Housing market outlook for 2025: 8 early predictions for home prices

Here’s the first round-up of where housing analysts are expecting national home prices to go next year.

Want more stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, daily ResiClub newsletter.

As we head into mid-July, the 2024 U.S. housing market has already begun shifting out of the seasonal window when there’s usually the most upward pressure on home prices and started moving into the softer seasonal window.

Even if there are some month-over-month declines in the second half of 2024—driven by softening markets around the Gulf—most housing analysts still expect national home prices to finish 2024 with positive growth. This would mark the 13th consecutive year of positive national home price appreciation.

But what about 2025?

Some housing market experts are already making their predictions, and ResiClub has put together a round-up of the full-year 2025 home price forecasts.

The finding? The average forecast tracked by ResiClub expects U.S. home prices to rise 2.5% in 2025.

Among forecasters ResiClub tracks, Goldman Sachs (+4.4% for 2025) is the most bullish, while Moody’s (+0.3% for 2025) is the most bearish.

Looking out beyond 2025, Goldman Sachs believes that national home price growth, as measured by the Case-Shiller National Home Price Index, will remain close to its historical annual average of +4.5% between 1988 and 2023. While Moody’s expects national home prices to experience a period of sideways movement.

The pandemic housing boom and following mortgage rate shock have stretched affordability relative to incomes. Moody’s thinks unhealthy affordability will constrain near term home price growth. Goldman Sachs believes that the lack of supply will outweigh affordability concerns.

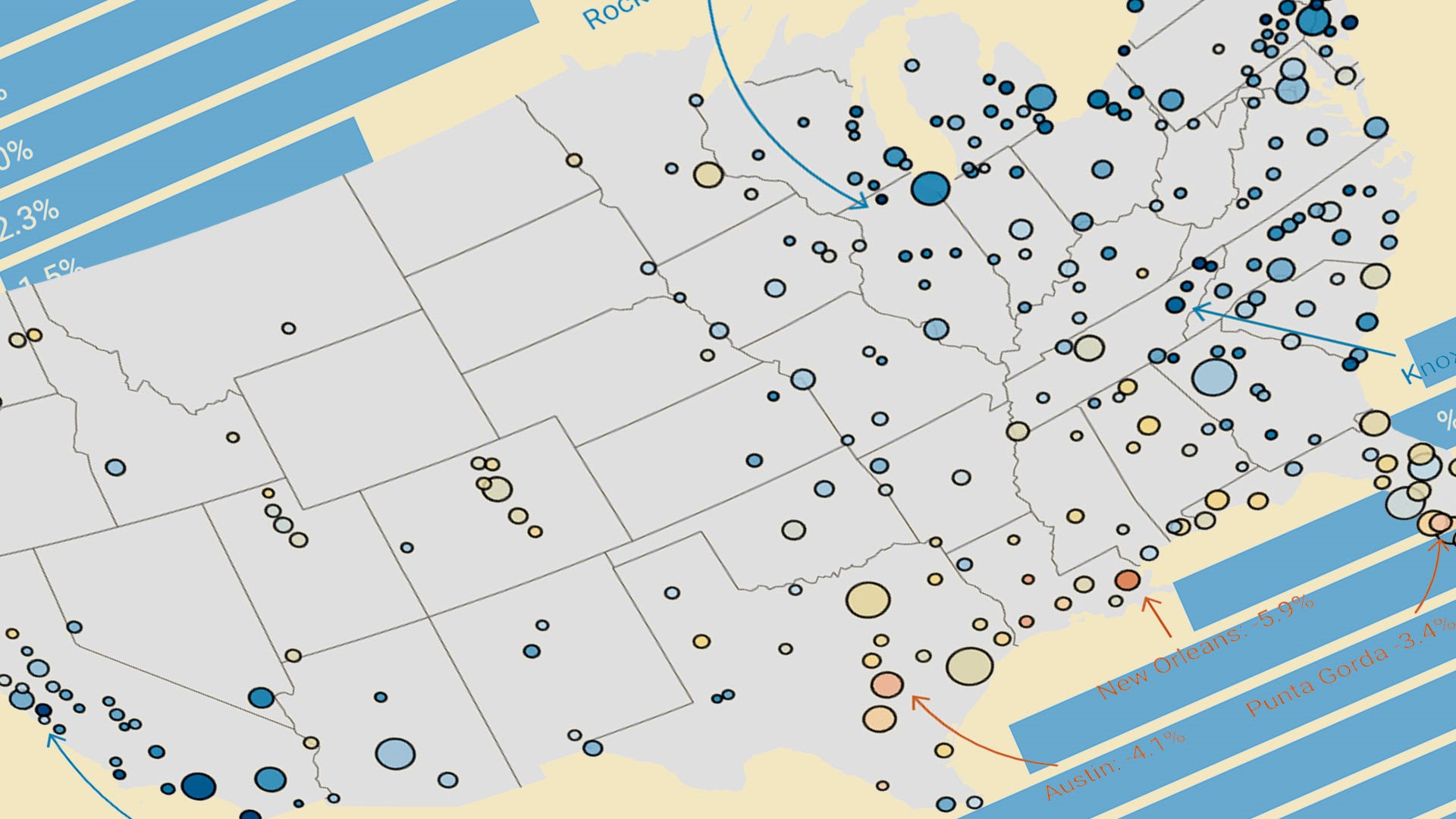

Even if the average national home price forecast for 2025 is correct, it’s possible that some regional housing markets could see mild home price declines, while some markets could still see elevated appreciation. That has been, after all, the case this year.

The key metrics to watch, in ResiClub‘s view, is the labor market and active inventory/months of supply (which currently suggest softening in parts of the Gulf, including Florida’s condo market).

Click here to view an interactive version of the year-over-year home price change map below.

A few notes about the forecasts: First, this round-up only includes forecasts publicly issued by these firms, or forecasts directly provided to ResiClub. Of course, there are other forecasts out there, that aren’t shared publicly, and thus not included in the round-up. (For instance, John Burns Research and Consulting has forecasts it shares with just its own clients).

Second, while all of these forecasts are for national home prices, the indexes can vary. Goldman Sachs, for example, forecasts for the Case-Shiller National Home Price Index, while Freddie Mac forecasts for the Freddie Mac House Price Index, and Moody’s forecast for its repeat sales index.

Thirdly, to maintain an apples-to-apples comparison, forecasters who predicted only within a 12-month window that did not align with calendar year 2025 were excluded from the roundup. For example, CoreLogic’s forecast published last month expects U.S. home prices to rise 3.4% between April 2024 and April 2025, while Zillow’s forecast published in June expects U.S. home prices to fall 1.2% between May 2024 May 2025. To keep an apples-to-apples comparison, CoreLogic and Zillow were excluded from the round-up.

ABOUT THE AUTHOR

Fast Company

(11)

Report Post