Introduction

Investing money in anything is never without risk. When investing in liquid investments, prices can and do fluctuate daily. Importantly, all liquid investments can fluctuate in price, and that includes both stocks and bonds. I mention this because price volatility, especially when investing in common stocks, represents one of the biggest risks that investors focus on, some to the point of obsession.

However, there is an important distinction that many people either fail to realize or consider. Price and value are not the same things. There are many that argue that the value of anything is the current price that someone is willing to pay. In the short run, they are correct. When dealing with liquid investments, if you are required to immediately sell the asset, for whatever reason, its value will be only what someone else is willing to pay you for it at that moment in time. Therefore, in that situation, price and value is the same thing.

On the other hand, to the longer-term oriented investor, who doesn’t need to sell an asset in a panic, it’s critical for them to know the difference between price and value. Understanding this difference is rooted in the reality that ultimately a business, any business public or private, derives its value based on the underlying performance that the business generates. These value drivers include, but are not limited to, operating results such as earnings, cash flows, sales (revenues) and dividends.

Intrinsic Value VS Daily Price Action

Common sense would indicate that the true intrinsic value of a business based on the fundamental metrics described above doesn’t change very much in a single day or hour. However, in a liquid auction market, it is not uncommon to see the price of a company’s stock change rapidly from one hour to the next.

With liquidity comes price volatility, as individual investors are continuously presenting bids or asking prices at which they’re willing to buy or sell a given stock at any moment in time. This dynamic process is continuously creating overvaluation or undervaluation of a given company’s stock price relative to its fundamental value.

In other words, at any moment in time the market can be mispricing a stock either over or under its true worth. However, as previously stated, common sense tells us that the true value of a large multinational business, or any business for that matter, cannot possibly change as quickly or as much as daily price quotations would indicate.

At this point, it is important to acknowledge that there are many people that believe that assessing fair value is totally subjective; I am not one of those people. Those who hold this view tend to be very price focused. Regardless of the underlying fundamental strength of the business behind the stock, if the price goes up it’s a good stock, if the price goes down it’s a bad stock.

To my way of thinking, people who believe that price and value is the same thing are denying themselves the opportunity to recognize a bargain, or perhaps more importantly, recognize the high long-term risk associated with excessive overvaluation. This brings to mind a famous Oscar Wilde quote. In answer to the question what is a cynic, Oscar Wilde allegedly quipped “A man who knows the price of everything and the value of nothing”

Classic Lessons in Valuation

What follows are what I consider two classic examples representing lessons on valuation. The reason I consider these classic examples is because I believe they clearly and undeniably illustrate the reality that the stock market can, and does, incorrectly price publicly traded companies. Admittedly both of these examples are extreme cases of incorrect stock pricing by the market. However, it is often by examining the extreme that true insights can be obtained.

In addition to providing evidence that the market can and does incorrectly price stocks at times, these examples also provide lessons on the importance of fair valuation. To state this more plainly, these examples also show that if you pay more than fair value when investing in even the best of companies, you can lose money, and do so, while simultaneously taking on too high of a risk. But importantly, the high risk is often obvious and easily avoided if you pay attention to valuation.

Finally, these two examples clearly illustrate the distinction between price and value discussed in the introduction. Stock prices in the short run can be driven by strong emotions such as fear and greed. These two examples present vivid examples of both fear and greed at work. The intrinsic value of a business is driven by fundamentals and can be calculated within a reasonable degree of certainty. Once this calculation is made, sound investing decisions can be made and implemented.

Cisco Systems, Inc.

The first graph on Cisco (CSCO) plots earnings and dividends only since 1996. Simply put, this is a picture of Cisco the business. Over this timeframe, operating earnings grew at the above-average rate of 13.2% and the company instituted its first dividend at the beginning of fiscal year 2011.

Considering that Cisco is a tech stock, the consistency of the company’s operating earnings history is quite remarkable. There was some cyclicality during both recessions, but importantly the company remained profitable. In other words, Cisco did not lose money in either recession. There are few businesses in the overall market that can match Cisco’s historical operating record.

