Ecommerce Numbers Rise – Thank Marketplaces

One in five shoppers say they have bought gifts from smaller businesses as much as possible during the fourth quarter in 2023, a stat from Jungle Scout that has doubled since 2022.

Jungle Scout’s quarterly Consumer Trends Report reveals how spending behaviors and preferences change over time in relation to current events.

The report, fielded with 1.000 U.S. consumers, tracks the types of products consumers buy, how retail stores and sites perform, and whether spending increased or decreased online and in stores.

The percentage of consumers shopping for holiday gifts from local and/or small businesses as much as possible jumped to 20% this year from 10% in 2022, with Baby Boomer shoppers leading.

Gift shopping strategies vary. Some 37% of consumers said they will search for deals on items people have asked to receive, while some 35% plan to surmise the recipient and 32% shopped on Amazon deal pages.

Amazon still stands as the most popular gift shopping destination, but it’s important to recognize how many small businesses sell on the platform.

The Amazon marketplace acknowledges that more than 60% of sales in the Amazon store come from independent sellers — most of which are small- and medium-sized businesses. Some 67% of U.S. consumers said they will turn to Amazon to buy presents this holiday season.

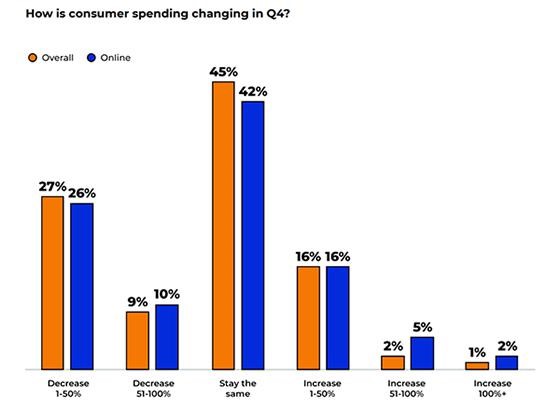

Online spending rose in Q4 — compared with other quarters this year — with a larger number of consumers than those whose overall spending increased. Some 23% said their online spending rose in Q4 compared with Q3.

Black Friday and Cyber Monday sales events attracted younger shoppers this year. Some 60% of Gen Z and 55% of Millennial consumers expected to shop on Black Friday, compared to just 30% of Baby Boomers and 36% of Gen Xers.

The majority of consumers in general are buying the same number of products across all categories in Q4 compared with Q3.

Consumers are buying more groceries, cleaning supplies and pet supplies, and fewer electronics, garden and outdoor products, and home and kitchen stuff.

The most popular online stores other than Amazon included Walmart, Temu, eBay, and Target.

Temu, a relative newcomer to the online space, is a rapidly rising competitor to more traditional retailers. Nearly one in four U.S. consumers have shopped from the site, along with SHEIN, in the past three months.

Inflation is affecting sales. In August, the U.S. inflation rate began rising again after consecutive months of declines. By September, the 12-month inflation rate was 3.7%, up 0.5% from July.

Based on these numbers, 68% of consumers entered Q4 with their incomes unchanged from Q3 — the highest this percentage has been since the data point was first collected in the fourth quarter of 2022. Household incomes have changed, however, during the past year, and it shows a fairly strong correlation to the quarterly changes in consumer spending seen during the same period, according to the report.

U.S. consumers plan to reevaluate their budgets and spending in the new year. The top priorities are family, physical and mental health and well-being.

Compared with a year ago, consumers are less focused on work and careers, while their interest in spirituality, hobbies and spending time outdoors has increased.

Some 42% of consumers said they plan to make New Year’s resolutions this year, down from 57% a year ago.

(5)

Report Post