— November 14, 2017

Pixabay

The topic of mergers and acquisitions in the IT industry is dominating conversations at vendor conferences, channel partner events, industry association meetings, and in online trade publications. It shows no indications of slowing down.

The acquisition and continued growth of larger managed service, cloud, and SaaS providers like mindSHIFT Technologies, All Covered, SoftLayer Technologies, and NetSuite over the last few years, and the continuous consolidation of small regional firms, has become a beacon to many MSPs, CSPs, SIs and VARs that a strategic plan with an acquisition end goal is the best growth strategy. But is that true?

These acquisitions primarily fall into two categories:

- Entrepreneurial Exit Strategy – A large percentage of small MSPs have been born of engineers or other technical professionals leaving their jobs at larger technology companies and striking out on their own. They’ve started their own IT reseller or managed services business with the goal of growing the company to a size large enough to command top dollar upon its sale.

- Growth Through Competitive Buyout – Larger, more established VARs, MSPs, CSPs, and SIs who want to increase their market share, industry penetration, product portfolio, or cloud services offering, may first consider how to achieve rapid growth internally – organically growing their customer base, product offering, geographical footprint, or vertical focus. However, this organic growth takes time and money and many mid-size firms determine that their speed and level of growth can be significantly increased by acquiring smaller IT competitors who already have the customers, industries, geographies, or services they need.

Change for those VARs, MSPs, CSPs, and SIs is a given. Technology and the IT industry as a whole are changing so fast that mergers and acquisitions seem to be the quickest and easiest road to growth.

It is important for you to evaluate what is best for your business – assessing whether to transform your organization internally, acquire another company, sell out to another firm, or divest your underperforming services and business units.

The Current M&A Landscape

2015 was a record year for tech firms making 4,416 acquisitions valued at $ 587 billion. Although the M&A landscape was just so-so in the first half of 2016, the acquisition switch was flipped again in October which became the busiest month ever for M&A deals in the United States. Industry survey’s report that 2017 could be even bigger than 2015.

What has caused this feeding frenzy of M&A activity over the last few years?

MSPs, CSPs, VARs, and SIs are involved in a 21st-century gold rush and land grab which can be summed up in two words – Cloud Computing.

Unlike other technology advances, the growth in cloud adoption has been enormous because it enables businesses of all sizes to overcome significant financial and resource intensive hurdles between their business needs and IT capabilities.

Small and mid-size businesses (SMBs) were the early adopters of cloud technology, primarily Software-as-a-Service (SaaS). First using business-class email, like hosted Microsoft Exchange and Outlook as well as data backup and archiving solutions, these companies are now seeking out more specialized solutions like line of business applications.

SaaS and other online services enabled companies who were previously unable to afford enterprise-grade infrastructure and software solutions to use them on a subscription basis – paying only a small predictable monthly fee. This ability to pay for only the services they needed and quickly scale their organization leveled the playing field for small businesses, enabling them to compete with larger companies that had more resources and deeper pockets.

The more recent adoption of public, private, and hybrid cloud solutions by large enterprises has also accelerated the pace of cloud spending and usage.

