Last month we published “How to Allocate Your B2B Marketing Budget,” but we may have spoken too soon.

Oracle and Econsultancy just released their 2015 report, with new numbers and trends.

But if reading an epic, 63-page report isn’t how you want to spend your lunch hour, I’ve summarized the main findings in this post. Don’t worry—I didn’t mind reading the whole thing.

First, a Quick Summary

- Digital marketing spend has reached an all-time high

- Earned media (i.e., social media and content marketing) is the biggest winner of increased budget spend

- Executives have greater digital marketing buy-in than ever

- ROI continues to plague marketers

Looking a Little Deeper

77% of companies report spending more on digital marketing, representing a significant 8% increase over last year. This marks an all-time high since the inaugural research report six years ago. Within digital spend, organizations break down budgets like this:

- Paid media: 39%

- Owned media: 35%

- Earned media: 25%

But it’s interesting to note that even though paid media remains the highest area for digital spend, nearly 1 in 10 respondents plan to decrease paid media investments this year. Display advertising, affiliate marketing, and paid search are the three areas organizations are chopping the most funding.

But if digital spend is on the rise, and paid media is getting chopped, how is the paid media budget being reallocated?

Content marketing.

“Content marketing has been the most buoyant channel in terms of where organizations are most likely to say they will be increasing budgets since 2013,” the report states.

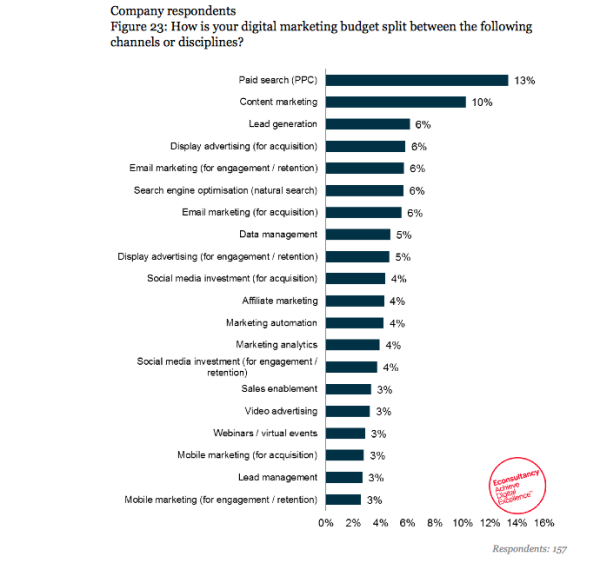

Content marketing is the second biggest “channel” or “discipline” marketers report funding (10%), followed by lead generation (6%), display advertising (6%), email marketing (6%), SEO (6%), and email marketing (6%).

It’s also the area in which organizations report the biggest increase in dollars.

- 71% of companies expect to increase spend on earned media (i.e., social media and content marketing)

- 67% of companies expect to increase spend on owned media (i.e., your own digital properties)

- 61% of companies expect to increase spend on paid media (i.e., display ads, and paid search)

And perhaps the best news of all for marketers, it that almost 3/4 of marketers are securing executive buy-in for digital marketing with greater ease. 72% of respondents said it’s “easier to secure boardroom buy-in,” up from 64% last year.

Related Content: [Guide] Setting the Stage for Content Marketing: How to Win over Executives in Four Acts

This ease of wooing the C-suite marks a paradigm shift in executive recognition of the power of digital marketing. Executives have been skeptical, but this new industry-wide buy-in is a bellwether for continued investment in the digital marketing space.

However, if marketers can’t figure out how to measure the impact of their efforts, it’s hard to say if execs will continue to be convinced of the power of digital—especially when 80% of CEOs don’t trust their marketing teams to deliver real results.

Inability to measure ROI jumped to the third most cited barrier to digital investment, up three places from 6th only a year ago. More importantly, marketers rate tying ROI to content marketing as the weakest connection. This might be why dollars continue to be pumped into more “traditional” digital marketing efforts like paid and display ads. These typically have better ROI figures, and are easier to grasp from the executive level.

With ROI in mind, it’s no wonder that the top three areas of marketing technology investments each reflect data, tracking, or revenue.

- A/B multivariate testing (50%)

- CRM (48%)

- Marketing analytics (42%)

Okay. So What’s the Big Idea?

The big idea is that digital marketing is here to stay. B2B companies stand to lose a significant competitive edge if they’re not investing in paid, owned, and earned media. And executive staff continue to desire stronger analytics and tools to track the ROI of vague digital efforts.

(310)

Report Post