Debit Vs. Credit Card Spending Rose During Holidays For COVID Lockdown Categories

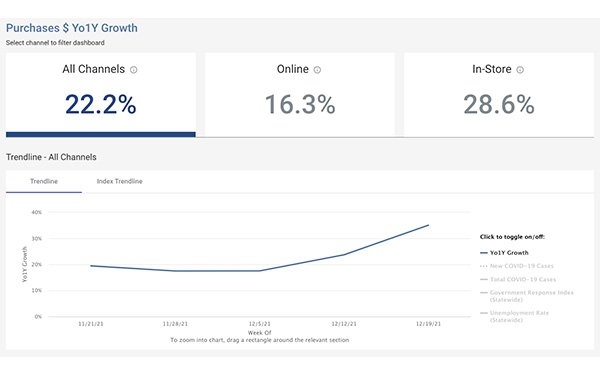

Despite supply-chain slowdowns and record out-of-stock warnings during the 2021 holiday season, U.S. consumer spending on credit and debit cards from the week of Thanksgiving through the week of Christmas for 2021 rose 22%, according to recent data.

Nick Mangiapane, Commerce Signals CMO, said travel, restaurants, apparel and in-store shopping were categories that experienced major sales during the 2021 holiday season — all things those consumers missed during COVID-19 shutdowns.

“There was a bigger shift to more card use, because people just didn’t want to handle cash or they bought online,” he said. “Some stores stopped accepting cash, and that trend stuck around.”

Commerce Signals analyzes data pulled in aggregate credit and debit card spending across 40 million households.

Overall consumers spent 22% more during the holidays. Online spending rose 16.3%, and in stores, 28.6%.

“Debit spending increased more than credit, during the pandemic overall, not specifically during the holiday period,” he said.

Airline sales during the holiday period rose 150% compared with the prior year. Hotels and motels rose 120%. Retail rose about 10%.

Mangiapane said restaurants that continued to advertise took market share. Bubba Gump Shrimp, for example, grew market share by 140.9% during the season compared with a year ago. Yard House grew 87.2% market share. California Pizza Kitchen grew 44.4% share.

Consumers are on the go. The technology can identify where stores or restaurants gained or lost share during a specific time period. The data also shows losses and gains depending on where consumers live, in addition to the city where the restaurant is located.

People are shopping both online and in stores, Mangiapane said. Consumers spent 54% more in restaurants and bars during the holiday period, compared with the prior year.

“The only categories that didn’t pick up as strong were toys and sporting goods,” he said. “Most people bought items in those categories in 2020. Electronic stores also had slower growth for most of 2021, compared with the prior year. Mail orders from catalog businesses also declined.”

(17)

Report Post