Yet in spite of this historical operating excellence, Cisco is one of the most maligned stocks in the market. Retired CEO John Chambers has also been severely criticized and often referred to as one of the worst CEOs in all of corporate America. I believe that criticism is unjustified based on the business performance that Cisco achieved under his reign as illustrated below.

With this next graph I bring in monthly closing stock prices since fiscal year 1996 and here we find a clue as to why Cisco, and ex-CEO Chambers, has been so severely disparaged. People often refer to the company as a dog that produced dead money for more than a decade. Ironically, they are correct, but not because Cisco the business performed poorly, nor because John Chambers was not an excellent CEO.

The culprit was the stock market because it incorrectly priced the stock relative to the business. Management is not responsible, nor did they have control of the price that the market placed on their shares. All management can do is run the business, generate earnings growth and cash flows, and return capital to shareholders via dividends or share buybacks when appropriate. Market price is often independent of those actions.

The orange line on the following graph represents a fair value P/E ratio of 15, which is appropriate for a company that produced the operating results that Cisco historically has. However, at the peak of excessive valuation in calendar year 2000, Cisco shares were being valued with a P/E ratio in excess of 160. Simple mathematics would indicate that this was approximately more than 10 times the company’s intrinsic value.

Cisco’s poor historical performance was not a result of it being a bad company or because its management was inept. The true culprit was a stock market gone mad.

I have often pointed out that I believe it’s an inevitability that a company’s stock price will eventually move to its intrinsic value. However, sometimes it can happen very quickly and in other times it can take longer. In the case of Cisco, it happened both very quickly initially, and then drifted towards fair value over several years thereafter.

To put this into perspective, I ran a calculation when Cisco’s P/E ratio was above 100 on November 30, 1999. You can see how wacky the market can be at times because its stock price rose dramatically from just over $ 44 at that time to over $ 82 by its peak in the spring of 2000. Of course, from there we saw a swift, and what can only be described as a brutal collapse, in stock price. Yet ironically, even through the recession of 2001, Cisco’s stock price never actually fell all the way to fair value (the orange line on the graph).

And even more ironically, the company stayed overvalued until we finally hit the Great Recession of 2008. Stock pricing can be irrational for a very long time, but that does not say that it is not visible. Cisco’s stock was a poor investment even though the company continued generating operating excellence. The bottom line is that long-term shareholders who held the stock from November 1999 until October 2009 would have lost almost half of their money even though the business was strong.

As a side note, I had invested in Cisco for clients in 1995, and starting in 1998 I was ceremoniously selling half of my position at a time. It was clear to me that valuation was excessive, but all clients could see was the price continuing to rise. As a result, I was fired by many clients. However, the vast majority came back after the bubble burst, but alas with a lot less money than they left me with.

As the above graph indicates, the 10-year timeframe 2000-2009 was a horrible decade for Cisco stockholders. However, as the following graph reveals, it was a very good time for Cisco’s business as the company grew earnings at the rate of 14% per annum.

Assessing fair or reasonable valuations is a very important process that can both reduce risk while simultaneously enhancing long-term returns. My final earnings and price correlated F.A.S.T. Graphs on Cisco illustrates the value of investing when valuation is low.

There are two points I would like the reader to focus on. First of all, the following graph includes the time when Cisco initiated its first dividend. Secondly, since the company morphed from an above-average pure growth stock into a dividend growth stock, its earnings growth of 7.1% is approximately half of the earnings growth rate achievements seen previously. Consequently, we now have a lower growing business that pays a dividend, and important to the theme of this article, is being priced at a sound and attractive valuation.

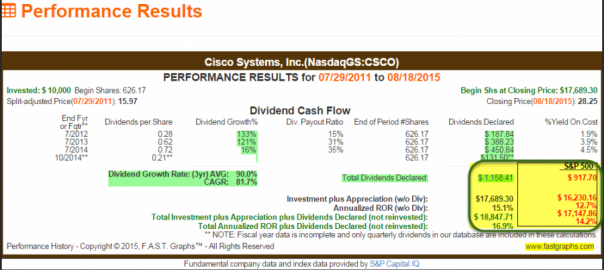

The associated performance results with the above graph illustrate the power and protection of fair valuation. On August 31, 2011, Cisco could be purchased at a P/E ratio lower than 10 instead of a P/E higher than 100, and was paying a dividend that started out low but grew rapidly. The end result was that from sound valuation Cisco outperformed the S&P 500 on both counts – capital appreciation and dividend income.