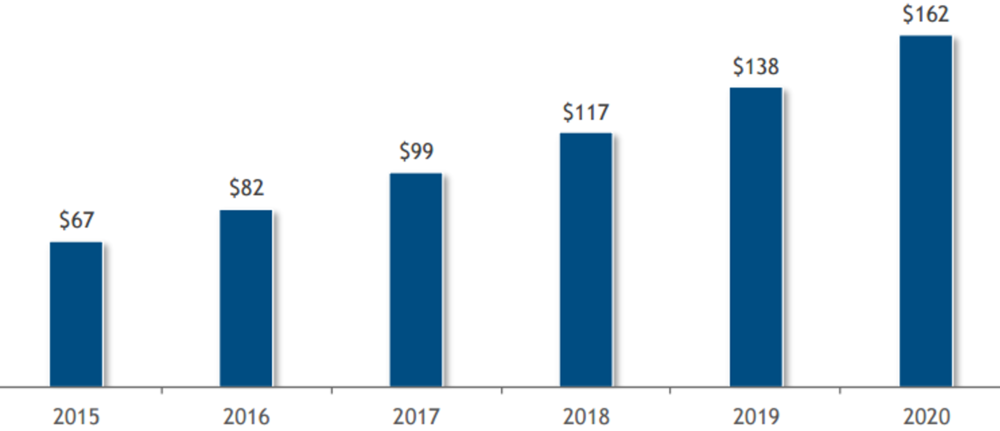

According to IT industry analyst firm IDC, cloud computing spending has grown at 4.5 times the rate of IT spending since 2009 and is expected to grow at better than 6 times the rate of IT spending from 2015 through 2020.

The Rapid Growth of Cloud Computing

Worldwide Spending on Public Cloud Computing, 2015-2020 ($ bn)

Average Compound Growth Rate, YE2015-YE2020, 19%

IT Spending Average Compound Growth Rate,

YE2015-YE2020, 3%

Source: The Salesforce Economy – IDC

In addition, technology is no longer the domain of the IT department. Internal corporate silos are collapsing and technology sales opportunities can be uncovered across organizations – in sales, marketing, accounting, customer care and other corporate departments.

Growth Strategy Options: Mergers, Acquisitions, Divestitures and Organic Growth.

The transition that the technology industry underwent over the last 10-15 years has helped to shape the transformation that is happening today. Traditional hardware and software resellers became Value Added Resellers. VARs and System Integrators are now turning themselves into Managed Service Providers. Some MSPs are even building their own IT solutions and launching indirect reseller channels, becoming technology vendors in addition to traditional MSPs.

As cloud computing is embraced by everyone from small businesses to large enterprises, technology providers are assessing their growth strategy options. There is no right or wrong answer to this. The answer depends on your business goals, growth strategy, position in the market, and how you want to transform your business.

Let’s first take a quick look at the distinctions between mergers, acquisitions, divestitures and organic growth.

Merger Definition

A merger is like an acquisition in that it unites to independent companies into one. It is different than an acquisition in that a merger is the coming together of two similarly sized businesses which agree to move forward as one new entity, usually with a new name. A merger is commonly completed to add value to both companies by expanding into new market segments, gain market share, or grow a company’s geographic reach.

The merger of two MSPs can enable the newly formed company to benefit from the best of expertise, personnel, products or services, and market penetration/differentiation that each brings to the relationship. A “merger of equals” enables the companies to more quickly and easily overcome the issues of capital outlay that would be required as part of an acquisition as well as the issue of time-to-market which can be dramatically shortened with a strategic merger rather than organic growth.

Acquisition Definition

An acquisition is different than a merger in that one company buys a 51-100% stake in another company, taking control of the acquired company and all company assets.

The acquisition could bring with it a large established customer base, additional technical talent, geographic diversification, an expanded portfolio of complementary services, and immediate growth opportunities that could take years or even decades to achieve if it was managed organically.

Divestiture Definition

In a divestiture, specific assets of the company are sold. This could include the sale of a business unit, products and services, or other pieces of the company. The company’s management often chooses to divest itself of certain assets because they are no longer of strategic value or are a drain on other resources.

The divestiture may help to refocus the business on its core objectives and business goals. It should not necessarily be seen as something negative or that the company has been mismanaging its business. Rather, it is often a way to enable a company to grow even more quickly.

Organic Growth Definition

Organic growth is that growth which a company achieves though the increased production of products and services and an increase in sales. The company’s goal is to meet and exceed their revenue and earnings objectives on a yearly basis.

Organic growth is achieved through growth in the existing business with an increase in output, an expanding customer base and new product development. As a result, organic growth takes time to achieve – much more time than if the company was acquired, merged with another firm or acquired other businesses in order to grow.

