Google Search: A Gross Margin Framework For Generative AI Modeling

Google, Microsoft and others focused on search are preparing the ad industry to make one of the biggest transitions with the introduction of generative artificial intelligence (GAI). On Thursday, Google announced the ability to create images with generative AI-powered Search experience (SGE).

What has not yet changed is search’s basic business and revenue model. It remains driven by query volume, advertising load, clickthrough rates, paid clicks and cost-per-click pricing.

The experimental Search Generative Experience (SGE) from Google provides an enhanced AI search experience to those opting in through Google Chrome.

Analysts at New Street Research have developed a framework for evaluating the impact of the Google Search Generative Experience (SGE) on search revenue and gross margins. The framework builds on previous work examining gross-margin impact, the bottom-up search revenue model, and recent AI capex work.

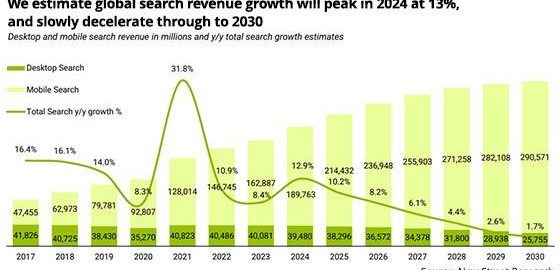

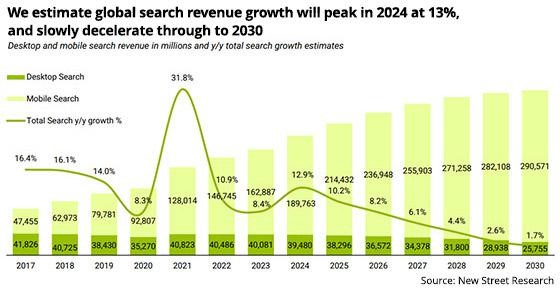

Global search revenue estimates from New Street Research forecast that the market will reach $316 billion by 2030, suggesting a compounded annual growth rate (CAGR) of 6.5% from 2023 until the end of the decade. It does not include other types of searches with vertical search — like online travel and retail media such as Amazon or Walmart.

The research firm published in a note on Thursday, estimating that search growth will be driven by continued momentum in mobile, growing at a CAGR of 8.6% from 2023-2030, and representing about 92% of total search revenue by the end of the decade. Desktop will see a decline of 6.1%.

Global search revenue today is nearly 80% mobile.

Google is the default search engine on about 99% of mobile devices, and for all platforms such as desktop, Google is the default on about 67% of all devices and computers vs. 28% for Windows, which has Edge/Bing as the default browser and search engine.

This is one of the contentions in the Department of Justice (DOJ) versus the Google trial currently underway.

One of the most important pieces of data in the research report pertains to the 2023 estimates. The analyst firm estimates search queries will increase 5.1% and CTR and ad load will remain relatively constant, leading to about 8% paid-click growth.

“We expect the declines in CPC in 1H23 will begin to ease in 2H23 and CPCs will decline -2.3% in 2023, yielding 5.5% search revenue growth,” according to the report.

The research group of analysts summarized the model. Changes to the click-through rate will likely become the biggest driver of search revenue despite investor focus on potential query share loss to Microsoft and or the ongoing DOJ vs. Google Search lawsuit, and the outlook for default settings, writes New Street Research.

New Street Analyst Matt Perault, who focuses on policy, cites “significant uncertainty in AI regulations, regulatory limits on self-preferencing, and remedies in the Justice Department’s case against Google as the top three regulatory actions that could impact search.

Excluding revenue share and payments to search partners like Apple, New Street analyst estimate the operational cost of “SGE to be about ~50% higher than traditional search, with depreciation of Gen AI infrastructure representing ~85% of the increase,” the research firm wrote in a note.

(17)

Report Post