The last few months have brought challenging times to all industries. COVID-19 has sped up the shift in payments as many companies move to digital to survive. Payment platforms need to respond to demand.

Many companies had two options for facing the crisis: close the business down or adjust rapidly. But the fact is that businesses have various levels of access to new technologies and digital tools.

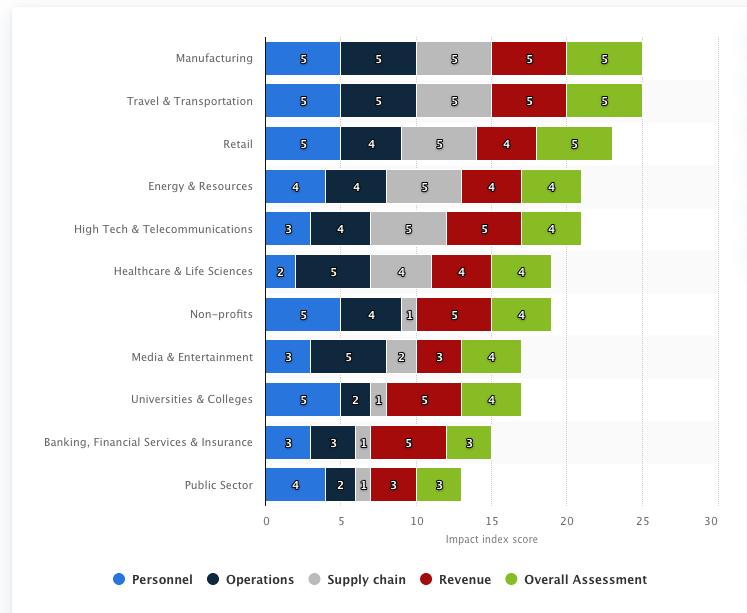

Projected coronavirus (COVID-19) impact index by industry and dimension, minor (1) to severe (5), in 2020. Source: Statista.com

The ever-growing popularity of online shopping

Lockdowns and restrictions have resulted in changes in consumer behavior. One of the direct results of the pandemic was a noticeable growth in online shopping. The e-commerce market is more popular than ever before, thanks to the adoption of ordering groceries and other everyday goods online. In Italy alone, e-commerce transactions have risen 81% since the end of February. The shift caused by lockdowns will change consumer behavior for good. Many customers will continue online shopping rather than returning to physical stores.

We can also observe a rise in cashless societies. This change is mostly because the World Health Organization warned that banknotes may spread coronavirus and recommended paying by card where possible or moving to online shopping. To meet consumers’ expectations for offline shopping, Visa and Mastercard decided to raise transaction limits for contactless payments across most European countries from EUR 25 to EUR 50.

While the pandemic brought a huge drop in brick-and-mortar businesses’ revenue and forced the closure of non-essential businesses, the online market took advantage of the situation. But there are also industries (such as travel) that recorded a severe decrease in profits due to the stoppage of activity.

Minimizing customer disruption with strategic partnerships

The pandemic was a catalyst for change in the way money is processed, but it also exposed weaknesses in the banking industry. The current situation forced banks to see the importance of digitization, and that’s where fintech companies come into play. Independent fintech companies have much more to offer online businesses than traditional banks.

The whole banking industry has taken a big hit, so legacy banks may wish to collaborate with fintech players to bring better solutions to their customers and keep their position in the market. Banks may try to team up with fintech companies that have better technology to provide payment processing at the speed today’s customers expect.

Merchants with advanced digital platforms are leading the way, and others will need to catch-up quickly. Payment companies that provide timely assistance will take a bigger slice of the cake.

The rise of fraud

Some companies have reported a nearly 700% increase in phishing attacks globally since March. Transaction fraud is also on the rise.

Any crisis makes opportunities for criminals, so merchants need to adapt to the new reality and improve their fraud prevention and detection. There’s a bigger need than ever for systems with dynamic rules that adjust quickly to certain industries and the current situation. Plus, merchants need to focus on real-time transaction monitoring to track anomalies and recognize trends.

For some merchants, the pandemic has come with a bigger number of chargebacks or refund requests than normal because people tend to cancel their orders. Online businesses need to pay close attention to false positives—it’s predicted that we can see a near-term impact of a higher volume of such transactions.

The current situation may also have an impact on trust in payments, which may lead to the adoption of distributed ledger technology for payments.

Coping with the next normal

It’s no exaggeration to say that the coronavirus pandemic has changed business forever. Years of change have been condensed into a couple of months. Even though this is clearly a very challenging time, we have seen a growing interest in digital payments and a number of businesses moving to the online space.

The COVID-19 pandemic completely changed consumers’ shopping behavior and has been a catalyst for change in the fast-moving payments industry. Unprecedented growth in online transaction volumes and digital innovation driven by changes in customer behavior wouldn’t be possible without the potential of technology.

Business & Finance Articles on Business 2 Community

(76)

Report Post