Shoppers will have a wide variety of deals to choose from on Prime Day, July 11 & 12. Many deals will come from ecommerce and in-store competitors.

Amazon will run its yearly summer Prime Day promotions July 11 and 12. Amazon Prime members will have access to deals, while Amazon’s competitors will court bargain-hunters online and in-store. As a result, it’s a great snapshot of ecommerce trends.

Why we care. As this year’s Prime Day proves, digital retail is never exclusively online. Top retailers are using a combination of digital and in-store deals to cover the multichannel ways shoppers look for deals.

This time last year, there were questions about how inflation and lingering supply chain issues might hinder sales. The 2022 event indicated that consumers were ready to buy online if the price was right — U.S. online sales approached $ 12 billion over those two days, up 8.5% from 2021.

Prime Day competition. While Amazon is expected to offer discounted prices on top categories like electronics, toys and home goods, other top retailers will look to poach shoppers next week as well.

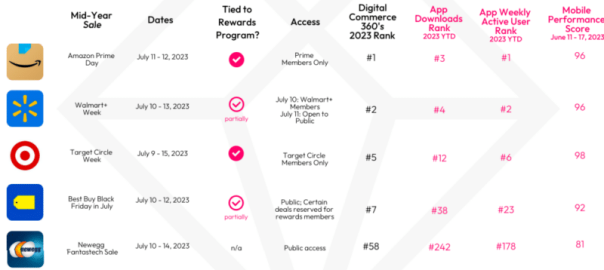

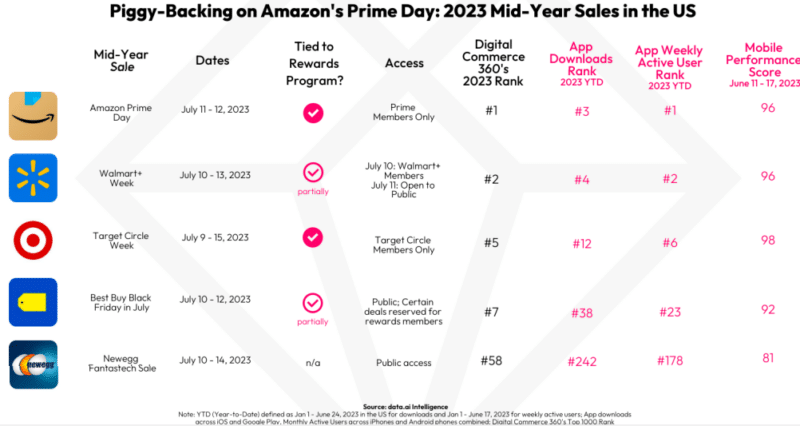

Here’s a list of top Prime Day promotions compiled by mobile and consumer data platform data.ai.

Many of the promotions are tied to loyalty programs. Target’s weeklong deals are exclusive to Target Circle members, while Walmart will provide early access to Walmart+ members before opening up deals to the public.

“Target, Walmart, Nordstrom and Best Buy have joined Amazon with key summer sales the past few years outside of the traditional 4th of July weekend,” said Kassi Socha, director analyst in the Gartner Marketing Practice. “Our year-over-year consumer research has observed growth in consumers shopping both sooner and in some cases, year-round for winter holidays. The more retailers bolster their promotional marketing during this timeframe, the more the consumer will be trained to pull forward their winter holiday shopping.”

Hybrid shopping. “Consumer adoption of hybrid shopping services is increasing,” Socha said. “Competitors to Amazon have strengthened their omnichannel offerings and may boost their summer sales results this year because they can get purchases to the consumer faster through buy-online-pickup-in-store, curbside pickup, or same day delivery.”

Groceries. The wider adoption of hybrid shopping means this year’s Prime Day promotions could open up non-traditional ecommerce categories, like groceries.

American consumers report high intent to splurge on restaurants and groceries, according to data.ai. Walmart and Target are well-positioned to capitalize on this with their ecommerce promotions, and by attracting foot traffic from habitual grocery shoppers.

Top categories. Omnichannel marketing platform Skai surveyed 1,000 consumers ahead of Prime Day to find out the top product categories shoppers were considering.

Here’s how the top categories ranked:

- Consumer electronics

- Household products

- Fashion and apparel

- Beauty and personal care

- Pets

- Toys and games.

Long and short game. Consumers are also willing to spend the time to hunt the best online deals, and they are ready to pounce on Prime Day if the price is right, Skai found.

Sixty-one percent of respondents said they started researching products over a month in advance of Prime Day. And 63% said they are happy to wait until Prime Day to find a better deal, even if the product they were eyeing was already on sale prior to the promotion.

Private labels. The demand for lower prices could find retailers promoting discounted store brands this Prime Day.

“A number of multibrand retailers have expanded their private label store brand assortment to appeal to price-conscious consumers impacted by inflation and improve their margins,” said Brad Jashinsky, director analyst in the Gartner Marketing Practice.

“The private label unit sales growth we see from Target, Walmart, and other multi-brand retailers is an indicator that pricing and macroeconomic conditions may be pushing consumers to trade down. We anticipate the trend will continue and impact summer sale results, making the need for brands to differentiate on quality and value important as consumers face difficult economic conditions.”

Hybrid shoppers who research online and are flexible about shopping online or in-store will have a wide variety of deals to choose from during Prime Day.

The post Ecommerce trends to watch for this Prime Day appeared first on MarTech.

(5)