Despite common sci-fi movie tropes to the contrary, the relationship between robots and humans has proven wildly beneficial. Plenty of industries have received productivity and efficiency boosts thanks to automation in various forms. This includes the finance industry.

Indeed, lending and investment entities are beginning to embrace automation at scale. After all, plenty of in-office functions can be replicated and performed by software instead of people. Moreover, as the World Economic Forum pointed out in a 2019 article, 43% of finance organizations’ regular duties were ripe for automation. Consequently, automated workflows could reinvent the ways that businesses and individuals interact with their financial partners.

How can you take advantage of how automation is impacting finance?

Though not all banks and lenders in the finance industry have fully taken advantage of automation, many have made at least modest leaps, such as offering digital wallets. As a result, those early adopters–and their clients–have enjoyed several key benefits that routine use of automation brings to finance.

1. Improve professionalism and communication.

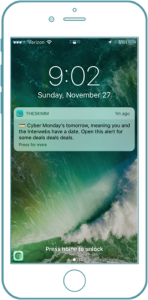

The financial industry remains highly competitive. One way for companies to stand out is through consistent messaging and communication. However, consistency can be tough to master across platforms and departments. This leaves financial institutions at risk of losing their edge in the industry due to incongruent public interactions.

Automation can solve this issue by ensuring that most communique follows an expected format and adhere to guidelines. At the same time, some messages can be personalized as needed. As noted by Mortgage Automator, loan origination, and servicing software for private lenders, customization doesn’t have to disappear because of automation. Documents can be perfect and even include auto-populated information, all while taking hardly any time at all to create.

Without fastidious communication efforts, financial organizations risk losing their ability to differentiate in a crowded field. Using automation, you’ll be able to promote communication and professionalism to make it easier to stake out a claim and get noticed.

2. Offer consumers and investors more choices.

Traditionally, consumers checked in with their local lenders when they needed lines of credit or mortgages. Similarly, businesses seeking corporate lending options went to their community branches to speak with loan officers. Now, geographic barriers to lending have been brought down due to an increase in automation.

Take the example of a bank that advertises low mortgage rates on the Internet. As long as the bank can accept approval requests from places outside its headquarters jurisdiction, it can expand its reach. At the same time, potential borrowers have more choices and can weigh the value of working with a lender that’s not down the street.

From the lender’s standpoint, accepting and evaluating borrower information through secure portals can improve marketing and sales conversion rates. Plus, the software can weed out high-risk borrowers. This frees up the lender to spend less time prospecting and more time converting.

3. Reduce human errors.

Humans make mistakes. That’s part of being human. Nevertheless, it can cost businesses a bundle, as Bloomberg reporting shows. For example, Bloomberg cites the case of a $ 900 million Citibank hiccup allegedly linked to an innocent human error. The costly mishap had ended in widespread legal ramifications, not to mention many questions about how such a financial blunder could have happened in the first place.

Automation can’t take away all the corporate gaffes that can befall a financial institution. Still, well-programmed automated procedures have less of a chance of failure. This is because machines don’t get fatigued and don’t forget steps. Instead, they tend to follow a course of events logically and predictably.

Will workers at banks or brokerages still commit the occasional faux pas? Absolutely. But reducing those incidents to a bare minimum saves financial organizations untold money, morale, and credibility.

4. Encourage trust among younger generation customers.

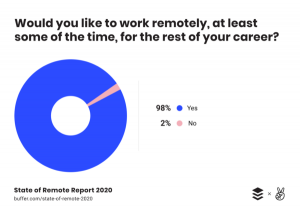

A 2021 media release from research firm Gartner encourages all companies to adopt financial automation. Why? Generation Z has grown up with digital technologies. As the next generational cohort to move into adulthood, Gen Z’s needs will doubtlessly fuel changes in companies. This includes a move to automated choices whenever possible.

Financial institutions that wait to initiate automation or experiment with automated software may put themselves in jeopardy. Generation Z doesn’t shy away from using mobile platforms, apps, and other digital interfaces for financing. Quite the opposite. Research from CNBC in 2021 explains that 99% of Gen Z and 98% of their Millennial counterparts already use apps for personal banking.

