Introduction

What is the best way to design or construct a common stock portfolio? This is a question I am often asked and my short answer is always the same – it depends. The truth is, there is no perfect method or strategy for designing a stock portfolio that is right for every individual investor. However, there are principles of sound investing that every investor can follow and apply when designing a common stock portfolio that’s just right for them.

Furthermore, there are general categories that individual investors fall into. Some individuals are young and planning for retirement while other individuals are closer to retirement, and there are some that are already retired. Additionally, each individual investor has different levels of financial resources that specifically apply. To complicate the process even more, individual investors of all types possess unique goals, needs, objectives and risk tolerances. Therefore, the logical secret to designing a successful common stock portfolio is to design one that’s most appropriate for you.

Therefore, the objective of this series of articles is not to attempt to dictate how individuals should design their own stock portfolios. Instead, the objective of this series is to provide information regarding common stock investing strategies and options that each individual can evaluate and ultimately utilize so they can implement and construct a common stock portfolio that’s just right for them.

At the end of the day, it comes down to making the appropriate choices. The most appropriate choices include, but are not limited to, utilizing the most suitable categories of common stocks available as well as the appropriate mix. In one context the choices approach the infinite, and this can be confusing or even overwhelming. On the other hand, the options can be generally categorized, thereby simplifying the process to a more manageable level.

Of course, individual investors also have the option of engaging professional help or self-directing their own stock portfolios. This can be done directly by hiring outside professional managers or by investing in packaged products created by professional managers such as mutual funds or ETF’s. However, this series of articles is intended for the self-directed individual investor interested in designing and managing their own common stock portfolios.

Stock Selection: What Are the Choices?

On the US stock exchanges alone, individual investors have almost 20,000 individual stocks (companies) to choose from. No matter how diligent you could be, it would be impossible for any individual to conduct a comprehensive analysis on all of them. Therefore, individual investors need a method of separating the wheat from the chaff.

One effective way to accomplish that is to break the larger list down into broader categories based on specific characteristics and attributes. In his best-selling book “One Up On Wall Street,” renowned mutual fund manager Peter Lynch presented what he referred to as “The Six Categories.” Personally, I believe that Peter Lynch provided a succinct summary of the broad categories or types of common stocks available for investment consideration.

However, his 6 categories are very broad, and therefore, within each category there are many additional nuances that investors are best served to recognize and understand. Nevertheless, I believe that Peter Lynch provided an excellent foundation with his presentation of the 6 broad categories available to investors. To clarify this important distinction further, I turn to Peter Lynch and his own words with the following quote:

“There are almost as many ways to classify stocks as there are stockbrokers — but I found that the 6 categories cover all of the useful distinctions that any investor has to make.”

In order to provide the reader with a more comprehensive understanding of the 6 broad categories of stocks that Peter Lynch presented, I offer the following review of each category with a few sample F.A.S.T. Graphs™ to provide deeper insights. Importantly, since Peter Lynch was primarily referring to the characteristics of 6 broad types of businesses, I have taken stock prices off of the graphs. My goal was to allow the reader the opportunity to focus on the types of businesses that Peter Lynch was describing without the bias that volatile stock movements can bring.

Peter Lynch’s 6 General Categories

Below I present Peter Lynch’s 6 general categories with a short description taken directly from his best-selling book “One Up On Wall Street.” Then I present an example or two with brief commentary of my own with the objective of providing a deeper insight into each category and what each offers from an investment perspective. When appropriate, my examples will come directly from what Peter Lynch said. But most importantly, my examples are not recommendations to buy today; instead, they are just offered as examples of the types of companies Peter Lynch was referencing.

Slow Growers

“Usually these large and aging companies are expected to grow slightly faster than the gross national product. Slow growers didn’t start out that way. They started out as fast growers and eventually pooped out, either because they had gone as far as they could, or else they got too tired to make the most of their chances. When an industry at large slows down (as they always seem to do), most of the companies within the industry lose momentum as well. Electric utilities are today’s most popular slow growers.”

Southern Company (SO): A Slow-Growing Utility

From the following graph we see a quintessential example of a slow-growing utility that Peter Lynch suggested as a popular slow grower. Long-term earnings growth has averaged only 2.5%. However, the primary attraction to investing in utilities is not for growth, instead, it is for their above-average dividend yields.

When you examine the performance of Southern Company since 1995, you see the benefit of its high dividend yield relative to the average company as represented by the S&P 500. However, you also discovered that capital appreciation, which averaged 2.8%, is highly correlated to its earnings growth achievement of 2.5%. Slow growth utilities can be excellent choices for retired investors seeking maximum income.

