Economic Impact On Performance

A disconnect between consumer sentiment and behavior has driven the economy, purchases and searches for years, but all that could be over.

Americans cut retail spending in October for the first time since March as interest rates reached a 22-year high.

Retail sales fell 0.1% in October compared with the prior month, the Commerce department reported Wednesday. This was the first monthly decline since March. At higher costs for items, consumers continue to increase credit-card debt.

Economic downturns have an effect on many aspects of society. While Americans continued to spend in October at restaurants and supermarkets — rising by 0.3% and 0.7%, respectively — automobile sales fell 1.1% in October, compared with the prior month.

In addition to the declining numbers, the downturn has surfaced in app downloads, as well as purchases made through them.

AppsFlyer found in 2023, the economic downturn had a significant impact on mobile app downloads.

Nearly all top media sources saw declines and app install ad-spend budgets fell by 20% in the third quarter of 2023 compared with Q3 in 2022.

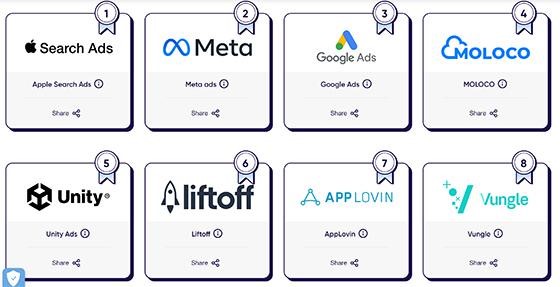

AppsFlyer’s Performance Index analyzed 75 media sources, with at least 11.5 billion app installs from 30,000 apps from April to September 2023.

Apple Search Ads (ASA) and Meta led the way across iOS gaming and non-gaming app downloads. ASA ranked as the No. 1 media source for iOS gaming apps and non-gaming categories in AppsFlyer’s performance index.

The company came in No. 1 in nearly all the rankings across every region and every category, particularly in non-gaming. And the dominance of ASA in non-gaming is even more pronounced than it is in gaming, coming in at No. 1 in all the rankings across every category and every region except for Latin America with unmatched scale and high quality.

Meta ads have rebounded following Apple’s privacy changes in 2022, when the company announced significant restrictions on data access. Meta continues to adapt post iOS 14.5, coming in at No. 2 in the power and volume rankings.

The company’s performance is mostly fueled by non-gaming apps on SKAdNetwork, Apple’s privacy-centric attribution interface, where it drives the highest number of installs, well above the competition.

Google Ads came in at No. 3 in the rankings thanks to its scale among non-gaming apps. It should be noted that for Google, iOS is secondary compared to Android, especially when compared to its web business.

Applovin ranked No. 5 for gaming ads in the global power ranking, driven by success in casual and hyper-casual games.

For non-gaming, Meta ads ranked 2nd in the global power ranking for non-gaming, driven by its performance in Life & Culture where it ranked No. 2, while Google reached No. 5.

The Android remarketing ranking found Google and Meta, and TikTok For Business to some extent, dominate market share.

Google Ads, which is the No. 1 company across most remarketing rankings, came in at No. 2 to Meta Ads in the shopping. Meta ads was able to close the gap with Google in the global power ranking because of its success in shopping, where it surpassed Google to come out on top.

TikTok For Business came in at No. 3 in the global power ranking, driven by its significant scale, particularly for shopping apps. Liftoff ranked No. 4, and Adikteev and Remerge followed at No. 5 and No. 6, respectively.

(6)