It only makes sense that they’ll want the same opportunity and convenience from corporate lenders as workers. So whether they want to open a corporate credit line or business checking account, they’ll lean toward the automated, advanced banking they’re accustomed to using personally.

5. Increase diversity among finance industry workers.

The topic of diversity in the finance industry has hit a fever pitch. However, when Accenture dug into the topic in 2020, the company found that organizations with diverse workforces performed better. At the same time, those organizations were more likely to appeal to modern consumers, 10% of whom already had shifted money away from financial institutions they felt lacked diversity and inclusion.

Where does automation come into the DEI picture for banks, credit unions, brokerages, and other institutions in the finance industry? The answer is through the institution’s sourcing, recruitment, and hiring efforts. For example, automated job application and interviewing processes can be programmed to remove as much bias as possible. By taking bias out of hiring, talented people from various backgrounds and experiences can come into the financial fold.

As the workforce begins to reflect and mirror the greater society, financial institutions that do likewise will naturally appeal to a wider swath of people and companies. As an added benefit, they’ll tend to attract new target audiences.

6. Provide modern, lightning-fast customer service.

The time for 24/7 service in the finance industry has come. Today, consumers and business people expect to apply for an unsecured or secured small business loan, check their balances, and even deposit checks anytime. The more choices they have, the quicker they can complete transactions and achieve their personal, professional, or entrepreneurial goals.

Take AI-enhanced chatbots, for instance. Chatbots can help customers self-serve by pointing them toward everything from a FAQs page to a YouTube video. From an automation perspective, chatbots take away mundane tasks from service agents during normal operating hours. This allows financial agents and lenders, and brokers to work with clients who have higher-level needs.

The best chatbots don’t act like robots, either. On the contrary, many chatbots have become so sophisticated that they mimic the cadence of natural, conversational human language, right down to pauses between words and “thoughts.” At the end of the day, clients are happy to self-serve with the assistance of chatbots. And financial employees can offer support for more complex customer cases or problems.

7. Shorten approval cycles and other common lending gaps.

Depending upon the type of loan and lender, Credible estimates some loans can take more than a week to move from application to approval or denial. However, most customers want the approval process to happen much quicker, whether they’re looking for a personal line of credit or a small business commercial loan.

The right type of automated lending software can speed up the lending approval journey considerably. Even if the software can’t give a definitive “yes” or “no” on the spot, it can parse the information to provide to a loan officer or other financial agent. The officer or agent can then use the data to make a final approval determination within hours of receiving the paperwork, rather than days.

Being the first bank or lender to approve a loan, matters. Consumers and business owners want to move through the financial process as quickly as they can. Consequently, they’re likely more apt to go with the first place that approves them, especially if they receive an attractive interest rate. Automation can pull in more applications and turn around inquiries without delays, which are serious friction points.

8. Stop fraud before it starts.

Make no mistake: Fraudsters are getting smarter. The New York Times investigators noted that reports of “scams” and “fraud” quadrupled across many online financial app reviews during the pandemic. And Due.com research acknowledges that cybercrime attacks have risen 300% since the start of Covid.

Fraud isn’t just annoying for consumers and companies, either. It’s costly, frightening, and embarrassing. It can even cause people, families, and businesses months or years of fiscal instability. Fortunately, smart machines can often interrupt them.

For this reason, many lenders are using AI predictive software to attempt to tamp down on fraudulent activities such as identity theft or data breaches. Per a Forbes piece from 2019, some predictive software has proven 200% more reliable than human-based fraud prevention solutions alone.

Financial entities that protect their customers against fraud may want to make their positioning clear by talking openly about the automated measures they’ve put into place to protect clients’ funds–and encourage an increase in transactions.

Organizations across the financial industry are continuing to explore and adopt the many financial automation solutions available. As they do, they’ll not only increase their ability to disrupt, but they’ll open the door for customers to experience better engagement, products, and support.

Business & Finance Articles on Business 2 Community

(131)

Report Post