Today, there are more than 2.32 billion smartphone owners around the world.

These devices aren’t just for browsing social media, texting, and making calls. They take owners beyond mere communication and act as resources for consumers who are finding and researching products – and in more and more instances, making purchases.

Mobile Commerce to Take Over as Primary Checkout Point

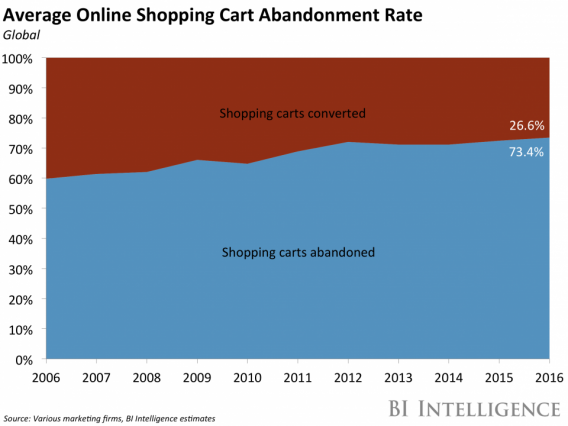

While the BI Intelligence Report indicates that mobile still only accounts for a relatively small portion of total present day retail sales, data from Statista projects that mobile commerce soon will represent the lion’s share of traffic and transactions online.

At the continued rate of growth, we can expect mobile to account for nearly 50% of all online sales by as soon as 2020.

However, there’s a big problem when it comes to mobile for many retailers: conversion rates are are lagging.

Mobile Conversion Rates Lag Behind, Though

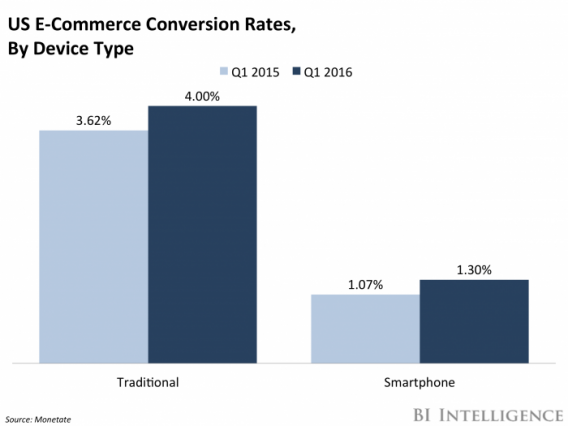

According to Monetate, the average U.S. conversion rate sits around 4% on desktop, but drops to a mere 1.3% on smartphones.

And while smartphones represented 46% of global ecommerce traffic in Q2 2016, Criteo data shows that only 27% of that traffic converted, which indicates there’s a major mobile optimization problem.

What’s the problem?

Sources like Business Insider suggest that friction within the checkout process is a major pain point for many mobile shoppers, and that it’s one of the leading sources of mobile cart abandonment.

Sources of Friction Within Mobile Ecommerce

Ever tried to complete a checkout process on your smartphone? It can be infuriating.

From start to finish, some mobile commerce checkout processes can include upwards of 10 steps as a user attempts to enter shipping and billing information – all on a small mobile screen. In the example below, you can see how even with a mobile responsive site, the checkout process can be aggravating and time-consuming.

Richard Lazazzera, founder of A Better Lemonade Stand, told BigCommerce:

Typing in address and credit card info is an awful experience on desktop, never mind mobile devices. Add to that the fact that many people are on the go while using their mobile device and it’s not hard to understand why mobile conversions remain so low.

And frustrating checkouts aren’t the only reason shoppers hesitate to complete a mobile purchase. Other points of friction within existing mobile ecommerce checkout processes include:

- Unoptimized mobile websites (more than 40% of small businesses still don’t have mobile-friendly websites).

-

When not connected to WiFi, cellular data connections can produce slow load speeds (slow load speeds paired with short attention spans = low conversion rates).

- Complex site navigations/menus don’t translate well on mobile (poor UX).

- Manual data entry within form fields isn’t intuitive (e.g. not automatically prompting the number pad display for entering zip code).

- Smartphone screens are still too small (average phone screen size is 4.7 inches).

There are many, many reasons customers aren’t following through and converting when it comes to retail purchases on mobile devices. And a lot of it has to do with the mobile experience during that final stage (when they’re trying to make a purchase).

Plus, many consumers use mobile browsing to research items and compare costs, then buy on desktop. For many retailers, though, this isn’t enough. There is too much opportunity to lose a customer between the mobile to desktop shift.

So how are retailers addressing this problem?

Digital wallets are part of that equation.

What are digital wallets?

Digital wallets are technology that allow for a one-click or expedited mobile checkout by saving consumer credit card information on a device (as with Apple Pay) or through a platform (as with Amazon Pay and PayPal One Touch).

Examples of digital wallets include:

- Amazon Pay

- Android Pay

- Apple Pay

-

BitCoin Wallet

- Google Wallet

- MasterPass

-

PayPal One Touch

-

Samsung Pay

- Visa Checkout

Digital Wallets: Improving Mobile Conversions

Knowing that time, data entry, and screen size are all major points of friction within the mobile conversion process, it makes sense to look for a resource that can simplify (and speed up) the mobile checkout process.