Medtronic plc

With my second example that illustrates the dangers of excessive valuation, I present Medtronic (MDT), a more traditional dividend growth stock. Medtronic is a Dividend Champion that has increased its dividend for 38 consecutive years according to fellow Seeking Alpha author David Fish’s CCC lists.

As I did with the Cisco example, my first graph looks at Medtronic the business based solely on earnings and dividends. With this example I’m looking at the timeframe for Medtronic’s fiscal years 2001-current time. What we see is a paragon of consistent earnings growth averaging 10.4% per annum (the orange line and dark green shaded area).

We also see that Medtronic’s dividend also consistently rose, but because their payout ratio also increased in 2009, dividend growth averaged over 15% a year or roughly 50% greater than earnings growth. Without stock price to contaminate our view, Medtronic looks like the perfect dividend growth stock to own over this timeframe.

The purpose of choosing this example is to illustrate that excessive overvaluation does not only apply to tech stocks. During the irrational exuberance period that began in 1995 and ran until 2000, many stocks, including the S&P 500 Index, became excessively overvalued.

On May 31, 2000 Medtronic’s stock price rose dramatically above fair valuation to a price of $ 51.62 and a P/E ratio of 56. This represented excessive overvaluation that was approximately 3 ½ times a fair value P/E ratio of 15. Note how the stock price literally moved sideways for almost a decade as a result. Once again we see an example of a great business but whose shareholders suffered from insane overvaluation. The stock market does not always correctly value stocks.

As I previously stated, a company’s stock price will eventually move back to fair valuation. This is a principle that I have observed thousands of times in the past. The difference between what occurred with Medtronic versus what we saw with Cisco was a long painful period of literally no capital appreciation. Of course, then came along the Great Recession of 2008 and Medtronic’s stock price promptly fell to fair valuation and then below.

The end result was almost a decade of negative returns. The only positive results came from the $ 3 worth of dividends that long-term shareholders would have received. Take note of this because as I will illustrate with my next graph on Medtronic, overvaluation also impacts dividend income.

There are additional lessons on the importance of valuation that are provided from my next illustration. Had you purchased Medtronic immediately upon it coming in to fair value at a P/E ratio of approximately 15, you would have experienced a short-term capital loss of almost 27% over the next 6 months as price bottomed on March 31, 2009.

However, as I indicated before, price moved back towards fair valuation by April 30, 2010, where you would have been in the black again. But then it dropped again and long-term shareholders suffered slightly more than 3 years of undervaluation before price inevitably moved back to fair valuation, and now beyond.

The end result would be a total annualized rate of return of 11.59%, but some of that comes from current overvaluation. Your total annual rate of return would have been over 9% to the point where Medtronic’s stock price was at a fair valuation P/E ratio of 15 on September 30, 2014.

But the important lesson I alluded to earlier is, note that you would have received $ 6.88 of dividend income during this timeframe which is approximately 2 years shorter than the 9 years when Medtronic’s stock price was overvalued. So not only did fair valuation provide strong returns from the same company, it also generated more than twice the dividends. Fair valuation lowers risk and increases both capital appreciation and dividend income.

Before I leave this section I would like to point out that I continue to consider Cisco an attractive dividend growth stock at current valuation. However, I believe the above graphs on Medtronic clearly indicate that it is once again an overvalued dividend growth stock.

For disclosure, I am currently long both of these stocks. However, I am currently continuing to favor Cisco but I have placed Medtronic on my overvaluation sell watch list. These are two examples supporting my contention that it is a market of stocks and not a stock market.

Dividend Favorites I Would Not Buy Today

Controlling risk in retirement portfolios by paying attention to fair valuation not only applies to the buy side, it equally applies to the sell side. My next two examples represent two of my favorite dividend growth stocks that I had the good fortune to purchase when they were available at attractive valuations.

