Consumers Sacrifice Brand Loyalty Down To The Penny

Taylor Sheridan, the creator of the hit TV series “Yellowstone,” recently purchased around 179 acres, give or take a few dozen, just miles from my property in Wyoming, where different words and phrases are used to talk about the economy, compared with Southern California and the rest of the United States.

In Wyoming people talk about trying to find a job to earn enough money to support their family or subdividing their farm and selling parcels to someone like Sheridan. Most Wyomingites work two or three jobs, and even then, when you need a plumber, carpenter or someone to remove snow, you’re put on their “list.” The wait could be weeks or months.

It’s a much different lifestyle than on the East and West coasts, where I was born and grew up, respectively.

Advertisers trying to reach Midwesterners should know decision-making at the grocery store is likely influenced most by price, quality, store sales and familiarity, respectively.

I’m describing Wyoming, a state where there are more animals — wild and domestic — than people. But a report released today from Ibotta uses those words to describe sentiment across the U.S. Ibotta’s second annual state of spending report found the majority of consumers sacrificing brand loyalty when faced with increased costs.

Making decisions on price, quality and familiarity makes it more difficult for brands to attract new consumers, as 74% of grocery purchases are repeat purchases, compared to 26% which are new.

CPG marketing data in this report comes from a survey of 422 marketers and agency reps, as well as data from an online survey of 5,006 grocery shoppers in the general U.S. population between July 24 and August 8, 2024.

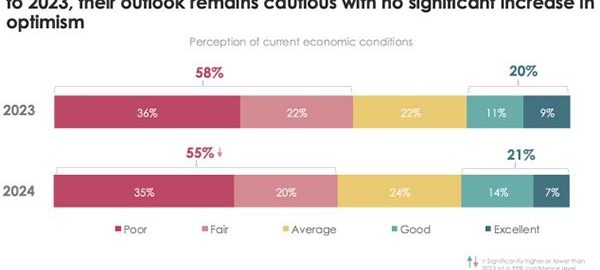

The consumers Ibotta surveyed reported a slight improvement in economic outlook this year, but 55% have a negative perception of current economic conditions compared with 58% in 2023. Still, many consumers remain cautious, with a positive perceptions of the economy rising by only 1% year over year.

Despite consumers’ more pessimistic outlooks on the economy this past year, 51% believed they will be better off in 12 months. When asked, only 34% say they are better off now than they were at this point in 2023.

These unmet financial expectations may be fueling variability when it comes to the perception of inflation — as well as uncertainty about its future trajectory. Only 36% of consumers believe inflation is slowing or that things are improving.

And despite reporting a reduced personal impact from inflation — down from 73% to 70% in 2024 — it continues to affect a large majority of consumers.

Advertisers, promotional strategies and competitive pricing, especially as the holidays approach could give brands an opportunity to encourage consumers to try their products.

Lowering the price, at least temporarily, could become key. Some 75% of shoppers say they will try a different brand if it is offered at a lower price than what they usually buy, while 64% agree that price is more important than brand name.

Grocery stores and retailers can tap into shoppers’ desire for value by offering promotional rewards to drive repeat business and sales. 78% of shoppers say they are more likely to return to a grocery store if they offer cash back, and 75% are more likely to buy more items if they can redeem a promotional offer.

Shopping habits have changed in the past four years and consumers are spending more on essentials, less on everything else. Survey results show shoppers have spent an additional $302 on food and beverage essentials during the past year, causing people to cut their spending in more discretionary categories like personal care/beauty, down $9; pet care, down $5; health, down $5; and cleaning and household items, down $3.

Within food and beverage, the categories with the biggest declines in year-over-year purchases may also be seen as discretionary. Alcohol fell 8%, plant-based meat and dairy fell 5%, snacks fell 4%, and frozen foods fell 3%.

Regardless of product necessity, more than half of consumers report switching to a less expensive alternative if something they normally buy has an increased price. Many people in Wyoming subsidize their food source by hunting, raising sheep, goats and cattle, and buying a four-season greenhouse to grow their fruits and vegetables.

Shopping habits have changed. Significantly fewer people analyzed in this study shop at least once a week, 77% in 2024, compared with 80% in 2023. Rewards or loyalty programs, sometimes, being the top deciding factor for shoppers when choosing a grocery store.

Some 60% of consumers believe they are spending more this year compared to last. 70% say inflation has negatively impacted their household finances in the past 12 months, and 72% agree that the economy has a direct impact on their grocery spending habits, specifically.

(5)

Report Post