Enter digital wallets.

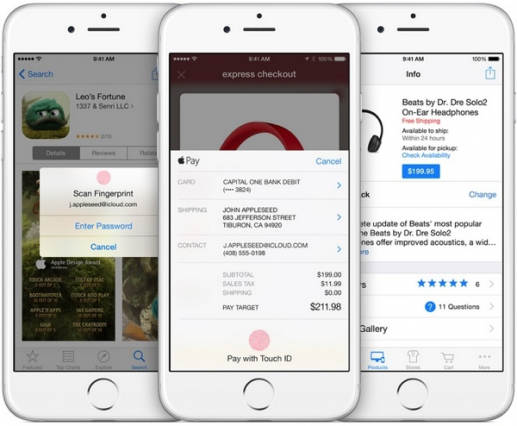

Digital wallets are making it much easier and faster to shop by taking a mobile-first approach to checkout UX. Apple, for example, incorporates touch ID with Apple Pay, making purchasing as convenient as holding a button.

This is just one appeal of digital wallets, one-click purchasing becomes the norm rather than the exception. What used to be a frustrating, time-consuming process can now be quickly executed by the shopper… and all without sacrificing information security.

And secure they are. ISACA, an organization that defines and encourages the adoption of online information security best practices, recently reported that mobile payments are the safest of all payment forms.

The reason?

Each mobile transaction is given a unique transaction number, meaning retailers don’t have access to card numbers. Account information isn’t stored on user phones, either. Any information saved on the phone is encrypted and can only be accessed via password or, on newer devices, by fingerprint.

As consumers become more comfortable with digital wallets and realize the convenience and security they can assure, more and more are taking advantage of these resources.

Increased Use of Digital Wallets

Today, ecommerce platforms like BigCommerce are seeing as much as 18% of platform gross business revenue processed through digital wallets. Digital wallet tools from large companies like Apple, Amazon, Android, Samsung and PayPal are seeing their user bases grow, too.

Apple’s CEO Tim Cook recently announced that Apple Pay has tripled its user base since the beginning of 2016 and that transaction volumes are up 500%, while Amazon shared that more than 33 million consumers have used Amazon Pay to make a purchase.

PayPal boasts a staggering 197 million users, with 40 million taking advantage of the company’s one-touch payment system.

And one-touch payment systems are especially interesting for the mobile ecommerce equation. Because they simplify multiple checkout steps into the single press of a button, they’re an excellent tool for conversion optimization.

Take PayPal’s one-touch integration, for example. When retailers leverage the PayPal digital wallet, all a customer needs to do to complete a checkout process from a mobile device is verify the purchase with his or her fingerprint. From here, a quick, frictionless payment is made.

No form filling required.

Similar tools with fingerprint checkout capabilities, like Google Wallet (now known as Android Pay), have also been proven to boost conversions within the mobile ecommerce environment.

Using this particular digital wallet, NewEgg saw a 2x increase in mobile conversions and Priceline.com saw a 71% higher conversion rate amongst its Google Wallet users. What’s more: one-fourth of all TabbedOut’s transactions came through this mobile payment channel.

And these aren’t the only ecommerce retailers seeing digital wallets improve mobile conversions.

Fanatics, a retailer of officially licensed sports merchandise, found that by introducing Google Wallet as a payment method, they were able to optimize their checkout process down to two steps.

They improved the mobile UX with this integration, too, which is validated and evidenced through positive customer reviews that specifically mention the ease of use associated with a Google Wallet checkout.

In another instance, NatoMounts, a company offering a smartphone docking product, has also seen digital wallets produce impressive outcomes.

Upon discovering that more than 90% of traffic to their site came from mobile devices, they introduced digital wallet payment methods to make it easier for mobile visitors to convert.

Brandon Chatham, owner of NatoMounts, told BigCommerce:

Having my audience come from a mobile platform, and wanting to encourage that impulse buy, I needed to implement systems that would allow them to act on that impulse buy. I wanted people to just be able to checkout in, literally, seconds.

We were able to achieve that by integrating digital wallet systems (Amazon Pay and PayPal) that accept quick-pay elements. In the first week, we had someone land on the site (a new customer) and hit the finish order page in less than 43 seconds.

That’s right. A new mobile visitor converted in just 43 seconds.

With the help of these quick payment tools, online retailers are finding that they can convert mobile shoppers at extremely fast speeds, and can better accommodate shoppers who visit their stores in a ‘ready to buy’ mindset.

Showing Mobile Shoppers What They Need

By catering to customers’ desires for a simpler, faster, less difficult checkout process from devices like smartphones, retailers are taking a step in the right direction for mobile CRO.

