Upwave CEO Chris Kelly thinks better AVOD and SVOD measurement would bring more ad dollars for the two sides to share.

The ongoing strike by writers and actors against Hollywood studios isn’t a top issue in the martech community. But, could martech solve it? Chris Kelly, CEO of Upwave, an analytics platform for brand advertising, thinks it’s possible.

He believes better ad measurement for advertising-based video-on-demand (AVODs) and subscription video-on-demand (SVODs) would get brands to spend more on them. The increased income would mean more money for all sides and that would settle the strike.

It’s a rational idea, but arguments over money don’t always respond to rationality. Our conversation about this raised other interesting questions, as well.

(Interview edited for length and clarity.)

Q: So tell me about how to end the strike.

A: This strike, like all strikes, is about money and economics. And a lot of the language we’ve seen coming from the studios, the content owners, is about the unclear economics of streaming.

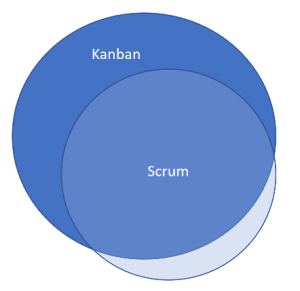

If you dig into that, you see they actually have higher average revenue per user for their AVODs (advertising-based video-on-demand). Meanwhile, the SVODs (subscription video-on-demand) believe they can have that once they’re scaled up. So you think, “OK, how do we get more if we want the strike to end and we want talent to be paid?” The studios are saying we need to have better economics from streaming. And streaming is saying we have to scale up the average revenue per user on the advertising-supported side. To do that, you need more brands to come to CTV and streaming apps.

The brands we work with to measure advertising want to know if AVOD works. They don’t just want to get told the number of views, they don’t just want to be told whether someone paid attention. Those are course critical table stakes, but for a brand-building campaign, you measure what’s called brand outcomes, which is what we do. Did you get an incremental change in some brand awareness? If you have that awareness, you’re trying to raise favorability. Or they’re trying to convert favorability to consideration for a product that people like but aren’t buying it out.

Q: How does that apply here?

A: The brands are telling us when those traditional brand KPIs get better in the CTV and streaming ecosystem, they’re going to invest more brand dollars. More brand dollars means that average revenue per user for AVOD goes up. If AVOD revenue goes up, assuming we believe what the studios are saying, that’s going to be impacting their economics of streaming in a good way. One of the big issues for the two sides of the strike is around the economics of streaming and both how much gets paid out and on what terms.

Now, we’re not strike experts, we’re not union experts, but it seems fairly straightforward to see what they’re fighting over. Instead of arguing about who gets how much of the pie, why are we not talking about how to make the pie bigger? If the pie gets bigger then every slice is worth a little more. So that’s how the dominoes fall in our brains when we look at the strike.

The key to getting to this place is measuring. Let’s prove that brand advertising works on these, on these programs. If it does, we’ll get more money. If you get more money, then that grows the pie and makes and hopefully eases these crazy tensions between the talent and the studios.

Q: Why do the brands think the impact of ads on AVOD and SVOD is different than linear TV? It’s still me watching my video.

A: Yeah, that’s a great question. If it’s the same content on the same screen for the same consumer, why do you think differently about it? I think there are two answers for that, the philosophical answer and the practical answer.

The philosophical answer is it shouldn’t. But that requires people going back and questioning whether linear has worked. There’s this free pass in the measurement world about outcomes on linear campaigns. For decades we said the TV-Industrial Complex is how brands were built. It’s how the media ecosystem was built up. How news operations were built up in America. And it got this free pass.

And ironically, all the questions around ‘Did my investment in that streaming app work?’ are raising questions about how do I know my broadcasting ads worked? I should probably measure the outcomes of that, too. At the end of the day, it’s not different. It’s the same content in the same ad on the same screen to the same family member. But linear outcomes have really not been measured at the top of the funnel.

Q: And the practical answer?

A: The practical answer is it’s usually different parties and different agencies who are touching these things. So, as you know, we’ve had digital agencies who worked on our brands’ display and banner ads and online video buys for years. At the same time, we had the TV agency that worked on the linear buy. Sure it’s the same creative, but when it’s converted into a 30-second pre-roll, it gets sent to the digital agency. When it’s a 30-second spot on broadcast, it gets sent to the TV agency and that’s changing.

And then this big question arises of who owns the CTV budgets? It’s TV, but it’s digital, it’s both, so who owns it? In general, the TV people have gotten more of that. But this is ending and there aren’t going to be digital agencies and TV agencies, they’ll just be media agencies who have to be cross-channel.

Q: You’ve put forward a theory that’s clear enough that I can understand it. But will something that clear and direct survive a Hollywood negotiation?

A: Yeah, I won’t claim any expert insight into being in the actual negotiating room and how the legal drama will play out. That part we don’t know. We just look at it from ‘team brand,’ as we say. So we know that brand advertising has paid for the movies, the TV shows we consume, the music we listen to. And that’s why this is always on our minds.

The post Is martech the solution to the Hollywood writers’ and actors’ strike? appeared first on MarTech.

MarTech(9)

Report Post