So, if your ultimate end goal is the continued growth of your business, there are several ways you can achieve this. However, deciding on which one is appropriate for your IT business will depend on things like your market position, cash on hand, competitive landscape, staff expertise, service and product portfolio.

Your Business Strategy: Be Acquired?

Are you interested in being acquired?

Selling your business seems the easiest, cleanest and fastest of all solutions – especially if all you are interested in is getting as much money as you can so you can start another business or travel off into the sunset to enjoy life. Since this is presumably a company you have nurtured from the beginning and given your blood, sweat and tears to, consider what will happen to the business once you have left. This will help to determine if a strategic acquisition is in line with your goals.

Here are 5 guidelines to follow:

1. What is Your Real Reason for Selling?

As you know, some owners bake the sale of their company into their strategic plan before they have even acquired their first customer. The goal may be to retire early, receive a cash windfall or move on to start another company. But there may be things you are overlooking.

Do you have a passion for technology, the industry, and working with customers to help them achieve their goals or are you simply focused on the dollar signs at the end of the rainbow?

Are you interested in stepping away from the daily management of the company but want to maintain some ownership stake so you will continue to receive payments over time?

Have you considered the effect that the sale will have on your staff? Will they be offered an ownership share in the new company? Are the new owners considering moving or consolidating your company’s location which may require your employees to relocate or lose their jobs?

Thoughtful consideration of why you want to sell the business will help provide the answers to when, how and to whom you sell.

2. Differentiate.

Let’s be honest, a new MSP business offering the same IT management and cloud services as everyone else seems to open daily and dozens of them can be found in virtually every city. What makes your company different from the rest? Why should you be singled out as a potential acquisition candidate and one that will command top dollar? What is your differentiator?

Do you have the largest percentage of MSP business in San Francisco, Dallas or other large metropolitan area? Have you developed a unique cloud-based IT solution for the legal industry that is being used by hundreds of law firms across the country?

Differentiators like a unique service, geography, industry or other area of focus will not only enable your business to stand out but add significant value.

In addition, if you are an MSP, CSP, VAR, or SI looking to be acquired, having an expansive client list is no longer enough to help you stand out. Product/service differentiation and diversification will now be the primary driver for interest in your company.

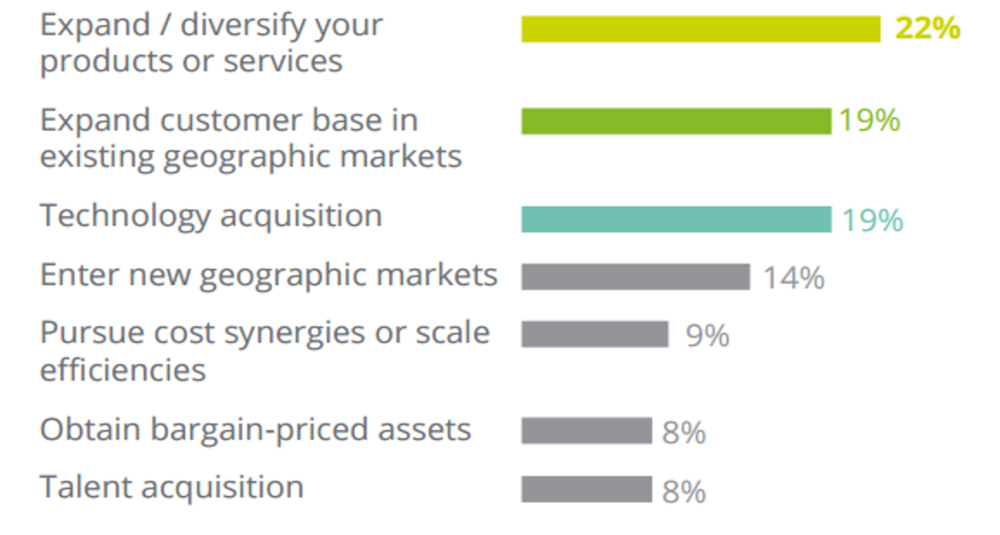

With Respect to Your Company’s M&A Strategy Over the Next 12 Months, What Is the Most Important?