Although I continue to admire both of these companies today as much as I did on the days that I purchased them, I no longer consider either appropriate long-term investments. Consequently, both examples are currently also on my sell watch list. This means they are flagged for potential sell on two potential conditions. First, if I see a material deterioration in fundamentals, or second, if I can identify equal quality replacements at fair value.

Kimberly-Clark Corporation

I originally purchased Kimberly-Clark (KMB) in December 2009 because I had funds available and I considered it an extremely high-quality company available at an attractive valuation. In my mind, everything was fine for the next 2 to 3 years until the company’s stock price began to separate from fair value.

Thanks to the company’s current excessive valuation, I have earned an over 14% annualized total rate of return which included a substantial amount of dividend income that grew each year. Frankly, thus far this has been a better return than I originally bargained for, as I will illustrate next.

As I have suggested in previous writings, I believe in calculating a reasonable future rate of return expectation prior to investing in a common stock, dividend growth or otherwise. When I initially invested in Kimberly-Clark, it offered a current dividend yield of approximately 3.8% but only moderate future growth expectations. Therefore, this was a high-quality high-yield income investment in my mind.

The following graph on Kimberly-Clark illustrates that I would have been pleased if the stock was currently trading at fair value instead of being currently overvalued. My expected annual rate of return out to year-end 2015 would be approximately 8.7%, and my growth yield (yield on cost) would be approximately 6.4% over my original 3.8% current yield.

Most investors would be happy with this problem, but I am not. Continuing to own Kimberly-Clark at current valuation represents a higher risk than I am comfortable with in retirement portfolios. If the company did revert to fair value by year-end, which as I previously suggested a company’s stock price eventually will, that would represent approximately a 25% capital loss from today’s levels.

Accenture plc

Accenture (ACN) was a dividend growth stock that was purchased at the end of May 2012 after the company’s price had returned to fair value. In contrast to the Kimberly-Clark purchase reviewed above, this was more of an above-average total return investment. At the time Accenture offered approximately a 2 ½% current yield and the opportunity for above-average growth of both earnings and dividends.

Based on the rate of return calculation in the pop-up on the below graph, this investment has greatly exceeded my original expectations. Most would consider that a good thing, but once again, I do not. Of course, I’m happy to have earned a return in excess of 22% a year, but I’m not happy with the company’s current high valuation.

The point is that I recognize that much of that return has come from an overheated market reaction, and therefore, simultaneously recognize the risk associated with continuing to own it. I hate it when that happens, I would much rather see my investments, so to speak, walk the valuation line.

When that happens I can continue to own them and not be forced into having to make another investment decision in order to replace it. I learned a long time ago that with every investment decision you are forced to make, you are also exposing yourself to the possibility of making a mistake.

As a bonus, I have prepared a free analyze-out-loud video on my website MisterValuation found here that provides a more in-depth and detailed look on controlling risk with blue-chip Dividend Champion Kimberly-Clark.

Summary and Conclusions

In my opinion and experience, investing in common stocks is not always about trying to make the highest return. Once an investor enters retirement years, controlling risk logically becomes a more important goal. However, as stated in the introduction, all investing entails a certain amount of risk. Fixed income investments face a greater risk from inflation. And with today’s low level of interest rates, fixed income offers little in the way of return.

In contrast, investing in common stocks offer no assurances or guarantees. However, when invested in successfully, dividend growth stocks do offer the opportunity for capital appreciation and income growth. But there is also the associated risk of potential loss.

But the primary point of this article is that valuation risk is an obvious risk that can, and should, be avoided. We may never be able to avoid all the risks associated with investing in anything, but we should strive to avoid those risks that we can control and recognize. Overvaluation is one such risk.

So my advice to retired investors that are choosing common stocks, including dividend growth stocks, pay attention to valuation and control risk in today’s generally overvalued stock market. You cannot do that by focusing solely on price action. It’s easy to be happy when the price of your stock is rising, but be on guard if it rises above a reasonable assessment of fair value.

Disclosure: Long CSCO,MDT,ACN,KMB at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Business & Finance Articles on Business 2 Community(184)

Report Post