Finding a competitive strategy that offers a sustainable advantage is a challenge for most professional services firms. In this article, we will try to make it a bit easier.

We’ll start by defining exactly what a competitive strategy is and explore the different types of strategies available. To make these strategies more tangible, we will also look at examples of each.

Next, we will identify where you might look to uncover your competitive advantages and how to put together your competitive strategy. Finally, we’ll identify some resources where you can dig deeper.

So, what exactly is a competitive strategy?

Competitive Strategy Defined

Competitive strategy is the long-term approach firms use to gain a competitive advantage in the eyes of their target audience. An effective competitive strategy will help a firm develop, enhance and exploit one or more competitive advantages.

A competitive advantage is a point of difference between a firm and its competitors that is valued by potential clients. Having a lower cost structure or greater specialized expertise are common examples of competitive advantages in the professional services.

Three Types of Competitive Strategy

Perhaps the most widely recognized taxonomy of competitive strategy is presented in Michael Porter’s 1985 book Competitive Strategy. He lays out two primary strategies: 1) cost leadership, and 2) differentiation. These are supplemented by a third factor that identifies whether you are taking a broad or niche market focus. Let’s look at each in turn.

- Cost Advantage Strategy. In a cost advantage strategy you are attempting to be the lowest cost producer. In the professional services, this usually means lowering the cost of talent by either using professionals from countries or regions with lower wages or employing more automation in the firm’s business process. In many industries, high capital costs limit competitors. This is not true in professional services. Consequently, cost advantage strategies are challenging to maintain over time.

- Differentiation Strategy. With a differentiation strategy, you are attempting to establish and maintain meaningful differences between your firm and competitors. Given the nature of professional services, finding and maintaining differences between firms is notoriously challenging. Later in this post, we will explore how to test potential differentiators to determine their viability as competitive advantages.

- Focus or Specialization Strategy. The focus dimension of competitive strategy recognizes that either a cost advantage or a differentiation strategy can be applied to a very broad (unfocused or general) market or a more narrow (niche) market. In other words, you can pursue a cost advantage in a narrow (niche) market segment or a broad market. The same is true for a differentiation strategy.

The resulting matrix of four common strategies is captured in Figure 1.

Figure 1. Competitive Strategies Matrix

We’ll explore examples of each of these strategies in the next section.

Examples of Competitive Strategy

So how do these competitive strategies translate to the professional services? With a fair amount of difficulty for many firms, as it turns out. A differentiation advantage often hinges on how a prospective buyer perceives the firm’s expertise in handling a particular business challenge. Let’s look at some competitive strategy examples.

Broad cost advantage. In the professional services world, this strategy often translates to “offshoring,” or using talent from a lower-wage region or country. Many companies outsource software coding to India, for example. Unfortunately, this strategy is relatively straightforward to replicate, so maintaining a cost advantage over time can be a challenge. Other firms can set up their own offshoring capabilities, negating your point of differentiation. Wages can also rise over time, eroding the cost advantage.

Niche cost advantage. Here you are attempting to achieve a cost advantage on a smaller scale by going after a specific niche. For example, rather than providing low-cost software coding to the entire marketplace, you are targeting a niche — let’s say credit unions. In this scenario, you do not have to maintain the lowest cost in every market, only the credit union marketplace. This example involves an industry niche, but a similar strategy might target a geographic niche, for example.

Broad differentiation. Let’s say you have a differentiation strategy that makes your firm desirable to the broad market. For example, you might have a business model that allows you to charge a fixed price when all your competitors bill by the hour. Of course, these sorts of advantages are often challenging to sustain because competitors have a habit of copying innovations that provide broad advantages. Perhaps the most durable differentiators are those born of expertise. Becoming known for specific types of expertise is how many firms implement these broad differentiators. Think McKinsey on strategy, for instance.

Niche differentiation. This is the most common and successful strategy used by professional services firms. Recent research confirms previous findings: the fastest growing professional services firms are much more likely to have strong specialization strategies. Specializing in industry niches and specific services are very common. We also see this strategy blossom when it comes to specialized expertise. When a firm becomes known as a leading expert in a specialized area of knowledge, it has a sustainable competitive advantage. For example, you could become the leading specialist in 401k programs for government contractors or the leading expert in marketing automation for real estate firms. Differentiated niches are where professional services firms tend to focus and thrive.

We’ll now turn our attention to finding a competitive advantage for your firm.

Sources of Competitive Advantage

Finding a sustainable competitive advantage is not an easy task for most professional services firms. Where do you even start looking? How can your advantage be maintained?

We’ll begin to address these challenges by looking at some possible sources of competitive advantage, as well as their pros and cons. We’ll start with those sources that tend to drive a cost advantage then move on to sources more aligned with differentiation and focus strategies.

Lower-cost labor. This is the strategy that made the term “offshoring” popular. Using talent from labor pools that pay lower wages is relatively easy in this era of modern communications. Assuming that the quality of talent is comparable to local professionals, you can create an immediate cost advantage. Of course, the downside is that this strategy can be easily replicated, so true advantages can be short-lived.

