— February 15, 2018

Growing an online business is incredibly difficult without healthy cash flow. If customers / sales channels are slow to pay, a seller can’t pay their suppliers and employees. Without paying suppliers and employees, there’s no inventory and no people to operate the business.

A business should always be striving for positive operational cash flow. With greater inflows than outflows, a company has extra resources to grow and expand. The key to achieving this healthy cash flow — inventory management.

To help sellers improve their cash flow, we put together this guide to help you improve your inventory management. By maximizing your inventory’s performance with these tips, your online business will have a greater net cash flow to grow.

What Is Healthy Cash Flow?

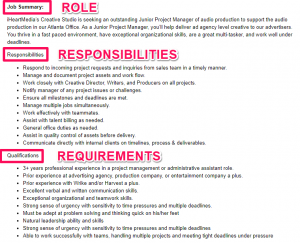

Cash flow is the amount of money being transferred into and out of a business. It’s usually calculated and presented on a budget sheet that identifies a company’s inflow and expenditures.

[Source]

A healthy cash flow is positive— more money is flowing into the business than flowing out of it. When a business generates more cash than it spends, it can grow its net cash flow over time and use that surplus to scale its operations.

Cash flow doesn’t paint the entire financial picture of a business. You also have to assess a company’s debt, profitability, and other factors to understand whether they’re financially secure. As a part of this financial evaluation, positive cash flow is a strong indicator of a healthy business.

How Inventory Affects Your Cash Flow

The cash flow cycle depends on your inventory. You spend the cash you have to buy your supply, and that inventory turns back into cash when it sells.

Consequently, your cash flow is easily reduced by poor inventory management. Specifically, issues with stocking your supply and customer orders can lead to fewer sales which hurts your cash flow.

Stocking your supply

A poor understanding of your inventory leads to miscalculating your supply. You haven’t properly tracked how often you sell your inventory, so you don’t know how many products you need to stock.

With a supply that’s too high, your cash flow is hurt by increasing expenditures. Your cost of goods goes up because you are buying and storing more inventory. At the same time, the demand for your goods isn’t high enough to satisfy the supply amount you’ve purchased.

For example, let’s say you buy thirty t-shirts at $ 10 a piece for $ 300. You want to sell each at $ 20, but there’s only enough demand to sell ten t-shirts. You invested too much in your inventory, and you lose $ 100.

With a supply that’s too low, your cash flow is hurt by decreasing revenue. If you only have a small amount of supply to sell, you only generate a small amount of revenue.

Let’s say you buy six t-shirts to sell. You manage to sell your entire supply, but you missed out on a larger profit by failing to meet the demand for ten t-shirts.

Without properly tracking your inventory, you don’t know how much of your products will sell or how much to stock. Your cash flow is reduced by spending either too much on inventory or earning too little from sales.

order issues hurt cash flow

Poor inventory management can also lead to order issues and customer dissatisfaction that hurt your cash flow.

Failing to track your inventory means you’re not consistently updating your supply. Without an accurate picture of your inventory, it’s easy to process an order that you can’t actually fill. Once you realize that you have less products than you expected, you can either:

- Delay shipping and delivery of the order

- Cancel the order

Both scenarios will leave the customer unhappy. If you continue to provide poor service due to poor inventory management, customers are going to lose trust in your business and stop purchasing from you. With this drop in sales, your cash flow will suffer.

[Source]

Your inventory management makes or breaks your cash flow. Sloppy management leads to problems that increase your expenditures or lower your inflow. Likewise, maximizing the performance of your inventory with better management leads to a strong, positive cash flow.

Inventory Tips to Improve Your Cash Flow

Boosting your cash flow with inventory management boils down to planning ahead. Establishing systems and habits for tracking your inventory flow allows you to predict the flow of your cash and avoid future mistakes that could hurt your cash flow. Stay organized, and your cash flow will remain healthy.

To get started, here are a few inventory management tips.

Track Your Inventory Flow

This first piece of advice is obvious, but the most critical. You need to meticulously record the:

- Quantity of products you’re ordering

- Quantity of products you’re selling

Tracking the amount of inventory you’re ordering and selling allows you to determine whether you’re overstocking or understocking. By comparing the inflow and outflow of your products, you know exactly how many products to order and satisfy customer demand.

Record your inventory flow regularly so you can measure any seasonal changes. Map out this flow on a calendar to visually understand how it fluctuates over time. Adjust your supply orders to accommodate demand increases or decreases at certain points in the year.

By consistently tracking your inventory flow, your supply orders will match the amount of inventory you’re selling. You earn a maximum amount of revenue by always meeting demand and cash isn’t tied up in extra supply. The result? Your cash flow stays positive and strong.

