How is Your Credit Score Calculated?

When applying for credit, your credit score is one of the most important factors that will help determine if you can qualify for credit and what kind of interest rate and terms you will be offered.

If you have an excellent credit score, then you are more likely to easily get approved for credit products at great low rates. If your credit score is low then you will likely find it more difficult to qualify for credit products, and if you are able to qualify you will likely be forced to pay higher interest rates and costly fees.

How long does it take to improve your credit score?

There are a variety of factors that determine how long it might take to see a significant improvement in your credit score. Depending on how poor your score is to begin with would have a powerful effect on the time it takes to see improvements that are significant enough to help you qualify for top of the line credit products at low rates. Even so, having a strong and achievable strategy can result in significant improvements to your credit score in as little a 30 to 60 days. By taking the right steps, you can see your score increase by 100 to 200 points in no time at all.

What is a good credit score?

Credit scores are made up of a 3 digit number that ranges differently from the United States and Canada. In the United States,and your credit score will range from 300 to 850, and from 300 to 900 in Canada. Equifax and TransUnion are the two main credit bureaus that calculate your credit score using a variety of factors. The majority of banks and lenders rely on the information provided by these two companies in your credit report to assess your creditworthiness. Your credit score helps lenders understand how risky of a borrower you might be and how likely you are to either make your debt payments on time, miss payments, or completely default on your debts.

In the United States 620 and above is considered to be a good credit score, whereas in Canada, most lenders consider a good credit score is considered to be a score of 650 or higher.

What is a bad credit score?

For those who may have experienced some financial difficulties or made credit mistakes in the past, they may have a low credit score as a result. Most Canadian lenders would consider a score of 599 or lower as a poor or bad credit score.

A bad or poor credit score can negatively affect your chance of getting approved for loans or mortgages through banks and other more conventional lending institutions. This doesn’t mean that you can’t qualify for credit, it just means that you might be more limited with your options and be forced to pay higher interest rates. Even with bad credit, you might still be able to qualify for prepaid credit cards, or a mortgage loan through an alternative lending institution such as a trust company. If your credit is really bad, then you can qualify for things like a mortgage or home refinance loan through a private mortgage lender. Here is some helpful information on how you can qualify for a private mortgage.

How is your credit score calculated?

Factors that impact your credit score

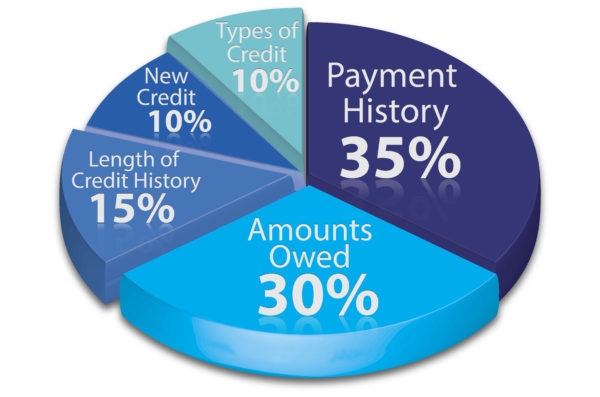

In order for you to be able to improve your credit score, you need to be able to understand how credit bureaus calculate your credit score:

-

Payment and Repayment History and Habits:

The habits you display through your payment history is one of the most influential factors that affect your credit score. About 35% of your credit score is based on your payment history and habits.

-

Utilization Ratio:

The utilization ratio takes into account how high of a debt balance you carry in comparison of your individual and overall credit limits. Your utilization ratios makes up approximately 30% of your credit score

-

Credit History Length of Time:

The length of time that you have been using credit makes up roughly 15% of your credit score.

-

New Credit History:

New accounts, recent credit applications, and new credit bureau inquiries makes up roughly 10% of your credit score.

-

Types of Credit You Have:

The various credit accounts that you might have accounts for approximately the remaining 10% of your credit score.

Here is a simplified breakdown of how most lenders in rate a borrower’s credit score:

United States:

- 800 – 850: Excellent

- 740 – 799: Very Good

- 670 – 739: Good

- 580 – 669: Fair

- 300 – 579: Poor or Bad

Canada:

- 800 – 900: Excellent

- 720 – 799: Very Good

- 650 – 719: Good

- 600 – 649: Fair

- 300 – 599: Poor or Bad

By understanding how your credit score is calculated, you can start to develop a realistic and effective plan to help improve your credit score and maintain it on an ongoing basis. With a good, very good, or excellent credit score, you will be able to qualify for better credit and loan products at great low rates.

Business & Finance Articles on Business 2 Community

(92)

Report Post