Data Roadmap For States’ Reopening Tracks Consumer Spend, Analyzes Behavior From 40M Households

As states lift COVID-19 stay-at-home orders, companies have begun to implement timelines for reopening.

Commerce Signals, a source of U.S. retail payment insights, makes it possible to support those decisions with credit and debit card spending data from 40 million households.

The company created the COVID-19 Consumer Spend Impact Dashboard. It updates weekly and allows users to analyze payment card revenue changes in various consumer categories, online vs offline sales changes, regional differences, and more.

“Businesses are taking on a lot of expenses to reopen,” said Commerce Signals CMO Nick Mangiapane. “If you’re a national chain, you’re going to want to understand what’s going on in a specific market and state.”

Companies may want to drill down into data related to specific cities and industries, something the tracker can do. Users also can see returns and credit — as in the case of airlines — as well as the average order size. The average order size for groceries, for example, rose 32% during the past four weeks compared with a year ago.

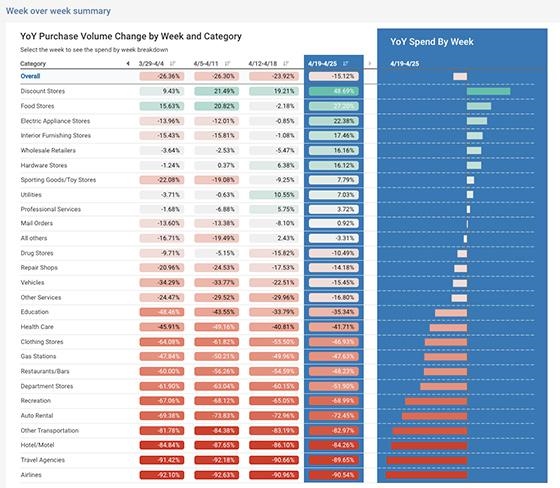

While overall year-on-year purchases fell 15.12% the week of April 19-25, discount store purchases rose 48.69%, while food stores rose 17.20% and electronic appliance stores rose 22.38%.

Some categories have improved compared with the prior week. Across the U.S., furnishing stores, wholesale retailers, hardware stores, sporting goods, utilities, professional services, and mail orders all rose.

The tracker provides the number of cases — whether purchases are offline and online — along with their year-on-year growth, as well as unemployment rates. Mangiapane seemed most surprised by the enormity of the declines.

The data also provides insights into the hardest-hit categories including travel, hospitality and restaurants, which fell as much as 90.54% the week of April 19-25, although they softened by a fraction of a percentage compared with the prior week.

Most of the hardest-hit categories, from gas stations to recreation and travel, saw the percentage of declines ease a bit.

What will Commerce Signals do after the tracker outlives its usefulness? It will morph into another form, Mangiapane said. “I’ve never been involved with launching a product that I hope had a short life span,” he said.

(21)