The revenue side of a new startup business can be the one that gets the lion’s share of attention from the beginning. Bringing money in can naturally be top of mind for any small business owner. The money going out is just as crucial.

Taking a realistic and analytical approach is a smart move, and that means thorough budgeting and planning for the future. Here are a few ways that small businesses can control spending.

Budgeting

It’s imperative that an entrepreneur devotes enough time to plan for financial scenarios, and to know where the business stands at any given moment. This will require significant effort from the owner and his or her financial support team, and it’s just as important in the 12th month as it is in the first. A story by SunTrust Banks explores this idea.

“You can’t manage what you can’t measure,” the story says. “Although two-thirds of owners agree they are responsible for cost control, many don’t have monthly budgets, according to a report of small business owners by the National Foundation of Independent Business. According to Bob Fifer, the author of the book Double Your Profits, if you want to save a lot of money in very little time, set a budget. It can save you a significant amount of money every month.”

Resist urges

A new startup owner may be tempted to indulge in certain investments, especially if he or she experiences early success. An initial influx of cash may be exciting, but there’s no guarantee it will always be that way, so a prudent approach is likely the best one. In a story for Forbes, Mark Evans details some of these areas to avoid, including throwing expensive parties, overdoing it on professional conferences and upgrading equipment that is still functional. And just because a business starts out fast doesn’t mean it should change its environment with a new-and-improved office.

“Why is it that a startup can do amazing things in a no-frills office but feels the need to move up in the world to a new and shiny office once they have money in the bank?” Evans writes. “To me, an office is just a place where people work. Just because it has a nice view or located in a better part of town doesn’t mean people will work harder, or you’ll be able to attract better employees.”

Don’t dive into advertising

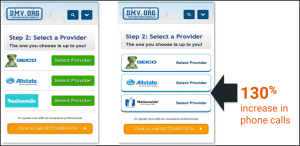

This is a potential dilemma for new small business owners: Use early funds to get the word out about the business, or focus those funds elsewhere? Anita Campbell explores this for smallbiztrends.com, and advises to press pause on the advertising side, especially in the age of social media.

“Advertising takes money,” she explains. “Besides, a lot of startups are still figuring out what they are doing in the first 6 months. Instead, ramp up your social media presence during this time. You can connect with your audience and develop more of a two-way dialogue during this time, gaining feedback from your target audience as well. If you must advertise, experiment with low cost alternatives such as Facebook Promoted Posts and Twitter Promoted Tweets.”

Don’t jump the gun on outside services

The first months of a startup can be a whirlwind. Some owners may think they need to branch out in the beginning stages with additional investments, or to enlist the services of outside groups. Limiting these moves can be the right way to go, according to a story by NerdWallet, featuring the guidance of financial advisor Jeremy Office.

“ … Identify a timeline early on and know when you need to incur expenses for the various stages of the company,” Office advises. “For example, don’t hire a public relations company until you have developed the product or service you want to offer. Often, companies will hire service providers because they think they are needed to build a business rather than because they have an established plan for using the service provider. One option is to ‘gamify’ the process with built-in rewards. Hire or acquire only when you have reached a certain milestone, for example.”

Keep growth in mind

A conservative approach to expenses can be a smart plan in the earliest stages of a startup, but the owner should also keep an eye on future growth. As Office recommends in the NerdWallet piece, “Stay focused on the expenses that are absolutely necessary for growth.”

“… Any activity that is supporting business development and growth, as long as it is rational, should move to the top of the priority list when deciding where to allocate working capital,” he explains. “Consistently monitor and reassess expenses. Sometimes you may not be spending enough in certain areas and you have to shift expenditures accordingly.”

Examine inventory

How much inventory should a new small business have on hand? It may be tricky to know at first, but being organized and examining what sells and when can help to keep costs down, as author Devra Gartenstein describes for the Houston Chronicle.

“Develop an efficient inventory-control system,” she advises. “Always have enough materials on hand to perform necessary tasks and meet customer demand, but don’t keep so much inventory that it gets in the way and ties up capital that should be liquid. Keep detailed inventory records and establish desired inventory levels to successfully communicate to your staff how much stock to order, and how often to replenish it.”

Methodical hiring

A new small business owner will of course need help. How much staffing is necessary can be a big question. As Campbell writes for smallbiztrends.com, hiring is an area that may take a back seat to other initiatives in the early stages.

“Adding employees requires you take the time to bring people on board, communicate with them so they understand the vision, and allow time for them to get acclimated,” she explains. “In some businesses, such as a restaurant, you MUST hire if you expect the business to run. But many other kinds of businesses are better off focusing on product development, marketing and/or sales before hiring a lot of people. Plus, you want to give yourself the time to select the best talent for ‘permanent’ hires; go with freelancers and contractors whenever possible in the first 6 months.”

Business & Finance Articles on Business 2 Community(73)