Campbell Soup Company (CPB)

However, not all slow growers are utility stocks. Therefore, I present Campbell Soup as a second example of a slow grower from the consumer nondurables sector. Since fiscal year 1996, Campbell Soup has grown earnings at 2.9%. The company does offer a moderately generous dividend, but its average dividend yield is lower than utilities such as Southern Company typically offer. Importantly, that previous statement implies that both companies are purchased when valuation is sound.

When you examine the performance of Campbell Soup over the timeframe covered in the above graph, you again discover a high correlation of capital appreciation of 3.8% to its earnings growth rate of 2.9%. On the other hand, due to its typical lower yields referenced above, total cumulative dividends are consistent with the average company, as represented by the S&P 500.

The Stalwarts

“Stalwarts are companies such as Coca-Cola, Bristol-Myers, Procter & Gamble, Hershey’s, Ralston Purina and Colgate-Palmolive. These multibillion-dollar hulks are not exactly agile climbers, but they are faster than slow growers.”

Stalwarts are an important category for retired investors and dividend growth investors. Many of the Dividend Aristocrats and Dividend Champions are found in this category. However, as Peter Lynch pointed out, stalwarts will not necessarily produce high growth, but most of the companies in this category would be considered blue chips. Nevertheless, quality often comes at premium valuations. Therefore, it can be difficult to find stalwarts at attractive values.

The Hershey Company (HSY)

Hershey was one of the companies that Peter mentioned in the above quote from his book. This is clearly a stalwart; however, even though I don’t have prices on the graph, if I did you would discover that this company has a long legacy of commanding a premium valuation. Nevertheless, it has grown earnings at an average rate of 7.6% since fiscal year 1997. On the other hand, earnings growth has been interrupted a few times along the way.

When examining the long-term performance of Hershey we once again see that capital appreciation is highly correlated with the company’s earnings growth rate. However, its cumulative dividend yield has been superior to the average company as represented by the S&P 500.

The Procter & Gamble Company (PG)

The blue-chip stalwart Procter & Gamble has grown earnings at 6.3% since fiscal year 1996. Although this qualifies it as a faster grower than the slow growers presented above, the reader should note that growth has been slowing in recent years (see red circle on graph). Although not depicted, growth over the last decade or so would place Procter & Gamble in the slower grower category comparable to what we saw with Campbell Soup. This is important because investors should be aware that companies can move from one category to the next, especially as they get larger, as is the case with Procter & Gamble.

Regardless, the long-term performance associated with the above graph clearly illustrates Peter Lynch’s point about faster-growing stalwarts. Long-term average earnings growth of 6.3% correlates highly with the capital appreciation of 7.1% that Procter & Gamble produced for shareholders.

However, the interesting aspect of Procter & Gamble’s performance is that total cumulative dividend income exceeded the income of the slow-growing utility Southern Company. This is attributed to Procter & Gamble’s higher earnings growth and dividend growth over the long run.

The Fast Growers

“These are among my favorite investments: small, aggressive new enterprises that grow at 20 to 25% year. If you choose wisely, this is the land of the 10- 40 baggers, and even the 200 baggers. With a small portfolio, one or 2 of these can make a career. Fast-growing company doesn’t necessarily have to belong to a fast-growing industry. As a matter of fact, I’d rather it didn’t.”

Although Peter Lynch did not mention any fast growers by name, I offer the following examples to illustrate the powerful returns possible with fast growers. Each of the three examples presented below met his criteria of a “10 bagger” or better. Two of them would classify as “small aggressive new enterprises that grow at 20% to 25% a year, but Google is currently a behemoth as a result of its extremely high historical earnings growth thus far.

I will let the F.A.S.T. Graphs™ and associated performance results on each stand on their own. The key points the reader should focus on are the historical earnings growth rates and the long-term returns that each have produced. However, it should also be noted that none of these fast growers pay a dividend and all the return has resulted from capital appreciation over time.

LKQ Corp. (LKQ)

Advance Auto Parts Inc (AAP)

Google Inc (GOOGL)

The Cyclicals

“A cyclical is a company whose sales and profits rise and fall in regular if not completely predictable fashion. In a growth industry, business just keeps expanding, but in a cyclical industry it expands and contracts, then expands and contracts again. The autos and the airlines, the tire companies, steel companies, and chemical companies are all cyclicals. Even defense companies behave like cyclicals, since their profits rise and fall depends on the policies of various administrations.”

