascinating aspect of this development is the tremendous potential it could hold for outsourced contingent workforce programs. Among all the complex issues an MSP must iron out with its staffing partners before launching a seamless program, payment terms are the sore spots we seldom talk about. The advent of FinTech could signal the next big industry solution.

A new type of financial services provider is emerging, and experts believe it has the power to transform global supply chains. Multinational giants such as Apple, Dell, Kellogg’s and Siemens have already engaged these financial technology companies – FinTech, for short — to help finance growth initiatives, penetrate untapped markets, innovate new products or services, and access capital previously unavailable in their supply chains. The fascinating aspect of this development is the tremendous potential it could hold for outsourced contingent workforce programs. Among all the complex issues an MSP must iron out with its staffing partners before launching a seamless program, payment terms are the sore spots we seldom talk about. The advent of FinTech could signal the next big industry solution.

The Unsung Importance of Payment Terms

Logistically and contractually, there are countless hills for MSPs to climb before they begin a new program or unseat an incumbent. Their negotiations don’t end with appeasing a client’s needs. They must strike an equitable balance between the customer’s objectives and a supplier’s incentive to participate.

Supporting the supplier population, the lifeblood of performance and delivery, is imperative. We often believe the loudest grumbles erupt during negotiations, when MSPs and suppliers haggle over contractual terms and conditions, volumes, tier status, margins, rate cards, service level agreements (SLAs) and more. Few people seem to consider the tolls that extended payment terms exact on staffing providers.

The move toward Net 90 payment terms highlights how America’s biggest companies continue to build on the aggressive cash management practices they adopted in the wake of the recessionary credit crisis. What began as a way to preserve cash when markets dried up has become a means of freeing capital to fund expansions, buy back stock, and support dividend payouts in periods of lackluster sales growth and shrinking profits.

Across industries, major corporations are trying to reduce the amount of cash tied up in day-to-day operations by extending their payment time to suppliers. These tactics, however, force ripple effects down the line. Companies that hold on to cash longer create deficits with suppliers, especially those confronted with having to obtain financing. Pitfalls of such decisions include dreadfully low engagement levels, unsustainable operating costs, attrition, and huge disadvantages in attracting exceptional talent.

MSPs in a Tough Spot When Clients Demand Extended Payment Terms

For disenchanted suppliers, blaming the MSP is a direct (albeit knee-jerk) reaction. Yet it makes sense on some level. The MSP is the party that oversees communications and is the entity to which suppliers have immediate recourse. The truth is that MSPs are stuck in the middle, left to mediate between the client — which actually demanded the extended payment — and staffing partners who suffer as a result. The trapped-between-a-rock-and-hard-place adage seems particularly relevant in this situation.

Does every MSP out there worry about the effect that extended payment terms have on suppliers? No. Offering additional discounts for early payment or stretching out remittance has very little impact on MSPs. The best of the bunch, however, understand the value of their supplier community. They harbor concerns about how their staffing partners will manage under the financial strain. After all, profits drive growth, performance, innovation, and longevity.

With all their overhead and statutory costs, suppliers need to realize a healthy margin to conduct business. Forcing staffing providers to bear the financial burdens imposed by floating payroll payments can lead to more harm than good for clients.

Of course, there are exceptional MSPs that take these matters seriously. A couple of years ago, analysts at some MSPs alerted their organizations about the coming trends in client payment terms. To remain competitive in their markets, many of their clients began requiring terms well beyond Net 30, 45 and 60 day standards. Today, our industry is witnessing a rise in 90-day terms as a new norm, most noticeably among Fortune 500 companies. With these delays, many staffing suppliers find themselves in the difficult position of 97-day abeyance periods from invoice to payment.

Even when MSPs continue to release payments to vendors within the typical 10-day period, the amended terms result in an average wait time of 90 days from the vendor’s payroll date, as opposed to 30. To work, several assumptions must be made.

- All vendors have established lines of credit.

- All vendors currently use their lines of credit to fund payroll during the accounts receivables (AR) period.

- All vendors can weather the additional interest expenses incurred by utilizing a greater portion of their available credit lines during the extended holding period.

The challenge is that MSPs can’t always deduce with certainty whether their staffing partners will have the necessary cash flows or means to obtain credit for bankrolling their weekly payroll during the AR waiting interval.

Because the supplier population is critical to the success of any program, a select number of MSPs have launched financing programs using their own banking relationships. One MSP I’m aware of designed a Net 20 payment term to suppliers, allowing them to remain in the program without significant impacts to their funds or operations. This also prevented potential disruption to clients.

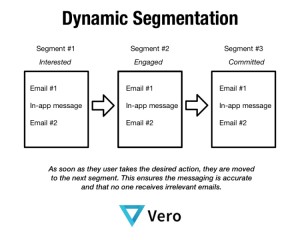

Others have proposed separate invoicing batches. Staffing partners are partitioned into two groups. The first includes suppliers that have the available funds or credit to handle the delay. The second includes those groups facing hardship. Despite noble efforts, these circumstances push MSPs into the difficult position of finding creative solutions that honor their clients’ wishes while supporting their staffing partners. And this is where a service like FinTech opens a new world of possibilities.

The Dawn of FinTech in Supply Chains

As Dale Rogers, Rudolf Leuschner and Thomas Choi explain in Harvard Business Review: “Financial technology companies act as intermediaries in facilitating transactions between a company and its suppliers. They enable both the buyer and supplier to improve their working capital by making it possible for the former to extend its payables and at the same time accelerate payment to the latter. This provides both sides with benefits, including greater liquidity and less variability in the timing of payments.”

- FinTechs are Internet companies that streamline financial systems and optimize the efficiency of funding supply chains.

- They work with many partners: online procurement platforms, financing organizations, and traditional banks, among whose members are Citi Group and HSBC.

- The majority of FinTechs operate as cloud-based platforms that enable procure-to-pay systems. These incorporate purchasing and accounts payable functionality.

- Once invoices are approved, suppliers may choose the time when they will receive their payment. In some cases, payments can be distributed within two days rather than the 90 to 120 day limits organizations now prefer.

- “The buying firm,” the authors note, “benefits through longer payables, which positively impact its working capital.”

In essence, the FinTech acts as a sort of broker between parties for the transaction. The article provides an example to illustrate:

“The supplier gives the buying firm a discount on the invoice amount at the buyer’s lower cost of capital. For example, when a supplier elects to receive payment for a $ 10,000 invoice in 15 days through the FinTech and the buyer submits payment to the FinTech 90 days after it approves the supplier invoice and buyer’s cost of capital is 2%, the discount that the supplier gives to the FinTech is only $ 41 (i.e., the supplier gets $ 9,959 of the $ 10,000).”

A Coming Trend?

Right now, most FinTechs seem to target direct client-vendor relationships in various types of supply chains, with an emphasis on manufacturing and materials. However, these services are relatively young and could easily spread to services supply chains such as human capital, where the procurement function is deeply involved and influential. For staffing firms that support direct clients, a FinTech could easily be utilized. Given the nuances of an MSP program, adoption could be more complex.

Time will tell whether the FinTech model has a role to play in our industry, yet the potential and positive implications are intriguing. More VMS providers are seeing the need to expand the capabilities of their offerings, which now include elements of SOW and services spend, independent contractor modules, and integrations with online recruiting platforms and freelancer management systems. If they eventually develop connections to interface with FinTech software, they could hold the key to overcoming a longstanding hurdle for clients, MSPs and their staffing partners.

Business & Finance Articles on Business 2 Community(40)