CPC Report Shows Where Ad Costs Rose And Fell

Pacvue’s Q1 2024 report examines fluctuating ad costs across platforms from Amazon to Instacart to Walmart during the first quarter of 2024, drawing on insights from thousands of advertisers.

It shows how retail media continues to chip away at paid-search media, despite paid-search advertising spend reaching a new high in 2023, despite the Internet Advertising Bureau reporting reporting in its full year 2023, that search accounted for $88.8 billion of $225 billion in U.S. digital advertising revenue last year. The report was conducted by PwC.

Search took the largest market share of advertising last year at 39.5%, but was down from 40.2% in 2022 and 41.4% in 2021.

Heading into 2024, Pacvue data shows that Amazon’s Big Spring Sale drove a 23% increase in Amazon Prime Subscribers.

Melissa Burdick, president of Pacvue, wrote in an email to Search & Performance Insider that competition among retail media platforms is driving innovation and creating new opportunities across the board for advertisers.

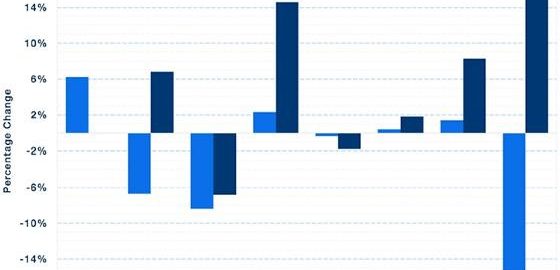

The cost per click (CPC) in Q1 2024 fell 6% quarter-over-quarter for Amazon Sponsored Products, but rose 6.8% year over year (YoY.).The YoY increase was most likely a result of increased competition due to the new March Big Spring Sale and Amazon’s incorporation of more non-endemic advertising opportunities.

In terms of return on ad spend (ROAS), Sponsored Products remained relatively flat, increasing by just under 2% from last year.

The brand average daily spend for Sponsored Products fell 15% quarter-over-quarter (QoQ), but rose 17% YoY.

“While Amazon maintains its lead in market share, retailers continue to innovate to remain attractive to brands, such as Walmart’s launch of Brand Term Targeting and its integration of Walmart Luminate into Walmart Connect,” Burdick wrote. “Walmart’s CPC was up 18% YoY, which indicates that advertisers are investing in these new innovations to ensure their ads are displayed prominently and reach their target audience effectively.”

CPC for Walmart Advertising in Q1 2024 rose dramatically YoY — more than 18% compared with 2023.

Increased competition is most likely a result of Walmart’s newly launched Brand Term Targeting with brands experimenting with new strategies to outbid competitors, according to the data.

As the cost of ads rose, ROAS took a significant hit, dropping 7% from Q1 2024.

Pacvue expects CPCs to increase slightly throughout the year as brands continue to find their ideal strategy.

Click-through rates (CTR) rose 15% YoY in the quarter, as a result of the newly introduced Brand Shops and expansion of Sponsored Brand and video placements on Walmart.

Brands also spent 15% more than in Q1 2023, indicating their eagerness to test new ad types and experiment with conquesting ad campaigns.

ROAS on Instacart in Q1 2024 saw a significant dip from last year, and with lower conversion rates on the platform, brands made an average of $0.64 less in ad return on every dollar spent.

With no sales event in the first quarter to help drive conversions, according to the report, consumers returned to pre-COVID in-store shopping levels, forcing CTRs and ad spend down.

(9)