By Sam Becker

Prior to 2022, it seemed like every other startup on the market was going public. But during 2022, as the Fed aggressively raised interest rates to curb inflation, the trend reversed. Global IPO volumes fell 45% year-over-year, according to data from Ernst & Young.

In the short term, the decline of startups going public makes sense: The economy was thrown into disarray by the pandemic and the war in Ukraine, and we’re still seeing the aftershocks work their way through supply chains, the global workforce, and more. Add in the disappearance of cheap money, and it’s currently no longer an IPO-friendly environment for many companies.

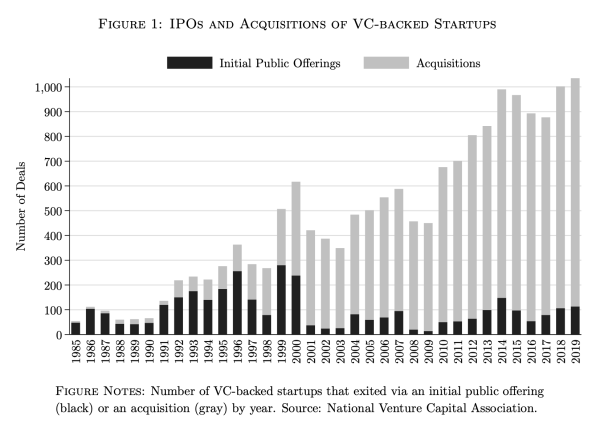

But a new paper, “The Great Startup Sellout and the Rise of Oligopoly,” shows that despite a relatively recent uptick in IPO activity, what we’re witnessing is actually a longer shift: Fewer companies are going public, more are being acquired, and that’s likely part of a big-picture strategy by established companies to insulate themselves from would-be competitors.

The study’s authors—economist Florian Ederer from Yale School of Management and assistant professor Bruno Pellegrino from University of Maryland’s Robert H. Smith School of Business—conclude that the trend is “accompanied by” an increase in the opportunity costs of going public, and the result is an increase in oligopoly power.

“Dominant companies that are disproportionately active in the corporate control market for startups have become more insulated from the pressures of product market competition over the same period,” the study reads. “These facts are consistent with the hypothesis that startup acquisitions have contributed to rising oligopoly power.”

In other words, companies are gobbling up smaller potential competitors before they get a chance to become bigger threats. The number of acquisitions in recent years dwarfs the number of IPOs, too. The study’s data shows that during 2019, for example, there were around 100 VC-backed startups that went public, but more than 1,000 were acquired.

The researchers also mention that while the trend was seen across the business spectrum, it was particularly pronounced in the tech sector. There are numerous potential examples of this over the years, such as Facebook’s acquisition of Instagram, Amazon’s acquisition of companies like GoodReads and Zappos, or even Apple’s purchase of Beats Electronics.

Buying competitors, killing competition

This isn’t a particularly new revelation. Ederer, along with fellow academics Song Ma Colleen Cunningham, published research back in 2018 showing a similar dynamic in the pharmaceutical industry. The study, titled “Killer Acquisitions,” estimated that 7% of acquisitions in the pharmaceutical space were designed to actively smother competition and that if those acquisitions had not taken place, the number of drugs in development would increase by 5%.

As such, bigger companies acquiring smaller ones in order to protect themselves from competitors was and is effectively holding back the number of potential medical treatments making their way to the market.

A similar dynamic could exist across the entire economy, including numerous industries and sectors. In aggregate, it could be leading to higher prices and worse products and services for consumers—if companies aren’t forced to respond to market competition by improving their outputs, why would they?

This has also caught the attention of regulators in recent years. Officials in both the European Union and the United States (via the Federal Trade Commission) have recently taken more aggressive stances toward merger approvals, as seemingly unchecked price hikes for a variety of goods and services have led to many consumers calling for government intervention.

This past September, Jonathan Kanter, assistant attorney general for the Department of Justice’s Antitrust Division, and Lina Khan, chair of the FTC, announced that they were working together to “strengthen antitrust enforcement.”

While the effects of that strengthened enforcement have yet to be seen, what’s clear from the research and from regulator positioning is that fewer IPOs are leading to concentrated market power—which is having a detrimental economic effect. Further, while IPO activity was frothy prior to the pandemic, the number of mergers and acquisitions occurring behind the scenes was drastically outpacing it. Ultimately, it’s not necessarily a good thing for consumers.

(20)

Report Post