By David Landsel

Picture it—you on the perfect beach, soaking up the sun, far from home, and without a care in the world. Maybe you’re staying in a stylish Airbnb just steps away, maybe you even splurged and flew here in business class, and you’ll do the same thing when it’s time to go home. That is if you ever leave, and why would you? After all, you didn’t pay a cent for the trip. Not yet, anyhow.

Frequent online shoppers—which is all of us these days, it seems—will most likely have a passing familiarity with the growing number of ways to pay the tab, or not pay, at least not for the time being; third-party services such as Klarna, Afterpay, Affirm, and Uplift are all battling for the opportunity to float you a small (or sometimes, not so small) personal loan to purchase everything from that back-to-office outfit to the bedroom set of your dreams,

After years of kicking the tires, and fresh on the heels of the largest sustained setback the travel industry has ever faced, Buy Now, Pay Later as it’s commonly known, wants to change the way you book your next trip. Suddenly, it seems as if every major provider, particularly third-party booking engines like Priceline and Expedia, is happy to give travelers the option to pay in sometimes minuscule installments. Some—PayPal Credit, for example, now an option for any Airbnb bookings—give you a generous promotional financing period that could end up allowing you to take your entire trip without opening your wallet even once, all without paying a cent’s worth of interest.

Booking travel has never been easier, or more flexible—no need to even check your balances before planning and executing your trip, no need to worry about cash flow, or spending your last cent before next payday on a taxi to the airport.

Of course, as long as Americans have been traveling commercially, there have been workarounds for those looking to avoid pay their tab up front—package tours, cruises, and the like have all been traditionally secured with a down payment, with a balance due before your travel date. Buy Now, Pay Later can ease that pressure in a way that’s almost unprecedented. Apply for the loan at checkout, receive your answer in seconds—all without harming your credit; some automatically structure the repayments for you, others offer an almost too-good-to-be-true kind of flexibility.

Welcome to the future—it’s how we travel now. But for how long?

“We are a credit thirsty society, we love the ability to use other people’s money, and then pay them back—even if it will cost more later,” says Henry Harteveldt, principal at Bay Area-based Atmosphere Research, which polled recent travelers on the subject, just over four in 10 said that the ability to use Buy Now, Pay Later made it possible for them to take the trip.

That’s a “small, but meaningful number,” says Harteveldt, and a number that’s likely to grow, as inflation and demand drive airfares, rental cars, and in many cases hotel stays ever higher; in March, a study conducted by Qualtrics for Credit Karma showed that almost 60 percent of consumers were more likely to use Buy Now, Pay Later because of inflation; nearly half of those surveyed considered it a good option in times of tight finances.

“The travel industry is always in favor, or receptive to a payment method that gets more people to click on the buy button, which doesn’t really affect their cost of sale, or their margin, or may even lead people to spending more, for example, if this means that someone might pay slightly more for an airfare, or add on a few optional products, or add a day to a hotel stay, or upgrade their accommodation—this helps the seller improve its business, they’re going to be all for it,” says Harteveldt. “They know the security around the transaction is acceptable; some of these companies have been doing business for more than three or four years, so at this point, it’s proven.”

“There’s no risk to the airlines, the third-party services are the ones taking on all the risk,” says Brett Snyder, founder of Cranky Flier, a popular industry blog. “It certainly has the ability to open up more travel opportunity for those who don’t have the cash to pay outright for travel. This is particularly good news for low cost operators who tend to appeal more to those on a tighter budget.”

How long will the party last? The Qualtrics / Credit Karma survey revealed that more than 60 percent of Americans had used Buy Now, Pay Later, and that they were using it more and more; of that number, 20 percent confessed to missing at least one payment, and 33 percent of those struggling to keep up had seen their credit scores decline. And while some require repayment from a bank account or a debit card, others accept credit cards, digging consumers into an ever deeper debt-hole.

“Every single time I go to book a plane ticket now, I’m being offered Buy Now, Pay Later,” says Clark Howard, consumer expert, host of the Clark Howard Podcast, and an outspoken skeptic of the shift in travel booking habits—a shift he notes is exceptionally popular with younger travelers. “The reason it does so well, the reason more than half of Americans have used it, is that it gives you the perception that you can afford it. It’s the perfect example of consumer psychology. People want the green light to spend money, when they know they shouldn’t.”

And if travelers are getting in over the head now, wait until things tighten up—there’s the almost-sure bet that the free-for-all situation won’t last—think the early days of Uber, when you could cross Los Angeles for $6, versus what you pay now.

“It’s that land grab—get the customers,” says Cranky Flyer’s Snyder.

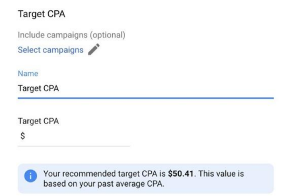

“One of the things I’m going to be watching is that as interest rates increase—if they start to shoot up, how much will the Buy Now, Pay Later organizations absorb, and how much will be passed along to the consumer, and how many people will just explore other methods,” Harteveldt says. In the meantime, staying on top of every loan you take out, however small, is key; in addition, make sure to read all of the fine print before agreeing to the transaction. “What’s very important for someone to understand the true cost of using that payment method—do they understand how many payments they are obligated to make, and what the total price will be?”

Not that urging caution is likely to stop many travelers in their tracks—not this summer, at least.

“After two years of having their lives restricted, everyone wants to do everything, all at once—I’m in airports all the time now, the lines are crazy. There’s pent-up demand, and they don’t want to be told no,” says Howard.

(26)

Report Post