The Twitter ad executive also announces three test expansions and talks about the TellApart acquisition and DoubleClick deal.

Copyright Aaron Durand (@everydaydude) for Twitter, Inc.

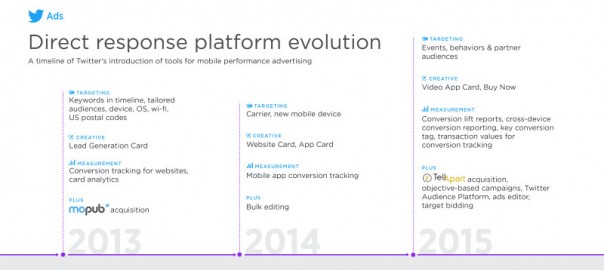

Over the past couple of years, Twitter has been investing in products for direct response advertisers to spearhead revenue growth. Twitter’s initial ad products — Promoted Tweets, promoted accounts and later, Amplify for video — primarily addressed upper-funnel efforts. In an interview with Marketing Land, Richard Alfonsi, Twitter’s vice president of global online sales, discussed the company’s work to develop products and tools that drive actions, add scale and offer deeper measurement insights. He joined Twitter three-and-a-half years ago after five years at Google.

“We are now focused on targeting and measurements tools that focus on mid- and lower-funnel goals,” explained Alfonsi by phone last week. “Twitter is a huge opportunity for direct response marketers. There are live conversations happening that pass a signal of intent that marketers can tap into,” says Alfonsi.

During our discussion, Alfonsi announced three test expansions:

- Direct response objectives — website clicks and conversion objectives — are moving into the Twitter Audience Platform in beta, giving direct response advertisers a way to measure results from the TAP audience of 700 million people beyond Twitter.

- Dynamic Ads Retargeting is starting to tap into TellApart technology. More on that acquisition below.

- Twitter’s partnership with DoubleClick to provide attribution data from tweet engagement to downstream actions will scale up in Q1.

“We’re expanding the way we think about Twitter Audience Platform and TellApart and the ways people engage with Twitter on mobile and convert on desktop,” says Alfonsi.

Launched in 2014, the Twitter Audience Platform (TAP) debuted with app-install ads and retargeting for a limited set of advertisers. In August 2015, Twitter expanded creative opportunities to include Promoted Video and Tweet Engagement ads across the Audience Platform for all managed clients. TAP’s inventory access off Twitter comes from its in-app advertising network, MoPub, acquired in 2013.

With the website clicks and conversion objective measurement beta, some self-managed advertisers will gain access to the added reach offered by the Twitter Audience Platform and transform Promoted Tweets into video, native ads, banners and interstitials on apps across MoPub. Advertisers will be able to run one campaign on inventory both on and off Twitter to drive and measure their conversion-based objectives.

TAP leverages both the TellApart and MoPub acquisitions. With relatively slow user growth on Twitter, the obvious route to giving advertisers more reach is through network opportunities. The next wave to broaden scale and reach will come from MoPub and other inventory sources that TellApart is already hooked into with exchange-based inventory, says Alfonsi.

Twitter’s TellApart acquisition and DoubleClick deal announcements came in tandem with the release of the Q1 2015 earnings report.

The DoubleClick partnership allows advertisers to measure the impact of Promoted Tweets through DoubleClick Campaign Manager (DCM). The first round of clients recently started using it, and the pilot will expand in the first quarter of 2016. The ease of buying in DBM is important, but attribution is the key driver for the deal. “DoubleClick is able to measure tweet actions and the downstream impact of those actions,” explains Alfonsi, enabling attribution across devices and platforms.

Twitter’s conversion tracking pixel launched two years ago and underwent an update earlier this year to include transaction values and the ability to isolate conversion types for tracking and reporting. The pixel is also able to track cross-device conversion activity from logged-in users. With 80 to 90 percent of Twitter activity happening on mobile, the ability to track ad engagements to conversion actions completed on desktop — where conversion rates remain higher than on mobile — is critical. It’s also table stakes these days, with Google, Facebook and others offering similar capabilities.

I asked Alfonsi how they are thinking about cross-device and mobile measurement in the near term. With mobile conversion rates steadily increasing, albeit still lower than desktop, at what point do you make mobile measurement and conversion optimization the priority over cross-device? Alfonsi answered, “Cross-device behavior is not going away any time soon, but the distinctions are going to go away. We feel like Twitter is well-positioned for this change — like the lead generation card, we’re thinking about other experiences like that.” Twitter’s lead generation cards allow users to sign up for an email subscription or other offer with one click on their smartphones.

Twitter began focusing on direct response advertising solutions in 2013.

The TellApart acquisition has stayed somewhat under the radar, but Alfonsi says the TellApart team is now quite integrated from a product engineering perspective, working side by side with the engineers working on direct response products. “You’ll see us doing more with integrated product launches,” he added. Thus the expansion of dynamic retargeting testing for retailers using TellApart.

TellApart’s predictive marketing platform offers cross-device retargeting solutions, including via dynamic ads and email marketing, so there’s an obvious opportunity.

Twitter also recently began testing conversion lift reporting to show advertisers how much their ads on platform move the needle. From the same targeting pool of users, ads are shown to one segment of the audience and held back from another. An early study of seven large performance advertisers showed a 3.2x lift in conversion rates among users who engage with Promoted Tweets, the company said. The feature is in early testing now with managed advertisers, but the vision is to make it widely available to advertisers to set up and run on their own.

“Marketers want to be able to target with real-time signals,” said Alfonsi. “We’re making sure we know how advertisers are measuring their advertising on Twitter, that they have the right tools to do so, and that they are finding success.”

Correction: A previous version of this article mistakenly stated the DoubleClick pilot expansion would allow advertisers to buy Promoted Tweets through DoubleClick Bid Manager. Instead, it is an expansion of the attribution pilot in DoubleClick Campaign Manager.

(Some images used under license from Shutterstock.com.)

Marketing Land – Internet Marketing News, Strategies & Tips

(69)

Report Post