Understand and Improve Your Order Issues

Order issues leave customers unhappy and less willing to purchase more products — but they’re also avoidable.

Understanding past order problems allow you to identify what went wrong with your inventory management and caused the issues. Knowing the root problem, you can make a plan to adjust your inventory management. Avoiding these order issues in the future will keep your customers happy and your cash flow healthy.

Follow these steps to figure out your past inventory mistakes:

1. Track the order problems that have already happened. Make a list of:

- Orders that didn’t get filled/were canceled

- Orders that didn’t arrive on time

- Orders with long turnaround times

2. Think back and note what led to these issues. Did you not have enough inventory in stock? Did you forget to update your inventory after past orders? Some issues may have been caused by factors outside of your inventory management, such as problems with a shipping carrier or a customer’s method of payment.

3. Make a plan to avoid what went wrong in the future. List out the ways your inventory management caused order problems, and identify what you can change in your practices as a seller to avoid these issues in the future.

4. Consider using an order fulfillment system. If you continue to have trouble processing and delivering orders correctly, you may want to consider using an order fulfillment system. Programs like Fulfillment by Amazon and Deliverr store your inventory and pack, ship, and provide customer service for your products.

[Source]

By using a fulfillment service, you don’t have to worry about order and delivery issues. You can focus on other areas of your business and rest well knowing your products are in good hands.

Backtracking and planning with these steps make it easy to avoid order issues in the future. By planning for future order mistakes, your customers stay happy and continue to make purchases that keep your cash flow healthy and positive.

Get Smaller Inventory Orders Frequently

Infrequently ordering large amounts of supply tends to tie up your cash in inventory. Sitting on a large amount of product that sells slowly over time means you’re waiting all that time to recoup your inventory dollars. Not great!

On the other hand, smaller and frequent inventory orders encourage greater cash flow because:

- You’re able to quickly sell the inventory you purchased since you only bought a small amount. Instead of tying up cash, the money you spent to buy your small amount of products is recouped quicker.

- You have flexibility in choosing your supply. When demand takes a surprising shift, you don’t want a large stockpile of inventory that’s outdated and won’t sell. Small, frequent supply orders give you the room to adjust your inventory if demand changes.

- Fresh merchandise is more attractive. There’s a reason why almost every online store has a “New Items” or “Just Added” section. Buyers want what they don’t have, so they’re eager to buy new products. Small, frequent inventory orders make it possible to change your supply to include new products.

Switching to small, frequent inventory orders is tricky if you rely on bulk supply deals to make a profit. If you normally receive discounted large orders, try to negotiate with your supplier to reach a reasonable price on smaller, frequent orders. Even if the switch costs slightly more, ordering less inventory more frequently pays off by increasing your cash flow.

Improve Your Cash Flow With Inventory Software

You can make serious improvements to your inventory management and cash flow using the strategies in this guide alone. That said, making these adjustments takes a lot of work. With so many factors to track, it’s easy to get overwhelmed.

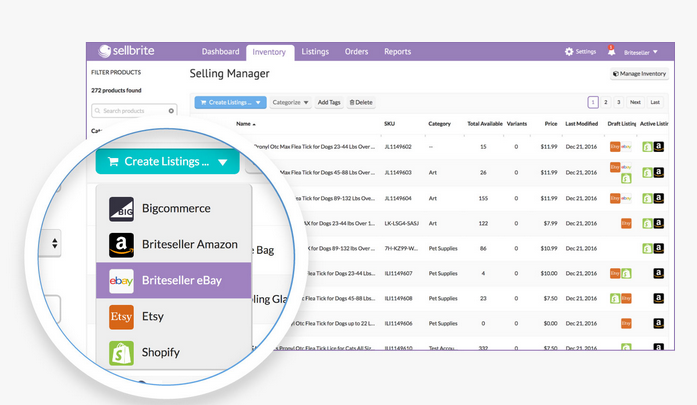

That’s why we recommend using an inventory management software like Sellbrite. Our software automatically updates your inventory every time an order is placed, so you avoid understocking. No matter how many channels you sell on, our system keeps your inventory organized.

By tracking how supply flows in and out of your business, an inventory management software makes it easy to map out your company’s cash flow.

Manage Your Inventory to Manage Your Cash Flow

As an online seller, you should never be surprised by your cash flow. Understanding the inflows and expenditures your business receives allows you to prepare for the future and adjust your budget to reach positive cash flow. This surplus makes it possible for you to grow and scale your business for long-term success.

Gaining this level of control over your cash flow can’t be done without excellent inventory management. Your supply is at the heart of the cash flow cycle. You spend money to buy inventory. You sell inventory to earn money. Meticulously track and manage your inventory flow, and you’ll have a firm grasp on your cash flow.

Business & Finance Articles on Business 2 Community

(45)

Report Post