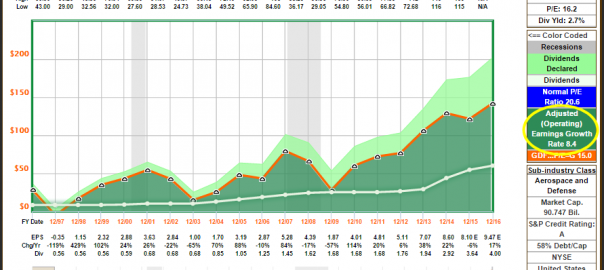

When examining the following graphs on well-known cyclicals in the autos, tire and steel sector, we see classic examples of what Peter Lynch meant when he said “profits rise and fall in regular if not completely predictable fashion.” The associated performance reports of each of these first three examples illustrates the unpredictable nature of investing in them.

I also included Boeing as a defense company to illustrate how they behave like cyclicals. However, most defense companies I have examined are a lot less cyclical than the autos, tire and steel deep cyclicals. As a result, the dividend income stream from most defense companies is often more predictable than their semi-cyclical earnings results. But most importantly, this illustrates how diverse companies can be within each of these 6 broad categories.

Ford Motor Co (F)

The Goodyear Tire & Rubber Co (GT)

The Goodyear Tire & Rubber Co (GT)

United States Steel Corp (X)

The Boeing Company (BA)

Turnarounds

“Turnaround candidates have been battered, depressed, and often can barely drag themselves into Chapter 11. These are slow growers; these are no growers. These aren’t cyclicals that rebound; these are potential fatalities. Turnarounds stocks can make up lost ground very quickly… The best thing about investing in successful turnarounds is that of all the categories of stocks, their ups and downs are least related to the general market.”

Crown Holdings Inc. (CCK)

In the late 1990s Crown Cork, then known as Crown Cork and Seal, was forced to reorganize as a result of being inundated with asbestos lawsuits and an ill-fated acquisition. However, I present this example to illustrate what Peter Lynch meant when he talked about how quickly turnarounds can make up lost ground.

To illustrate my point, I offer the following Crown Holdings earnings graph with prices included. Here we discover that once earnings growth resumed, what was once a turnaround turned into one of the fast growers discussed above.

American International Group (AIG)

One of the most recognized companies in the financial services sector was American International Group. The company had actually amassed a strong record of earnings growth prior to the bursting of the financial bubble. However, the following graph clearly illustrates the complete collapse of earnings.

On the other hand, since 2012, we see how American International Group represented a classic example of what Peter Lynch meant when he said they could turn around quickly. Since 2012, earnings growth has averaged more than 40% per year. However, most of that average growth is attributed to the 285% growth achieved in 2012.

Even though American International Group’s earnings growth has slowed down since 2012, shareholder returns during this turnaround period have been more than double the S&P 500. Personally, I consider turnarounds a very risky category. On the other hand, for those investors with an appetite for risk, they can be quite rewarding as both of these examples illustrate.

The Asset Plays

“An asset play is any company that is sitting on something valuable that you know about, but that the Wall Street crowd has overlooked. The asset play may be as simple as a pile of cash. Sometimes its real estate.”

Plum Creek Timber Company (PCL)

Frankly, I was not able to come up with a clear example of an asset play. However, Plum Creek Timber Company might represent an example of what Peter Lynch was talking about. The company does own or control a large amount of timber producing real estate and they do have a program for selling it. However, the majority of their revenues come from selling wood related products.

Nevertheless, the underlying value of their real estate holdings is not necessarily reflected in their ongoing operating results. However, I believe it is a speculation to believe that shareholders would benefit in a meaningful way – at least over the short to intermediate term. My point is that I consider asset plays too speculative for most investors.

As a bonus, I have prepared a free analyze-out-loud video on my website MisterValuation which provides a more in-depth and detailed look at Peter Lynch’s 6 categories of stocks.

Summary and Conclusions

In this part 1 on stock selection, I have simply presented the 6 broad categories that investors have to choose from based on what Peter Lynch wrote about in his best-selling book. It’s important to state that investors could in theory construct a fully diversified common stock portfolio by only using companies from 1 of the 6 broad categories. For example, a diversified portfolio of dividend growth stocks could be created utilizing stalwarts only.

Nevertheless, the primary objective of this part 1 of a series on stock selection was to illustrate the broad categories available for common stock investors to choose from. In that regard, this article was oriented towards developing a clearer understanding of the types of companies available to various classes of common stock investors. Moreover, this article was also designed to illustrate the vast differences there are among the 6 categories of common stocks. This supports my continuing contention that it is a market of stocks and not a stock market.

In part 2, I will discuss an assortment of common stock portfolio design strategies that investors might consider, depending on their goals, objectives, needs and risk tolerances.

Disclosure: Long SO,PG,LKQ,AAP,GOOGL,F at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

(213)

Report Post