Automation. By replacing people time with automated processes you can dramatically reduce costs. The primary challenge is that automation spreads so rapidly that you can only sustain an automation advantage by continuously improving your technology. If you intend to stay on the front edge of technical innovation, you’ll need to invest continuously to maintain your edge.

Services integration. In traditional manufacturing or distribution, a very common cost advantage strategy is vertical integration. Start with your process and identify all the inputs needed. Then develop or acquire the capability to control those inputs. Henry Ford made this strategy famous. His cars required steel, so he built his own steel mill. In this way, you control your costs.

In the professional services arena, a services integration strategy involves offering a larger group of related or interdependent services than your competitors. While this may have a convenience benefit for some clients, it is primarily a cost reduction play.

Process advantage. Process advantages arise when you have an approach to offering services that delivers the same or similar benefits at a lower cost. But developing a truly proprietary process is not simple. Many firms claim to have them, but few actually deliver. And, of course, many process advantages can be very challenging to maintain, especially if they can be easily copied.

Service level. An advantage can be gained by providing a very different level of service to your target audience. That service level might be greater, as with a premium service offering, or much lower, as with a self-service approach. In either case, the specific service level must be valued by a significant segment of your target audience if it is to provide an advantage.

Culture. Your firm’s culture can be the source of a competitive advantage if two conditions are met. First, the culture must provide an actual benefit — it must be something that clients recognize and appreciate. Second, you need to be able to prove it. How? Recognition from a respected independent source (such as an award or press reports) is a good start.

Business model. Developing a new business model is a great way for a professional services firm to gain a competitive advantage. When everyone else offers a fee for service model, you develop a model based on paying for results. When the industry zigs you zag. This is a proven way to build competitive advantage to a segment of the market. The downside is that these innovative business models can be copied. However, many firms are reluctant to explore new or exotic business models, so you will have a significant first mover advantage.

Talent approach. Some firms take a distinct, identifiable approach to the way they recruit or manage talent. For example, one of our clients hired only programmers with PhDs in computer science. Another firm focused on hiring very bright, young computer science graduates from Ivy League schools. Armed with these credentials, they sought out high-value, high-risk projects that required up to the minute skills. These two talent strategies provided competitive advantages to their respective target audiences.

Expertise. Having one or more leading industry experts on staff is one of the most reliable and durable strategies to build a competitive advantage in the professional services. This approach is used in almost all niches. While geographic location was once a limiting factor of this strategy, it is becoming less and less relevant in today’s expanding marketplace. Professional services buyers are more and more willing to work with someone outside their local area. And once established, highly visible expertise is easier to maintain as a competitive advantage.

Brand. Think of your firm’s brand as it’s reputation multiplied by its visibility. The better and more distinctive your reputation — and the greater it’s visibility among your target audience — the stronger the brand. How can a brand provide a competitive advantage? Well-known, credible brands provide a “safe choice” for clients, making it easier and less risky for them to choose a service provider. Also, because well-known brands have greater visibility, they provide more opportunities for referrals. Those referrals are further accelerated if they center on specific areas of expertise.

Services offered. This approach is closely related to the services integration strategy described above. The main difference is that instead of developing a suite of interrelated services, you focus on providing a broad range of services. These services may have little or no relationship to each other. Many firms think of this as a “full service” advantage. The risk in this strategy is that prospective clients may not recognize your range of services as a competitive advantage. In fact, research shows that buyers often prefer specialists to generalists.

Industry focus. One of the most common ways of differentiating your firm is to specialize in serving a limited number of industries. You might specialize in servicing the needs of the not-for-profit community or the health care industry, for example. For many firms, this can be an effective way to establish a competitive advantage. When you promote an industry focus, buyers tend to assume you have specialized knowledge and a deeper understanding of their industry. The primary concern with an industry focused competitive strategy is that your firm’s fate may be linked to the fortunes of the industry you serve. Sometimes that is good, other times not so much.

Geography served. Local, regional, national or international? You are making a strategic choice when you decide which geographies you will serve. In years gone by, most professional services tended to be local in nature, and opening offices in other areas was a big decision. Today, technology has broken down geographic barriers and buyers are becoming increasingly comfortable hiring firms around the country and even overseas. Low-cost communications and real-time video have made remote work practical for many professionals, and firms have many more options for building practices unbound to a single location. This democratization of work opens up greatly expanded opportunities. But it unleashes a tidal wave of new competition, too.

Role served. By focusing on the needs of a single role within a corporate structure you can offer services that are better suited to your audience’s needs. Much like an industry focus, specializing in a role gives you a perceived “specialist’s advantage”. You are assumed to have greater insight into specialized needs and challenges. But this approach differs in an important way from other competitive strategies described above. Instead of seeking out buyers for a predetermined set of services, you tailor your services to fit the needs of the role you serve. As a result, your services may differ from those offered by other firms in your profession. This is a subtle but important difference when it comes to securing a competitive advantage.

Business problem solved. Just as specializing in a specific role can be a source of competitive advantage, so too can focusing on solving a particular business problem. What qualifies as a business problem? Well, it must be something that is recognized as a difficult issue that lacks a clear existing solution. The problem must also be of sufficient concern that a company is willing to invest in a solution. While many professional services firms solve common business problems for their clients, a business problem specialist has a strong focus on — and expertise in — solving a particular business challenge. That’s what makes them so appealing to buyers.

