— January 11, 2018

www_slon_pics / Pixabay

Whether you’re corporate or entrepreneurial, firing a customer can create an emotional roller coaster. More than likely, the soon-to-be ex-customer has been a source of frustration, discord, anger and financial loss. You know everyone will breathe easier, but you can still dread the showdown.

The problem customer might represent a major account, responsible for a large percent of your revenue. Or they may lash out to damage your reputation, or mount a lawsuit, or threaten physical harm your business or staff. If you are in a larger corporate structure, you may be concerned that the customer might engage your supervisor, or their supervisor, or the board of directors.

It’s time to take inventory and assess options.

Trying to Maintain the Relationship:

Option 1: Keep doing what you’re doing. Let the abusive customer have their way, try to placate them and do your best on internal damage control. If the irritation is minor and the impact on your ability to serve other customers and maintain staff morale is intact, this is certainly one course of action. But if this were the easy choice, you probably wouldn’t be reading this article. Firing a customer is stressful, but sometimes the status quo creates even greater stress.

Option 2: Talk with the customer. Identify their expectations. Assess what you can do to satisfy them, within your limits. Recognize you have more than this one customer at stake. You have your relationships with other customers who may be ignored while you fight fires with the problem account. You have staff morale, and the possibility of losing good employees, who do not have to accept abuse in the workplace. You have your own health and stress to consider. However if you can identify and address the core issues, you might be able to co-exist.

If Firing a Customer is Necessary:

Option 3: If a parting of the ways is in the cards, is there a win-win option? A competitor or near competitor might be a far better fit for your problem customer. The problem might not be them, or you, but the proverbial square peg and the round hole. This doesn’t mean pawning them off on a competitor to unload your problem onto them. But if there is an organization which by size, or corporate culture, or sweet spot is a better fit, everyone wins.

Option 4: Impact assessment and damage control. If a break is foreseen, know your exposure and risks, and act in advance to mitigate these. Set a strategy which takes risks into account. Work on the time, setting, and content of your message, to maximize the odds of a gracious parting of the ways.

- What are your legal risks? Read you contracts and agreements and engage legal counsel as necessary. Know what threats are real and which are invalid. Also know any legal risks you may not have considered.

- What are your physical risks? Are you, your staff or facilities at risk of physical harm, now or in the future? Consider basic precautions, alert law enforcement if necessary, and seek expert advice if physical action is a possibility.

- What are your financial risks? Are you positioned to write off any receivables, if that comes to pass? What is your financial exposure, what are your options, and what is the likelihood of success?

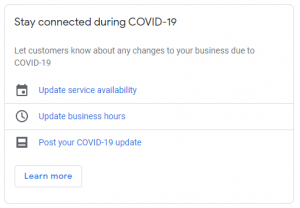

- What are your operational risks? Will the client be blasting you on social media? Are they in a position to damage your current and future relationships with other clients? Identify potential targets, and set a plan to make courtesy calls. Reassure those who might be drawn into the drama that your business is there and ready to serve them. This can also present an excellent opportunity for you to poll your other clients, and explore how you can serve them even more effectively.

- What are your career risks? If you are in a larger organization, what is the likelihood the disruptive client will escalate the issue to your supervisor, or higher? If the client ie especially vocal, visible and connected, what is the likelihood this action will impede your career? What is the impact on your reputation? As a customer becomes problematic, keep your supervisor apprised of the situation. Seek their input and advice. Don’t let them be blindsided. Work with them to strategize the message, timing and context for dissociating from the client. If the issue arises in a future career interview, have a carefully prepared response.

Future Avoidance:

Firing a customer is a learning experience. While it “goes with the territory” for business leaders, avoiding the drama, stress and disruption, when possible, is well worth the effort.

- Set realistic expectations. If you need three days to deliver certain items, customers should not expect a two hour turnaround. Sometimes sales discussions become ambiguous; strive to ensure you and your customer have the same understanding.

- Keep dialog open. The best restaurants, whether corner coffee shops or four star gourmet establishments, have staff who routinely check back to ensure their customers are satisfied. Be proactive with your customers. Touch base regularly; don’t wait for them to call you.

- Have a trial period. When possible, have a fixed time agreement, after which you will both sit down and determine if the relationship is working. A trial period enables you to address differences before they become major issues. It also provides the opportunity for either party to leave graciously, without extended explanation.

- Part company early. A customer who balks at paying bills, who questions every line item and argues every charge is not going to change. The abusive individual who “is a close personal friend of the chairman of the board,” is not likely to be happy, regardless of what you do. And a customer who is acting unethically or illegally is definitely not a good fit for an ongoing business relationship. Poor behavior tends toward the worse, not the better. Try Option 2 above, but be ready to part ways before you become deeply entangled.

Firing a customer, when necessary, is a part of business. Know your options and strategize in advance. Make the best decision and take action to address customers unsuitable for your organization. Be willing to say goodbye to the problem customer.

Business & Finance Articles on Business 2 Community

(71)

Report Post