Source: Mergers and Acquisitions Year-End Trends Report – Deloitte

3. Sales Reigns Supreme.

It may seem unnecessary to say that sales reigns supreme. Doesn’t it reign supreme in every business?

Remember that many small MSPs and VARs are often run by owners or executives who started their careers as engineers or other technical professionals and they pride themselves on their knowledgeable support teams and breadth of engineering expertise.

Although these are important components of a successful business, a potential suitor is looking elsewhere. Things like ARPU (Average Revenue Per User), churn rate (number of customers who have stopped using your products or services over a specific period), MRR (Monthly Recurring Revenue), and CLV (Customer Lifetime Value) are at the forefront of an acquisition discussion to demonstrate company value and generate top dollar for the business.

4. Don’t Slow Down Marketing. Rev It Up.

It can be tempting to pull back on marketing spend when you have decided to sell your company. You may want to reallocate the funds to another area of the business or hold onto it to show more cash on the books.

Any company interested in acquiring your business will do their due diligence, researching your position in the market, your strategy, and success in acquiring new customers. Their interest will quickly wain if you do not have a healthy online (and offline) marketing presence and a well-known, well respected reputation. It is important to maintain the market perception of your business as assertive, dynamic and strong.

5. 80% of Success is Just Showing Up.

This well-known quote, “80% of success is just showing up,” sums up how important it is to take advantage of every opportunity that comes along, no matter how small or insignificant it may seem. IT companies known to be shopping their business around for sale are on the radars of industry analysts, potential corporate suitors, and others who have their finger on the pulse of the market.

Accept their meeting requests. The buyout offer may not be one that you are interested in considering but you may gain industry insights or competitive and market intelligence. It can help you flush out the true value of your business on the open market and potential companies who may be interested in doing a deal.

Your Business Strategy: Buy A Business?

Ok, so maybe your goal is not to have your business acquired by another company but to be the company doing the acquiring.

Some CEOs take a long time to decide to pull the trigger on possibly acquiring another organization. What holds them back? It’s certainly not laziness or lack of ambition. It is actually the concern that if they take their eye off the ball which is right in front of them (their current business) to pursue an acquisition, their existing business will suffer. Acquiring a new company can be a full-time job, requiring them to not only conduct all the preliminary due diligence but to establish a team that will carry out the integration.

When purchasing a business, it is important to first ask yourself these questions.

- Where will the money come from? Do you have the funds to finance this deal? Will you be funding it yourself, using personal assets, or will you take on outside investors?

- What will happen to the senior management team of both organizations? Will your current team be responsible for managing all acquired assets? Will you require the acquired team to leave after a period of time or will some be incorporated into your current team?

- Are you going to set up a formal integration team whose primary responsibility will be the successful integration of the acquired company into your organization? Is this the only acquisition you will be doing or does your strategic plan include additional acquisitions? If so, how will you continue to run your company on a daily basis as its CEO and, at the same time, manage the acquisition and successful integration of additional businesses?