Technology focus. Many firms specialize in supporting specific technologies. Product and service bundles are common. The whole value-added resellers industry is built upon securing this type of advantage. It has the advantage of being a clearly understood specialization. But this model comes with risks, too. Technologies can get supplanted or go out of style. Consequently, this source of competitive advantage must be monitored closely, and the firm must be prepared to change with the marketplace.

How to Develop Your Competitive Strategy

Strategy development is a challenge for many professional services firms. Too often it is a quasi-negotiation among firm principals. There may be limited objective information and analysis and an abundance of anecdote and speculation. The sad result is often a competitive strategy that offers no real advantage.

But it doesn’t have to be that way. There are steps to make the process more objective and fruitful. Here is what we recommend.

1. First consider your business situation

Competitive strategy is developed in the context of your business situation. Is yours a mature firm with a well-developed brand and a reputation for stability, or a brand new start-up? What are your business imperatives? Do you need to grow in size or maximize profitability?

These kinds of business objectives shape what is possible and what is optimal. Your analysis can range from a simple SWOT exercise to a sophisticated analysis backed up by reams of data. The only thing you cannot do is ignore your business realities.

2. Research your target markets and competitive environment

Research is perhaps the single most important step to arriving at a sustainable competitive advantage. It offers you the opportunity to understand how your firm is, or could be, different from competitors in ways that are meaningful to your potential clients.

There are two types of research of relevance here. The first is research on your target markets. This allows you to better understand their needs, desires and buying process. The findings will help you understand what is an advantage to this audience. A well-designed study can also help you choose among possible target markets.

The second type of research addresses your competitive environment. How are you different from (or the same as) your key competitors? The research will help you identify any competitive advantages you already have, as well as evaluate potential new strategies. Importantly, this type of research can also tell you if the competitive advantages you currently claim are in fact real.

3. Identify current or potential sources of competitive advantage (differentiators)

So now that you have assembled the facts, it is time to pick your competitive strategy. In your research, you will likely have identified some potential advantages. For instance, if some clients already see you as more flexible than your direct competitors, is that an advantage to nurture and build upon?

You can also consider whether to add a new advantage. Where to start? We recommend consulting the list of competitive advantages in this article. Try each one on for size. Does it fit the type of organization you are today? Does it address the needs of your business situation?

A good way to evaluate potential advantages is to apply the three-step test that Hinge uses for evaluating differentiators:

- Is it true? It must be true to be sustainable. Aspirational advantages are fine as long as they are grounded in reality and you are actively working to bring them to fruition. You can’t just make them up.

- Is it relevant? Does it really matter to the potential client at the time they are making their firm selection? If it is not an important factor at that point, you will not gain a strategic advantage.

- Is it provable? Prospects are inherently skeptical. They are used to ignoring unsupported claims. Can you point to a proof point? Is there objective support for your claim?

If your potential can pass these three tests you have a strong candidate for a competitive advantage. Now you need to validate your selections.

4. Validate your competitive strategy

Because these are high-stakes strategic decisions, it is prudent to validate your selections before implementing them. One approach is to test the competitive strategy. Try it out with some prospects and see if it is giving you the advantage you seek. Realize that its effectiveness may be muted, since the full strategy is not yet in place. However, you should get a sense of its likely impact.

But not all strategies can be tested before they are implemented. The investment may simply be too great. Instead, you can do a validation study to simulate the impact of your strategy. For example, you can have your research firm interview potential prospects to gauge their reaction to contemplated changes. While not as strong as an actual live test, a validation study can lower potential risk relatively quickly and with fewer staff resources.

Once you have validated your strategic selections it is time to plan how you will implement and sustain them.

5. Develop an implementation plan

Some competitive advantages may already be fully implemented in your firm. In those cases, your task is to focus on communicating those advantages to the marketplace. This element of a plan is often called a marketing or brand building strategy. This plan focuses on target audiences, messages, communications techniques, budget and schedule.

There is another type of implementation that you may need to consider as well. If you are planning to implement a strategy that involves developing a completely new characteristic of the firm, you will need to plan how that is going to happen. Does it involve new hires? Training existing staff? Changing policies and procedures? Acquisitions? These sorts of major organizational changes do not happen on their own. They must be planned for and diligently implemented.

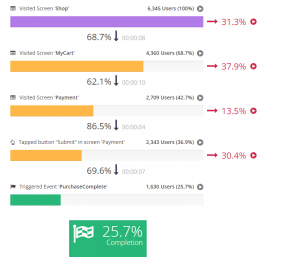

And of course, any implementation plan will fall short if it does not have a tracking and evaluation component. What are you tracking? First implementation. Is your competitive strategy being implemented as planned? Second is impact. Is it producing the desired impact? Does closing percentage improve? Are you growing faster or more profitably? Are you enjoying the business impact you sought to produce?

For in the end, these are the true measures of your competitive strategy.

Business & Finance Articles on Business 2 Community

(97)