Research echoes this sentiment:

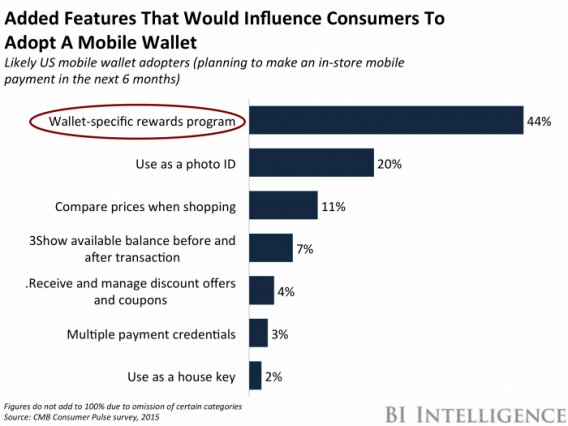

- 44% of consumers would adopt a digital wallet with a rewards program incentive.

-

67% of respondents under the age of 50 are interested in a totally mobile path to purchase, according to Merkle data.

- On-the-go shoppers want faster, better mobile checkouts: 42% of on-the-go smartphone users expect to make a purchase within the hour.

But even in the face of this data, the question many mobile retailers are asking is: if we incorporate digital wallets, will customers actually use them?

Widespread use of digital wallets is a work in progress. Have they become widely used and accepted by the masses? Not quite.

However, they do present an opportunity to cater to those who fall into the ‘innovators’ and ‘early adopters’ categories within the technology adoption life cycle. Plus, being a leader in improved mobile UX can help you gain a competitive edge.

And the companies offering digital wallet tools are also helping lead digital wallet adoption efforts by leveraging promotional opportunities for retailers as well as customer rewards for repeated use.

VentureBeat reported that digital wallet Samsung Pay recently released a new user interface that allows merchants to promote deals based on location, as well as gamification elements for users (like coupons and savings) in exchange for social sharing and number of transactions within the digital wallet.

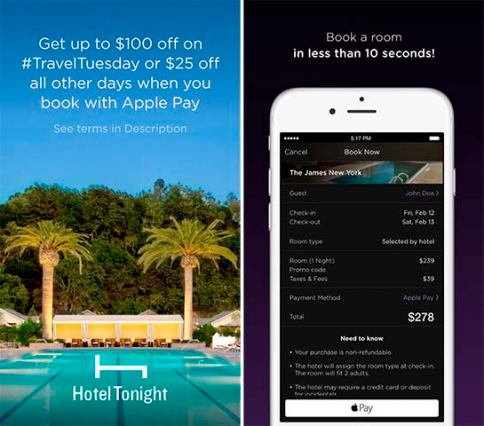

Other brands are offering discounts for payment with digital wallets via their own promotional efforts, which aim to increase use of these mobile-friendly assets and demonstrate the improved user experience.

In one instance, Hotel Tonight offered mobile bookers coupon codes of $ 20-100 off hotel reservations made using Apple Pay with Touch ID.

So while only a portion of your target audience may currently use digital wallets, integrating these resources can be part of your larger mobile CRO strategy… and it’s a way to better capture your increasing number of mobile leads.

Choosing a Digital Wallet Integration for Mobile CRO

The next question, then, is: how do you decide which digital wallet to integrate with your mobile website?

Selecting a digital wallet to integrate with your mobile ecommerce efforts will depend on a few different factors, such as:

1. Most common mobile devices your customers use. If a large portion of your mobile traffic comes from iOS, a digital wallet integration for Apple Pay might be a good option.

2. Customer survey data. Gathering feedback from your shoppers about which digital wallet tools they own/use/want allows you to go to the source for this information. Data from Statista shows that PayPal is the most widely-used digital wallet as of December 2016, but your unique audience may be different, so it’s important to survey them and find out.

3. Flexibility & flow. If you’re looking for a digital wallet that accommodates a wide variety of browsers, various payment types, and includes one-touch capability, maybe the PayPal integration makes sense. Not all digital wallets are created equal: some digital wallets are bound by their browser. Apple Pay, for example, is limited to the Safari browser.

You’ll also want to think about how the external payment method flows with the rest of your checkout process, as in some instances where one-touch isn’t available, the shopper will have to log in to the digital wallet.

In this example from ThinkGeek, you can see how the look is fairly seamless across the store’s shopping cart page and PayPal’s login, making it feel like a more natural and consistent experience all the way through.

4. Ease of integration. Some ecommerce platforms already have integrations built for various payment gateways, which can help shorten the list based on how quickly and easily you can start accepting digital wallet payments from mobile shoppers.

Consider each of these factors when deciding which digital wallet integration makes the most sense for your business, and then monitor your metrics to see how your selection performs post-implementation. You may find that you need to test various integrations to find which one performs best.

Conclusion

With tools like one-touch payment that allow mobile shoppers to checkout quickly and with limited friction, online retailers can boost their mobile conversion rates by simply adding a payment method.

Digital wallets and their growing user base are still in the relatively early stages, but they do present an important opportunity to deliver an improved mobile checkout process, which means delivering a better customer experience overall.

Find out which one might be best for your mobile shoppers and see how adding one of these tools impacts your mobile CRO efforts overall.

Business & Finance Articles on Business 2 Community(156)

Report Post