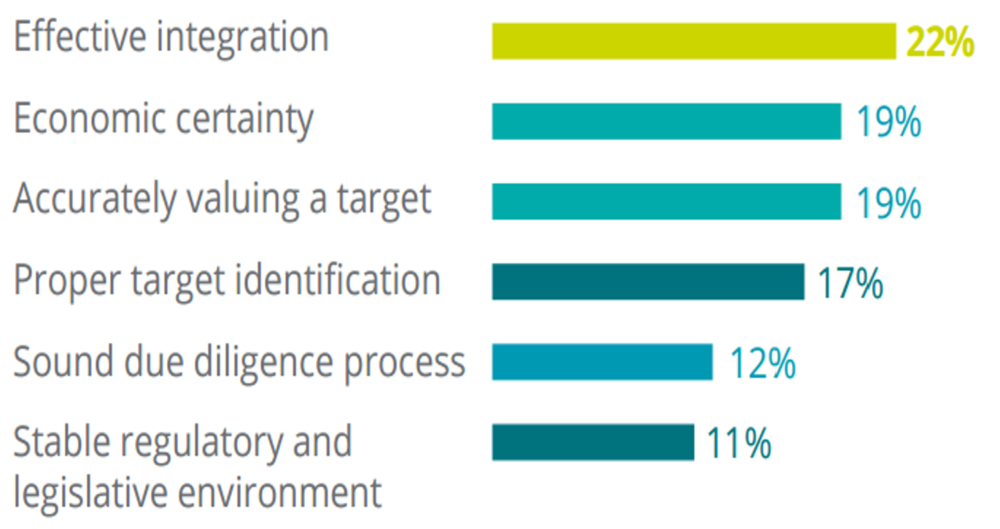

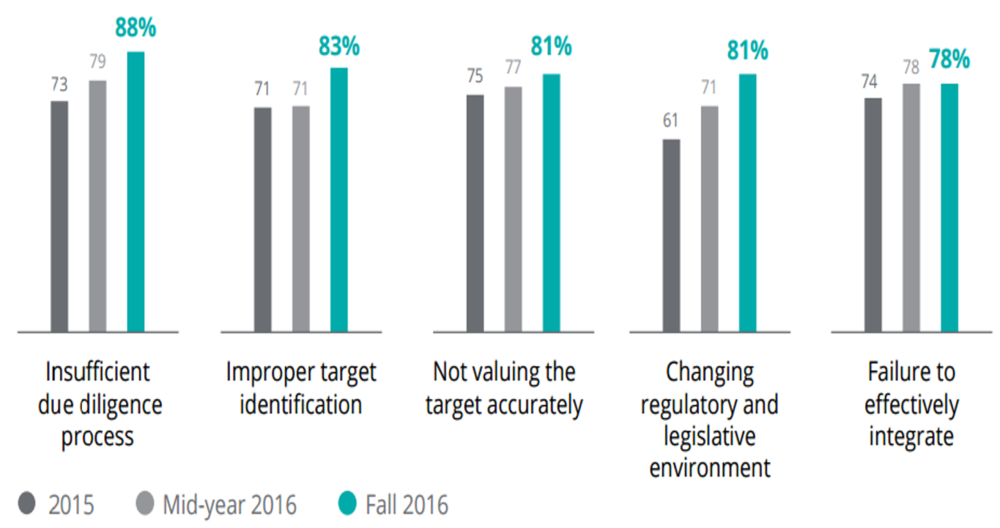

According to Deloitte’s Mergers and Acquisitions Year-End Report, effective integration is the top-ranked factor by corporate respondents in achieving a successful M&A transaction. On the flip side, insufficient due diligence is the biggest impediment to achieving a successful M&A transaction.

What Is The Most Important Factor in Achieving A Successful M&A Transaction for Your Company?

Source: Mergers and Acquisitions Year-End Trends Report – Deloitte

What Is The Biggest Impediment to Achieving A Successful M&A Transaction for Your Company?

Source: Mergers and Acquisitions Year-End Trends Report – Deloitte

Conclusion

Even if you have not formally decided that your goal is to sell your business, buy another company or divest underperforming pieces, it’s important to include an M&A line item in your strategic growth plan from the beginning. This will give you a complete picture of all of your available options as your company grows and changes.

However, whether you ultimately choose to take one of these roads or not, remember that the decision is as individual and unique as your organization. Never let any industry analyst, financial firm, author, or other executive tell you that one option is better than the rest. Only you know what is best for your business based on your goals, priorities, readiness, resources, employees, and corporate culture.

Business & Finance Articles on Business 2 Community

(81)