rawpixel / Pixabay

Local businesses have been financing their regulars for centuries. Literally. And as long as the communities were small, SMEs weren’t thinking about automation, collection agencies, and credit scores. At best, they had a paper ledger with the amounts they’re owed. And the client would come back and pay them or transfer installments.

Business knew that the client is going to come back to that same store time and time again. So in-house financing was based on people relations, trust, and the existence of closed communities “where everybody knows your name”.

The age we’re lucky enough to live in is virtually borderless and offers immense freedom. In terms of the products and services we have access to, vendors, manufacturers, and partners we work with and even countries we live in. Such freedom can be tempting to some people and the sense of responsibility took a hit compared to the simpler times. And even though in-house financing is an amazing tool both for the SME and the customer, for a while there was no good way to make sure you’re not dealing with a scammer who isn’t going to pay you back for the goods or services you provide.

That’s why the POS financing trend was stale, compared to eCommerce, waiting for FinTech to catch up and provide business with easy-to-use, intelligent solutions to automatically issue, service, and collect credit safely. And FinTech did catch up and turn the entire internet into a global community where SMEs run minimal risks financing their clients and the borrowers can enjoy smooth interfaces and intuitive business flows when applying for an in-house financing program.

Why in-house financing has reemerged in recent years

To this day, there’s a conception that launching a lending program is too complex a matter to easily automate. And partly that’s true. It’s no WordPress website. But with the development of financial technology, the digital lending entry barrier got lower and the solutions competing among themselves become more accessible by the day.

Running an in-house financing program used to be associated with an enormous amount of risk of non-return. There were simply no mechanisms to control, charge, and find the borrowers if they chose not to pay. In addition, lending would require too many additional resources: origination, underwriting, servicing, the collection – this work’s got to be done by someone. To make it self-sustainable, one had to charge higher rates which led to fewer conversions and kind of devaluated the whole point for the business.

But that’s changed. The way it works now, given that the business has chosen the right lending automation provider, is:

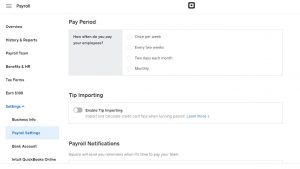

- The user fills out a simple application form online

- It gets processed by the decision engine of the solution and assigned a risk score

- The business owner decides whether they’d like to finance this user

- The borrowers get their product and then get automatically charged every month or two weeks until their debt is paid in full

- The data about the loan is stored and presented in the analytics and reporting tools and later archived.

Basically, the only human involvement lenders usually choose to keep is at the stage of loan approval. But even that isn’t a must once you trust the risk assessment algorithms enough.

With that in mind, it becomes clear why in-house financing is living through a renaissance right now. In the market where large enterprises are pushing SMEs out of business, POS finance isn’t a whim but a must-have monetization and retention tool.

The good thing is that one doesn’t need to create this kind of automation from scratch anymore. This post shows several tools to automate day to day lending operations. In the past, only huge companies could afford to develop, launch, and maintain this kind of software. And if you ever used a website of a large company, you may know that often they aren’t able to deliver good quality and intuitive user experience.

Providers of FinTech solutions are analyzing the market carefully and create the software that addresses the exact needs SMEs have. Small to mid-size enterprises are a big focus for the cause of how big of a market they are and since in-house financing really does present business with a huge new monetization space.

Chances are, your business has very similar processes to thousands of other ventures in your niche. And when it comes to POS financing, there are ready-made solutions that can be deployed and fully integrated and operational within days. But in order for financing to work smoothly, the system has to be flexible enough to adjust to the small peculiarities of your business.

How to choose a lending automation solution for in-house financing

There’s plenty of choices when you start looking for a lending automation solution. Everyone claims to be able to solve every problem. But unfortunately, often that’s just marketing fluff that has very little substance underneath.

The things to take into account when looking for the optimal financing automation software provider are:

- Intelligent decision making – there’s no point in implementing an automation system if the credit decisions aren’t going to be smart. The algorithms have to look deep into your users and help you make the right decision 99% of the time.

- Automation of the entire lending process should be done from one platform to avoid compatibility issues (decision making, risk evaluation, origination, underwriting, servicing, collection, reporting, archiving).

- Customer support should be trained and accessible at any time of day and night because the money is at stake.

- There should be successful customer use cases similar to your business so that you could check the way it works.

- The provider should grant you at least a few demos showing how the system will work

- Make sure the provider will help your staff with onboarding and training so that you used the system to its full potential.

- The system should integrate with all the necessary third-party products and data sources

- Quite obviously, you should be able to get the value for your money.

- The provider should have a well-established brand with customer testimonials and high ratings.

- Hopefully, your business booms even more once the financing are in place. So the system should be flexible and scalable enough to support your growth.

Final thoughts

In-house financing, be it B2C or P2P, helps you differentiate from the competition, retain your existing customers, convert more of the new clients, and at the same time make more money. Right now is the time in the history of FinTech when the market hasn’t yet adjusted to the new technological advancements in full but the software is already there and is able to put in-house financing on cruise control.

To sum up, in-house financing is making a grand return into the retail and SME spheres. And even though changing your business isn’t easy but that’s a necessary part of the evolutionary and market processes going on all around us.

Business & Finance Articles on Business 2 Community

(51)